3 UK Growth Companies With At Least 10% Insider Ownership

Despite facing a third consecutive week of losses, the UK market continues to show resilience with sectors like technology experiencing notable fluctuations. Amidst these changing dynamics, growth companies with high insider ownership in the UK present an interesting focus, as significant insider stakes often suggest confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 22% | 142.7% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Underneath we present a selection of stocks filtered out by our screen.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

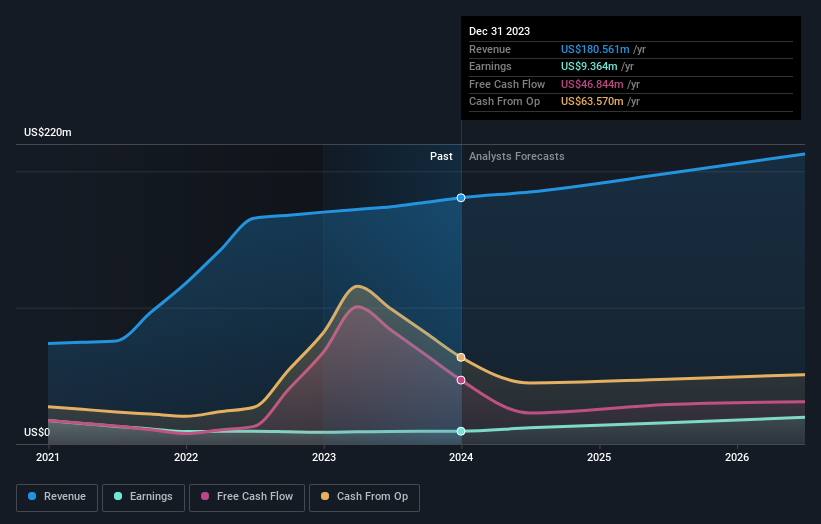

Overview: Craneware plc, a company that develops, licenses, and supports software for the healthcare industry primarily in the United States, has a market capitalization of approximately £838.88 million.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Craneware, a UK-based company with high insider ownership, shows promising financial growth with a reported sales increase from US$84.67 million to US$91.21 million and net income rising to US$4.06 million in the latter half of 2023. Despite modest revenue growth projections at 7.3% annually, earnings are expected to surge by approximately 28.5% per year over the next three years, outpacing the UK market forecast of 13.1%. However, its anticipated Return on Equity is considered low at around 11.2% in three years' time.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

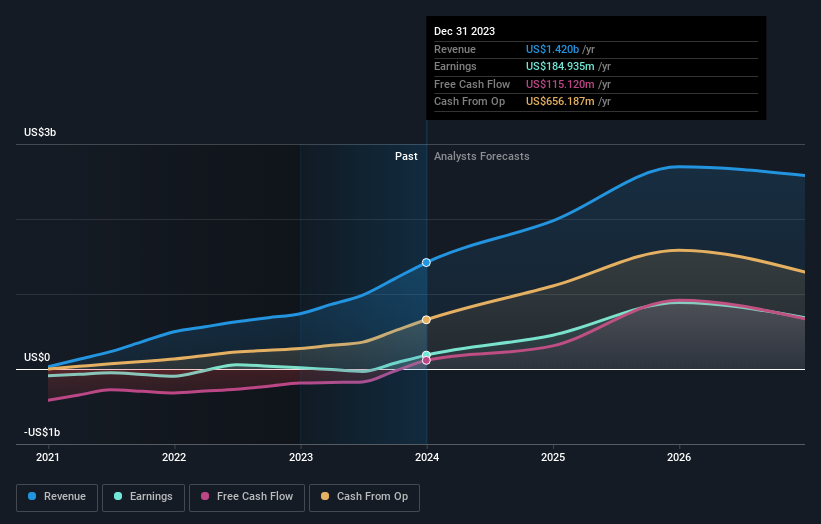

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of hydrocarbons, with a market capitalization of approximately £2.19 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

Insider Ownership: 10.7%

Energean, a UK-based growth company with significant insider ownership, is trading 19.7% below its estimated fair value and has shown robust recent performance with a 970.8% earnings increase last year. Despite a high level of debt, the company's revenue and earnings are forecast to grow by 12.6% and 19.42% per year respectively, outpacing the UK market averages of 3.7% and 13.1%. However, its dividend coverage remains weak due to insufficient earnings and cash flows support.

Click here and access our complete growth analysis report to understand the dynamics of Energean.

The valuation report we've compiled suggests that Energean's current price could be quite moderate.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.94 billion.

Operations: The company's revenue is primarily generated from three key segments: San Jose at $242.46 million, Inmaculada at $396.64 million, and Pallancata at $54.05 million.

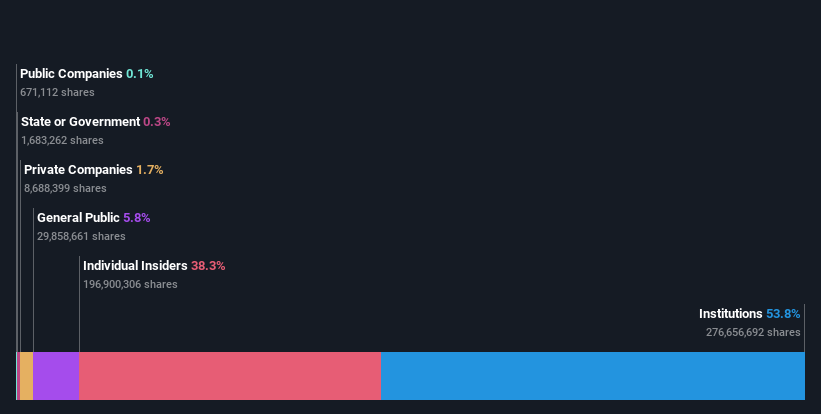

Insider Ownership: 38.4%

Hochschild Mining, a UK-based growth company with high insider ownership, is navigating a challenging landscape with a recent net loss of US$55.01 million and lower sales year-over-year. However, the firm shows promise with expected revenue growth outpacing the UK market average and forecasts indicating profitability within three years. Insider activities reflect confidence, marked by more buying than selling recently. Additionally, strategic M&A pursuits aim to bolster its portfolio, exemplified by potential investments like Monte Do Carmo.

Take a closer look at Hochschild Mining's potential here in our earnings growth report.

Our valuation report unveils the possibility Hochschild Mining's shares may be trading at a premium.

Next Steps

Delve into our full catalog of 66 Fast Growing UK Companies With High Insider Ownership here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW LSE:ENOGLSE:HOC and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com