ZTO Express (ZTO) Q1 Earnings Miss Estimates, Decline Y/Y

ZTO Express Inc.’s ZTO first-quarter 2020 earnings of 12 cents per share (RMB 0.82) missed the Zacks Consensus Estimate of 27 cents. Moreover, the bottom line declined significantly year over year. Results were affected by coronavirus-related woes despite a 4.9% increase in parcel volume to 2,374 million.

Total revenues of $553 million (RMB 3.92 billion) also declined year over year. The downside was due to decline in revenues at the express delivery services unit, which contributed 88.7% to the top line.

Detailed Operational Statistics

Revenues in Express delivery services declined 16.1% year over year, affected by coronavirus headwinds. Freight forwarding services revenues, contributing 6.3% to the top line, inched up 2.1% year over year, owing to increase in cross-border e-commerce demand amid coronavirus concerns. However, revenues from sales of accessories declined 15.2% year over year.

Meanwhile, total operating expenses of this China-based company declined 10.6% to RMB 446.6 million. Selling, general and administrative expenses increased marginally year over year. Gross margin deteriorated to 20.9% in the first quarter from 27.5% in the year-ago quarter. As of Mar 31, 2020, ZTO Express repurchased 7.7 million ADSs at average price of $17.33.

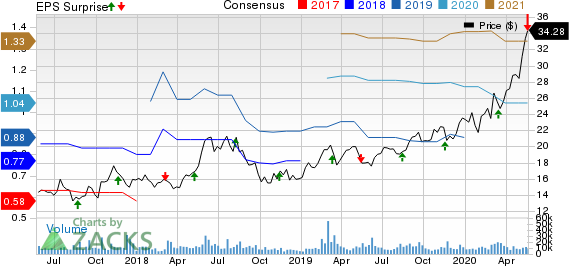

ZTO Express Cayman Inc. Price, Consensus and EPS Surprise

ZTO Express Cayman Inc. price-consensus-eps-surprise-chart | ZTO Express Cayman Inc. Quote

Liquidity

ZTO Express, carrying a Zacks Rank # 3 (Hold), exited the first quarter with cash and cash equivalents of RMB 5.02 billion, compared with RMB 5.27 billion at the end of 2019. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

ZTO Express expects parcel volumes in the range of 15.9-16.4 billion for 2020. This indicates a 37-42% increase for the combined last three quarters of the year. Additionally, adjusted net income is anticipated between RMB 5.39 billion and RMB 5.83 billion, indicating a 10-20% rise for the combined last three quarters of the year.

Performance of Other Transportation Stocks

Within the broader Transportation sector, Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation WAB, Alaska Air Group, Inc. ALK and Trinity Industries, Inc. TRN reported earnings numbers a few weeks ago.

Wabtec, carrying a Zacks Rank #4 (Sell), reported first-quarter 2020 earnings of 97 cents per share (excluding 39 cents from non-recurring items), falling short of the Zacks Consensus Estimate by a couple of cents. Moreover, the bottom line declined 8.5% year over year due to higher operating expenses. Total sales jumped 21.1% year over year to $1,929.9 million but missed the consensus estimate of $2,026.2 million.

Alaska Air, carrying a Zacks Rank #3, incurred a loss of 82 cents per share (excluding $1.05 from non-recurring items) in the first quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $1.27. In the year-ago quarter, the company reported earnings of 17 cents. The downturn is due to an unprecedented drop in air travel demand in the wake of the coronavirus outbreak. Revenues came in at $1,636 million, missing the Zacks Consensus Estimate of $1,691.1 million. The top line also declined approximately 13% year over year.

Trinity’s first-quarter 2020 earnings of 11 cents per share (excluding $1.22 from non-recurring items) missed the Zacks Consensus Estimate of 14 cents. Moreover, the bottom line plunged 54.2% year over year. However, total revenues of $615.2 million surpassed the Zacks Consensus Estimate of $478.5 million. The top line also inched up 1.7% year over year on higher volume of railcars. The stock carries a Zacks Rank #5 (Strong Sell).

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

ZTO Express Cayman Inc. (ZTO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance