Alan Fournier's Strategic Moves in Q1 2024 Highlighted by Major Stake in Enovis Corp

Insight into Fournier's Latest 13F Filings and Investment Adjustments

Alan Fournier (Trades, Portfolio), the seasoned investor behind the transformation of his hedge fund into a family office, has recently disclosed his first quarter 2024 portfolio adjustments through the latest 13F filing. Fournier, who began his career at Sanford C. Bernstein and later contributed significantly at Appaloosa Management, is known for his unique investment approach that blends growth and value investing with sophisticated hedging and leverage techniques. His latest moves provide valuable insights into his strategic thinking in the current market environment.

Summary of New Buys

Alan Fournier (Trades, Portfolio)'s portfolio saw the addition of new stocks in this quarter, with a notable focus on:

Enovis Corp (NYSE:ENOV), where he purchased 400,000 shares, making it a significant new holding that represents 6.19% of his portfolio, valued at $24.98 million.

Key Position Increases

The first quarter also saw Fournier increasing his stakes in existing investments:

Antero Resources Corp (NYSE:AR) saw an addition of 220,000 shares, bringing the total to 1,133,000 shares. This adjustment marks a 24.1% increase in share count and impacts the portfolio by 1.58%, with a total value of $32.86 million.

Summary of Sold Out Positions

Fournier decided to exit certain positions entirely:

Travere Therapeutics Inc (NASDAQ:TVTX) was completely sold out, with Fournier disposing of all 55,800 shares, which had a -0.11% impact on the portfolio.

Key Position Reductions

Reductions were also part of this quarter's strategy, with significant cuts in major tech giants:

Alphabet Inc (NASDAQ:GOOGL) saw a reduction of 176,000 shares, a -46.93% decrease, impacting the portfolio by -5.37%. The stock had an average trading price of $143.05 during the quarter.

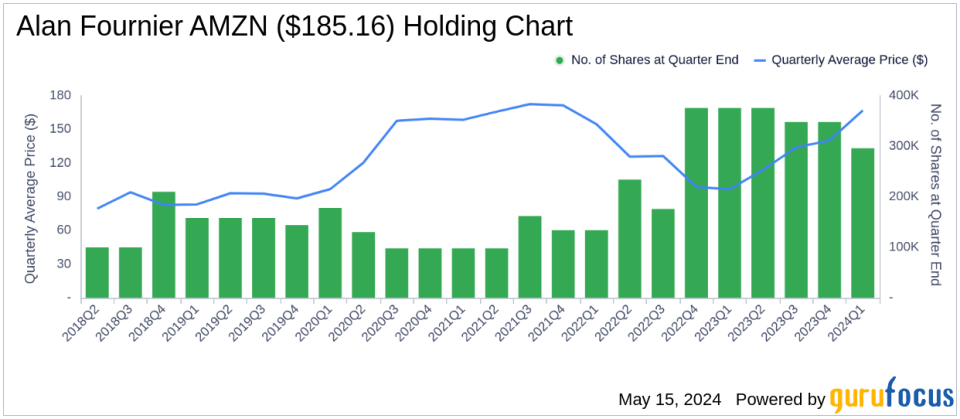

Amazon.com Inc (NASDAQ:AMZN) was reduced by 52,000 shares, a -14.94% decrease, impacting the portfolio by -1.72%. The stock traded at an average price of $166.93 during the quarter.

Portfolio Overview

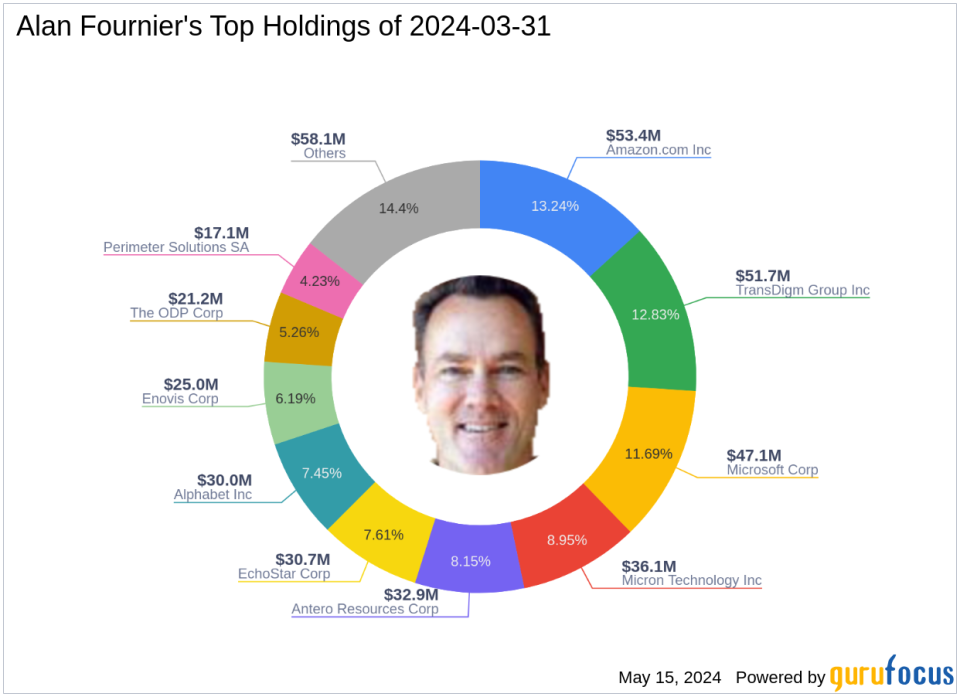

As of the first quarter of 2024, Alan Fournier (Trades, Portfolio)'s investment portfolio included 44 stocks. The top holdings were:

13.24% in Amazon.com Inc (NASDAQ:AMZN)

12.83% in TransDigm Group Inc (NYSE:TDG)

11.69% in Microsoft Corp (NASDAQ:MSFT)

8.95% in Micron Technology Inc (NASDAQ:MU)

8.15% in Antero Resources Corp (NYSE:AR)

These holdings are predominantly concentrated in sectors such as Technology, Industrials, Consumer Cyclical, Energy, Communication Services, Basic Materials, and Healthcare.

The strategic adjustments made by Alan Fournier (Trades, Portfolio) in the first quarter of 2024 reflect a dynamic approach to portfolio management, emphasizing both new opportunities and strategic reductions. His focus on significant entities like Enovis Corp and adjustments in tech giants like Alphabet and Amazon highlight his responsive investment philosophy in the evolving market landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance