David Abrams' Strategic Emphasis on Loar Holdings Inc in Q2 2024

Insightful Analysis of Abrams Capital Management's Latest 13F Filing

David Abrams (Trades, Portfolio), the founder and CEO of Abrams Capital Management, has once again demonstrated his adept investment acumen in the second quarter of 2024. With a career foundation built alongside Bauposts Seth Klarman (Trades, Portfolio), Abrams has developed a distinct, value-oriented investment philosophy. His firm, established in 1999 and based in Boston, prides itself on an opportunistic approach, focusing on long-term investments in a concentrated portfolio that spans various asset classes including stocks, debt, and distressed assets.

Summary of New Buys

During the recent quarter, David Abrams (Trades, Portfolio) made a notable new addition to his portfolio:

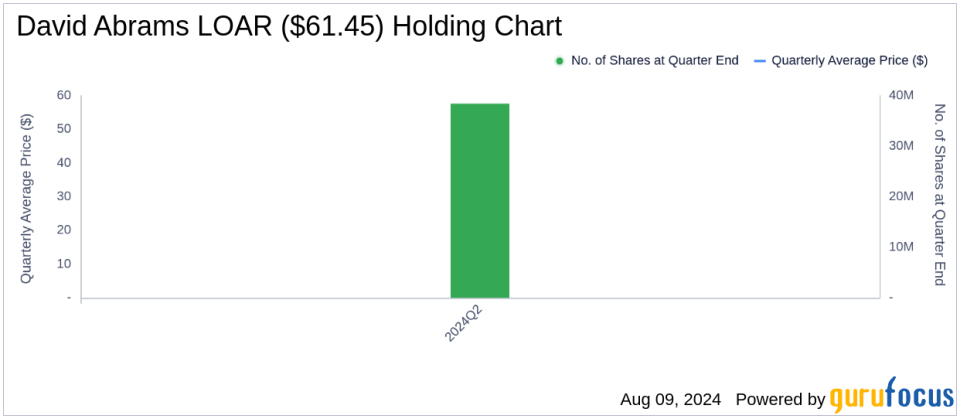

Loar Holdings Inc (NYSE:LOAR) emerged as a significant new holding, with Abrams purchasing 38,434,378 shares. This investment now constitutes 40.13% of his portfolio, amounting to approximately $2.05 billion.

Key Position Reductions

Abrams also adjusted his stakes in existing investments:

The most substantial reduction was in U-Haul Holding Co (NYSE:UHAL), where he cut his position by 202,006 shares. This adjustment led to a 72.92% decrease in his stake, impacting the portfolio by -0.42%. During the quarter, UHAL shares traded at an average price of $65.09, with a three-month return of -0.58% and a year-to-date return of -4.58%.

Portfolio Overview

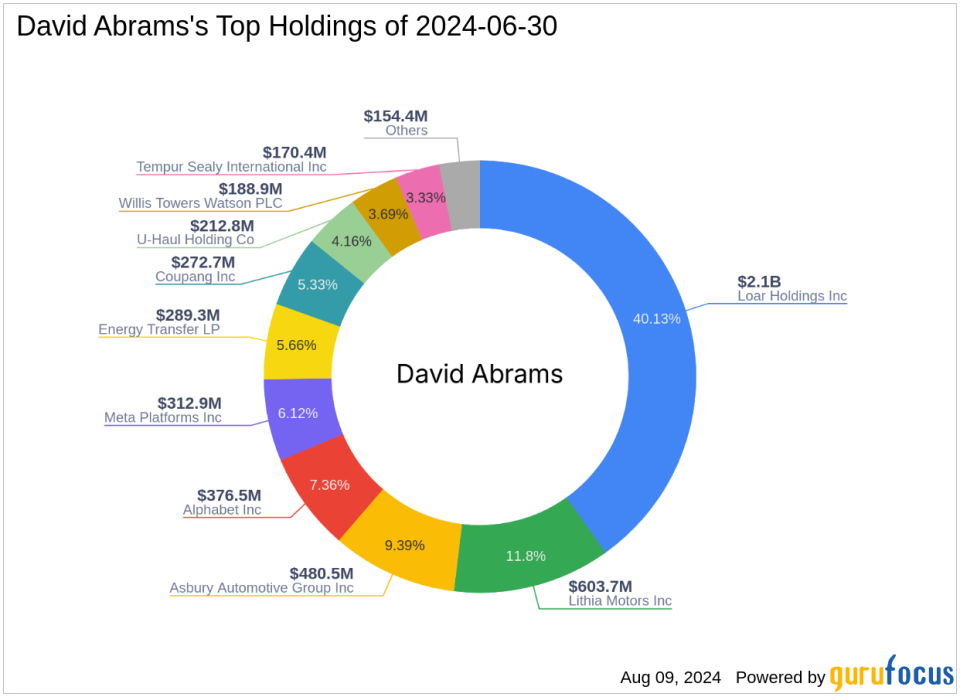

As of the second quarter of 2024, David Abrams (Trades, Portfolio)' investment portfolio comprised 14 stocks. The major holdings were:

40.13% in Loar Holdings Inc (NYSE:LOAR)

11.8% in Lithia Motors Inc (NYSE:LAD)

9.39% in Asbury Automotive Group Inc (NYSE:ABG)

7.36% in Alphabet Inc (NASDAQ:GOOGL)

6.12% in Meta Platforms Inc (NASDAQ:META)

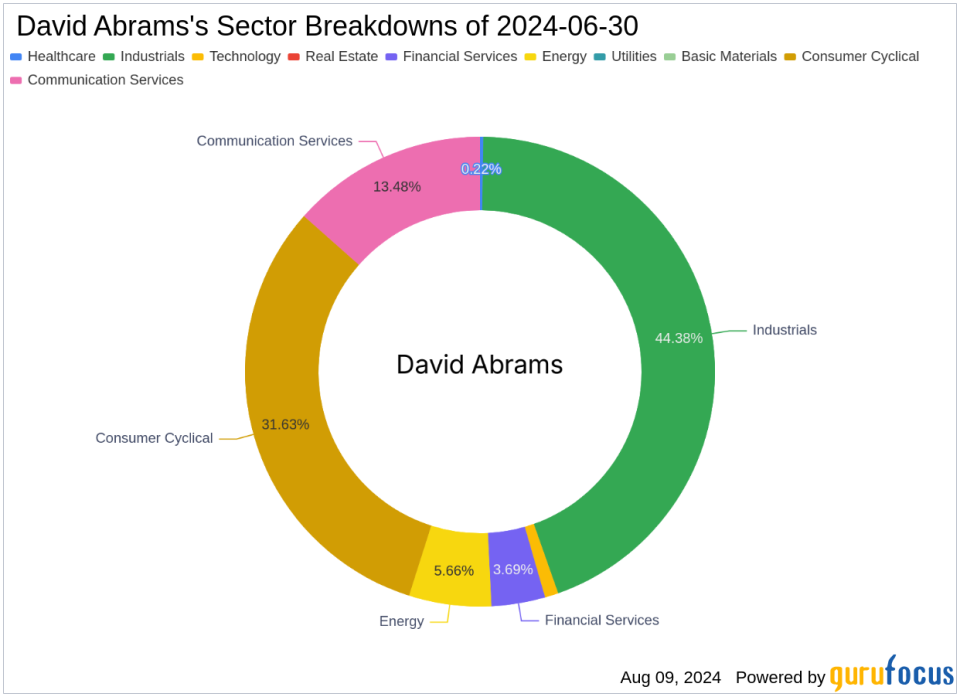

These investments are predominantly concentrated in seven industries: Industrials, Consumer Cyclical, Communication Services, Energy, Financial Services, Technology, and Healthcare.

This strategic distribution highlights Abrams' focus on sectors that offer potential for substantial value growth, aligning with his fundamental, long-term investment philosophy. The significant investment in Loar Holdings Inc underscores a confident outlook on the company's future performance and its alignment with the overall investment criteria of Abrams Capital Management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.