ASX Growth Companies With High Insider Ownership And Up To 47% Earnings Growth

Despite some recent fluctuations influenced by the Reserve Bank of Australia's contemplations on interest rate adjustments, the Australian Securities Exchange (ASX) has shown resilience, with particular strength in sectors like energy. In this context, growth companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those most familiar with the company's potential and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Biome Australia (ASX:BIO) | 34.5% | 114.4% |

Liontown Resources (ASX:LTR) | 16.4% | 51.2% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Chrysos (ASX:C79) | 21.3% | 63.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cettire

Simply Wall St Growth Rating: ★★★★★★

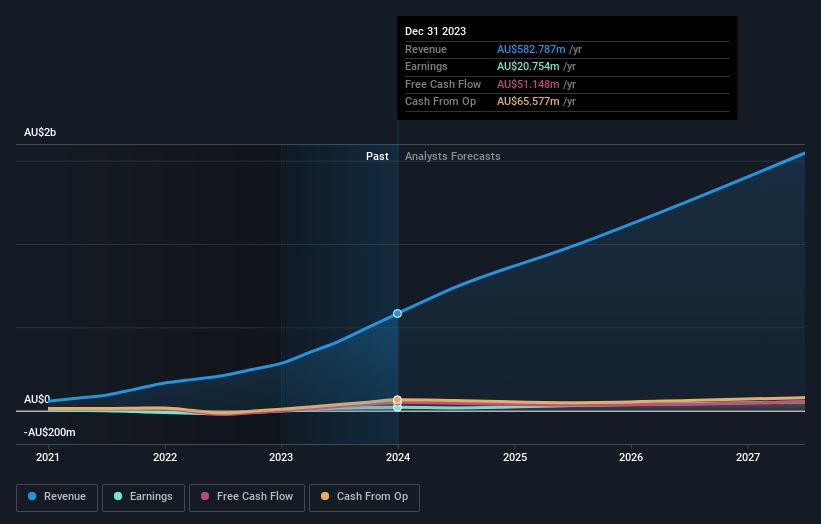

Overview: Cettire Limited operates as an online retailer of luxury goods, serving customers in Australia, the United States, and internationally, with a market capitalization of approximately A$496.62 million.

Operations: The company generates its revenue primarily through online retail sales, totaling A$582.79 million.

Insider Ownership: 28.7%

Earnings Growth Forecast: 26.7% p.a.

Cettire, an Australian e-commerce retailer, recently turned profitable and is poised for significant growth with earnings expected to increase by 26.7% annually, outpacing the Australian market's 13% forecast. Despite a volatile share price and recent shareholder dilution, Cettire trades at A$74.5% below its estimated fair value. High insider ownership aligns leadership with shareholder interests, enhancing its appeal as a growth-oriented investment despite some operational risks.

Take a closer look at Cettire's potential here in our earnings growth report.

The valuation report we've compiled suggests that Cettire's current price could be quite moderate.

Emerald Resources

Simply Wall St Growth Rating: ★★★★★☆

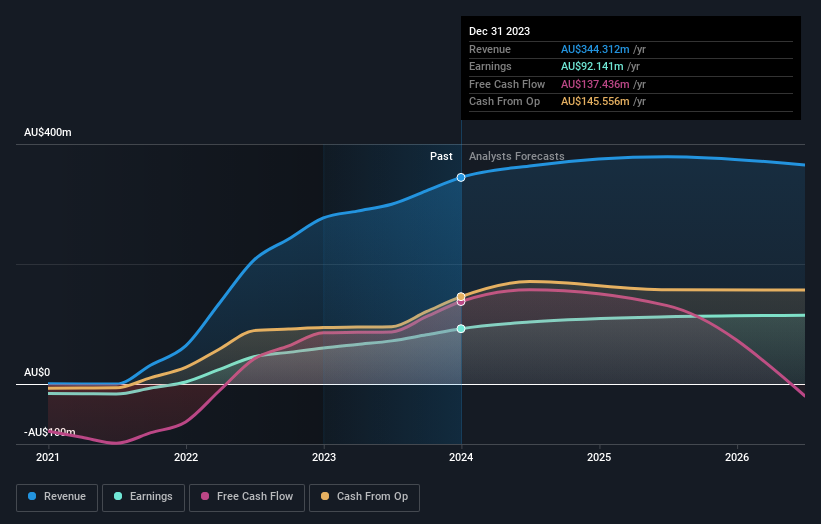

Overview: Emerald Resources NL is a company focused on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of approximately A$2.30 billion.

Operations: The company generates its revenue primarily from mine operations, which amounted to A$339.32 million.

Insider Ownership: 18.5%

Earnings Growth Forecast: 23.2% p.a.

Emerald Resources, an Australian company, is expected to see its earnings grow by 23.2% annually over the next three years, surpassing the local market's forecast of 13% growth. Although revenue growth at 18.6% per year is robust compared to Australia's average of 5.3%, it doesn't reach the high-growth benchmark of 20%. The firm has experienced significant profit growth in the past year (53.4%) and a high forecast return on equity (20.7%). However, shareholder dilution occurred last year, tempering some positive outlooks.

Unlock comprehensive insights into our analysis of Emerald Resources stock in this growth report.

Our expertly prepared valuation report Emerald Resources implies its share price may be too high.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

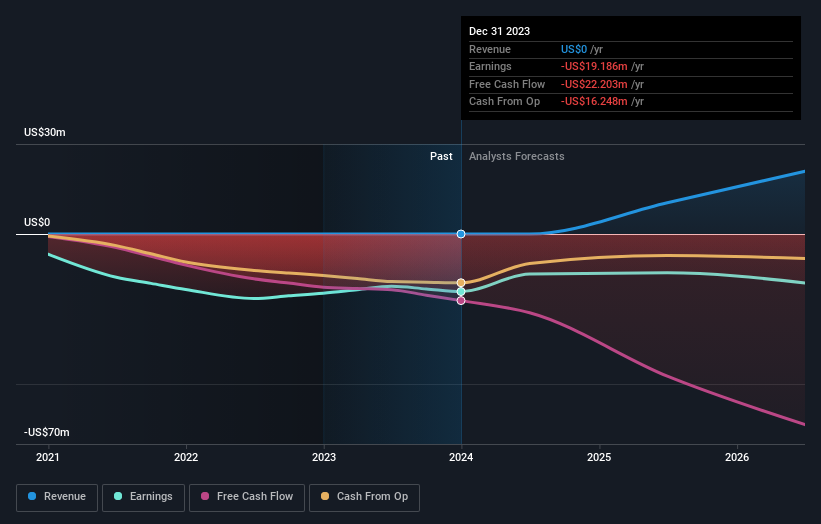

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$578.80 million.

Operations: The company is primarily involved in the exploration and development of mineral properties in the United States.

Insider Ownership: 15.8%

Earnings Growth Forecast: 47.4% p.a.

IperionX is poised for substantial growth with a forecasted revenue increase of 76.2% annually, significantly outpacing the Australian market's average. Despite recent shareholder dilution, the company's strategic partnerships, like those with Vegas Fastener Manufacturing and United Stars Holdings, underscore its commitment to expanding its advanced titanium products market. However, it’s trading at 82.4% below its estimated fair value and has a low projected return on equity of 11.7% in three years, highlighting potential undervaluation or underlying challenges.

Dive into the specifics of IperionX here with our thorough growth forecast report.

Our valuation report unveils the possibility IperionX's shares may be trading at a premium.

Summing It All Up

Get an in-depth perspective on all 89 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:CTT ASX:EMR and ASX:IPX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance