Singapore markets open in 8 hours 39 minutes

Straits Times Index

3,287.75 -5.38 (-0.16%) S&P 500

5,026.27 -45.36 (-0.89%) Dow

37,964.32 -496.60 (-1.29%) Nasdaq

15,508.83 -203.92 (-1.30%) Bitcoin USD

64,032.04 -592.07 (-0.92%) CMC Crypto 200

1,387.30 +4.73 (+0.34%)

Mitsubishi Heavy Industries, Ltd. (7011.T)

Tokyo - Tokyo Delayed price. Currency in JPY

Add to watchlist

At close: 03:15PM JST

| Previous close | 1,358.00 |

| Open | 1,330.00 |

| Bid | 1,328.00 x 0 |

| Ask | 1,330.50 x 0 |

| Day's range | 1,322.00 - 1,338.50 |

| 52-week range | 501.80 - 1,460.00 |

| Volume | |

| Avg. volume | 43,092,454 |

| Market cap | 4.463T |

| Beta (5Y monthly) | 0.56 |

| PE ratio (TTM) | 22.07 |

| EPS (TTM) | 60.16 |

| Earnings date | 08 May 2024 |

| Forward dividend & yield | 16.00 (1.18%) |

| Ex-dividend date | 28 Mar 2024 |

| 1y target est | 1,316.70 |

Zacks

ZacksMitsubishi Heavy Industries (MHVYF) is on the Move, Here's Why the Trend Could be Sustainable

Mitsubishi Heavy Industries (MHVYF) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

POWER Magazine

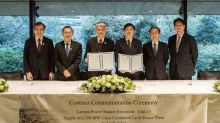

POWER MagazineMitsubishi Power Supports New Gas-Fired Unit in Hong Kong

Mitsubishi Power, a division of Mitsubishi Heavy Industries (MHI), announced the company has received an order for gas turbine combined cycle (GTCC) power generation system equipment for Lamma Power Station’s […]

Zacks

ZacksRecent Price Trend in Mitsubishi Heavy Industries (MHVYF) is Your Friend, Here's Why

Mitsubishi Heavy Industries (MHVYF) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.