CapitaLand and UOL-led consortium submit $805.39 mil bid for Holland Drive GLS site

The $805.39 million bid put forward by the CapitaLand-UOL consortium is the highest out of three bids that the government received for the 133,330 sq ft residential site when the tender closed on May 14.

A consortium of four property developers led by CapitaLand Development (35%) and UOL Group (35%) have submitted a $805.39 million bid of a government land sale (GLS) site at Holland Drive. The other two partners in the consortium are Singapore Land Group (20%) and Kheng Leong Co. (10%).

The $805.39 million bid put forward by the CapitaLand-UOL consortium is the highest out of three bids that the government received for the 133,330 sq ft residential site when the tender closed on May 14.

The second highest bid was jointly submitted by Hong Leong Group and Hong Realty, which put in a bid of $765.26 million ($1,221 psf per plot ratio). While CK Asset Holdings put forward a $632 million ($1,008 pf ppr) bid for the site.

Thus, the $805.39 million bid submitted by the CapitaLand-UOL consortium is 5.24% higher than the second highest bid from Hong Leong Holdings and Hong Realty.

The 99-year leasehold site along Holland Drive in prime District 10 has a maximum gross floor area of about 626,650 sq ft. According to a statement from a spokesperson for the CapitaLand-UOL consortium: “If awarded the tender, the consortium plans to develop two 40-storey condominium towers accommodating 680 units on the site”.

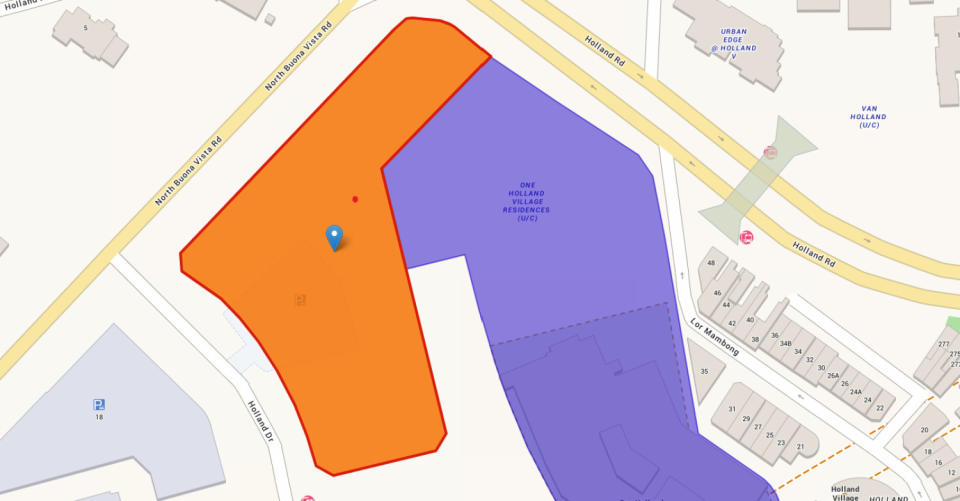

Competition for this Holland Road GLS site was less intense compared to the neighbouring mixed-use GLS that has since been developed into One Holland Village. That site garnered 15 bids from 10 different consortiums.

It was ultimately awarded to Far East Organization, and its joint venture partners Sekisui House and Sino Group, in 2018. Their bid of $1.2 billion translates to a land rate of $1,888 psf ppr.

According to Leonard Tay, head of research at Knight Frank Singapore, the three bids for the latest GLS site at Holland Road was “within expectations given the current state of developer sentiment in the private residential market”. He adds: “The continued low number of interested developers in the form of bids reflect the guarded sentiments that most developers have in today’s operating environment”.

Tay points out that the high cost of construction, elevated borrowing costs, coupled with government property cooling measures have brought the cumulated development risk to “seemingly unappetising levels for most but the biggest of developers,” he says.

Wong Siew Ying, head of research and content at PropNex Realty, shared a similar sentiment, and opined that the number of bids for this GLS site suggests that developers are “circumspect” as the market once again witnessed relatively conservative bidding. “The top bid land rate for this Core Central Region (CCR) plot came in below our expectations,” she says.

The $805.39 million ($1,285 psf ppr) bid from the CapitaLand-UOL consortium is 31.9% lower, in terms of psf ppr price, than the $1.213 billion ($1,888 psf pr) that Far East Organization and its partners forked out for the neighbouring mixed-use site.

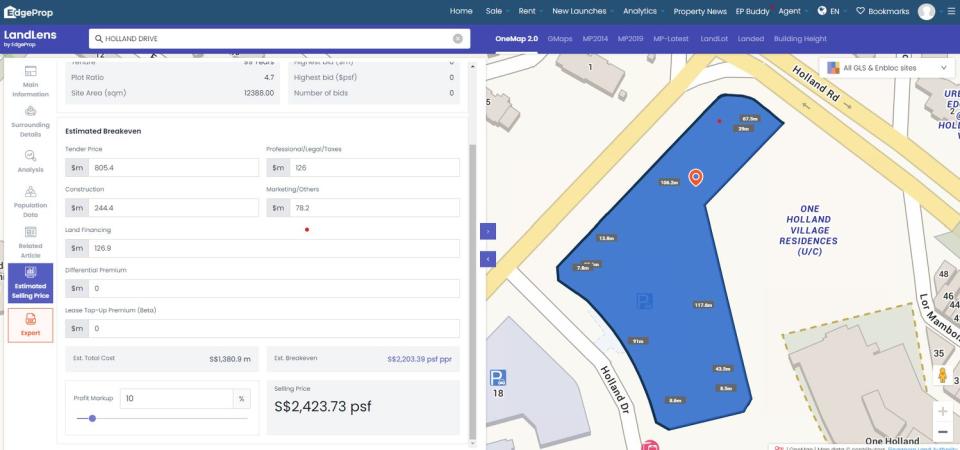

Details of the GLS site can be found of EdgeProp's property analytics tool, Landlens. (Map: EdgeProp Singapore)

If the latest Holland Drive GLS site is awarded to the CapitaLand-UOL consortium, the land rate of $1,285 psf ppr would be the lowest for a CCR GLS residential plot since the Kampong Java Road site was sold for $1,192 psf ppr in January 2019, says Wong. That site has since been developed into Kopar at Newton.

“Although the residential Holland Drive site is not really comparable with the mixed-use parcel that has become One Holland Village, developers are clearly submitting more conservative bids compared to six years ago. Additionally, the size of the site might have deterred others with the large ticket size,” says Tay.

Marcus Chu, CEO of ERA Singapore says that the new project will benefit from a captive market as some owners of nearby landed properties may be looking to downgrade to single-level units as they age, as well as owners of the older developments in the area who may be looking to upgrade.

Mohan Sandrasegeran, head of research and data analytics, SRI, says that the historical performance of new launches in the Holland Road area underscores a strong market demand for new private residential homes in that area. “Projects such as One Holland Village Residences and One-North Eden have demonstrated considerable appeal, with both developments fully selling out. Additionally, the recent launch of nearby Blossoms By The Park has seen an impressive uptake with over 90% of its units already sold,” he says.

One Holland Village mall had its soft opening last December. The other components of the mixed-use development — the fully-sold 296-unit One Holland Village Residences, and the 255-unit Quincy House serviced residences — are expected to be completed in 4Q2024. (Picture: Samuel Isaac Chua/The Edge Singapore)

The 296-unit One Holland Village Residences launched for sale in November 2019 and was fully sold by August 2023. The residential project achieved an average selling price of $2,807 psf.

If the CapitaLand-UOL consortium is awarded the GLS site, Tay estimates that the project could see a launch price of approximately $2,800 psf.

This was echoed by Sandrasegeran who says that a launch price that ranges between $2,800 psf to $3,200 psf aligns with prevailing market conditions and positions the future development advantageously to capitalise on catchment demand.

Only PropNex forecasts a possible average selling price at above $2,700 psf for the new development. “We anticipate positive buying interest for future homes built on the site - subject to sensitive pricing that fits the housing budget of local buyers,” says Wong.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance