CRH to Boost Australian Business by Acquiring Adbri With Barro

CRH plc CRH, in partnership with the Barro Group, is set to acquire Adbri Ltd., through the Scheme of Arrangement, after receiving approval from Adbri’s Independent Shareholders.

In December 2023, CRH and Barro jointly announced the acquisition of Adbri. CRH had 4.6% interest and Barro had approximately 43% shares of Adbri. CRH had proposed to raise its stake in Adbri to 57%.

Now, with the recent approval for the Scheme of Arrangement by the Court on Jun 14, 2024, CRH will acquire the remaining 57% of ordinary shares of Adbri, not owned by Barro, for a cash consideration of A$3.20 per share. The total equity valuation of Adbri is said to be $1.4 billion, on a 100% basis. The deal also values approximately 53% of Adbri's issued share capital that the partners Barro and CRH do not currently own, and which CRH will acquire for $0.7 billion.

CRH is optimistic about this strategic inorganic move as this will bring in additional opportunities for growth and development in its existing Australian business, which concerns its core competencies including cement, concrete and aggregates. The acquisition is expected to close on Jul 1, 2024.

Strategic Acquisitions

CRH consistently focuses on expanding its geographical footprint and product portfolio through strategic acquisitions. The company primarily utilizes several opportunities to expand its product offerings in various fields comprising its solutions capabilities and road infrastructure, utility infrastructure and outdoor living.

During the first three months of 2024, the company acquired eight companies for a total consideration of $2.21 billion. The primary attraction of these inorganic moves was the acquisition of Hunter, which is a portfolio of cement and ready-mixed concrete assets and operations in Texas, for a total value of $2.11 billion. The acquired entity is included in CRH’s Americas Materials Solutions segment. The remaining seven acquisitions expanded CRH’s exposure toward developing its integrated solutions strategy in the areas of road infrastructure, critical utility infrastructure and outdoor living.

Furthermore, in 2023, CRH completed 22 strategic bolt-on acquisitions for an investment of approximately $700 million. These new acquisitions sparked the company’s exposure to high-growth markets and enabled it to leverage the market trends in fostering its growth.

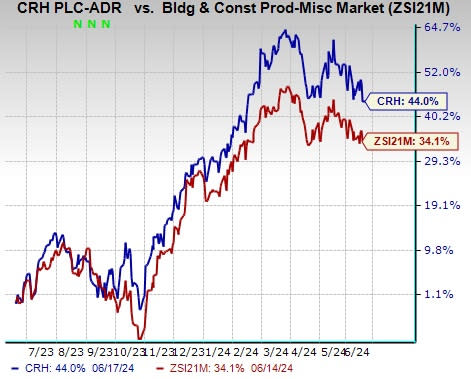

Image Source: Zacks Investment Research

Shares of this provider of building materials solutions have risen 44% in the past year, outperforming the Zacks Building Products - Miscellaneous industry’s 34.1% growth.

Zacks Rank & Key Picks

CRH currently carries a Zacks Rank #3 (Hold).

Here are better-ranked stocks from the Construction sector.

Owens Corning OC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

OC delivered a trailing four-quarter earnings surprise of 17.4%, on average. The stock has risen 44.5% in the past year. The Zacks Consensus Estimate for OC’s 2024 sales and earnings per share (EPS) indicates growth of 16% and 7.4%, respectively, from the prior-year reported levels.

PulteGroup, Inc. PHM currently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 12.5%, on average. PHM's shares have risen 55.2% in the past year.

The consensus estimate for PHM’s 2024 sales and EPS implies an increase of 7.9% and 10%, respectively, from the prior-year reported levels.

Armstrong World Industries, Inc. AWI presently sports a Zacks Rank of 1. AWI delivered a trailing four-quarter earnings surprise of 15.2%, on average. The stock has surged 60.6% in the past year.

The Zacks Consensus Estimate for AWI’s 2024 sales and EPS indicates improvements of 9.3% and 10.7%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance