Straits Times Index

3,287.75 -5.38 (-0.16%) S&P 500

5,005.36 -66.27 (-1.31%) Dow

37,959.74 -501.18 (-1.30%) Nasdaq

15,391.76 -320.99 (-2.04%) Bitcoin USD

63,165.03 -2,877.09 (-4.36%) CMC Crypto 200

1,346.41 -36.16 (-2.62%)

Enel SpA (ENEL.MI)

| Previous close | 6.09 |

| Open | 6.11 |

| Bid | 6.01 x 0 |

| Ask | 6.01 x 0 |

| Day's range | 6.00 - 6.11 |

| 52-week range | 5.47 - 6.82 |

| Volume | |

| Avg. volume | 25,717,022 |

| Market cap | 61.311B |

| Beta (5Y monthly) | 0.95 |

| PE ratio (TTM) | 16.68 |

| EPS (TTM) | 0.36 |

| Earnings date | 09 May 2024 |

| Forward dividend & yield | 0.43 (7.06%) |

| Ex-dividend date | 22 Jul 2024 |

| 1y target est | 7.50 |

Insider Monkey

Insider Monkey11 Best Italian Stocks To Invest In 2024

In this piece, we will take a look at the 11 best Italian stocks to invest in 2024. If you want to skip our overview of the Italian economy and all the latest news, then you can take a look at the 5 Best Italian Stocks To Invest In 2024. The global economy, and particularly […]

GuruFocus.com

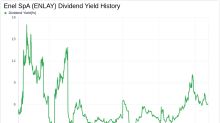

GuruFocus.comEnel SpA's Dividend Analysis

Enel SpA (ENLAY) recently announced a dividend of $0.23 per share, payable on 2024-02-14, with the ex-dividend date set for 2024-01-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Enel SpA's dividend performance and assess its sustainability.

- Reuters

UPDATE 1-Italy's Enel finalises sale of several US green assets to Ormat

Enel finalised the sale of a renewable asset portfolio in the United States to Ormat Technologies for $271 million, Italy's biggest utility said on Thursday. Under the agreement, Enel is divesting its entire geothermal portfolio in the United States along with a number of small solar plants, for a total capacity of 150 megawatts (MW). The move is expected to have a positive effect worth about 250 million euros ($274 million) on Enel's consolidated net debt but negatively impact, by around 30 million euros, the group's reported net income, the group said in a statement.