Zimmer Biomet (ZBH) Procedure Recovery Strong, Margin Woe Stays

Zimmer Biomet's ZBH strategic spin-off of the non-core dental and spine business, its focus on emerging markets and stabilizing market trends bolster our confidence in the stock. On the flip side, factors like macroeconomic uncertainties, pricing pressure and unfavorable currency fluctuations continue to adversely impact Zimmer Biomet's sales. The stock currently carries a Zacks Rank #3 (Hold).

In the past year, Zimmer Biomet has outperformed its industry. The stock has lost 24.6% compared with 45.6% fall of the industry.

Zimmer Biomet, in spite of a difficult macroeconomic scenario in the second quarter, posted better-than-expected earnings and revenues. Zimmer Biomet ended the second quarter of 2022 with better-than-expected earnings and revenues. Each of the company’s geographic segments and product divisions, barring “other,” recorded year-over-year sales growth at CER.

Revenues were driven by continued execution along with strong COVID recovery across most markets. According to the company, strong procedure volume recovery extended from the first quarter, especially as Zimmer Biomet moved into April and May, followed by a moderation in recovery in June. U.S. sales grew 1.3%, driven by a strong recovery in execution as COVID cases subsided and elective procedures returned, especially in Knee and Hips.

Despite the near-term pressure, Zimmer Biomet is putting in efforts for business recovery in 2022. In Q2, the Knees business grew 11.2%, driven majorly by strong knee procedure recovery across most regions. Within the Hips business, easier comparisons outside the United States along with strong international procedure recovery drove growth. Zimmer Biomet raised its 2022 financial guidance, expecting a better-than-expected COVID recovery.

A raised 2022 guidance indicates that this trend will continue for the rest of the year.

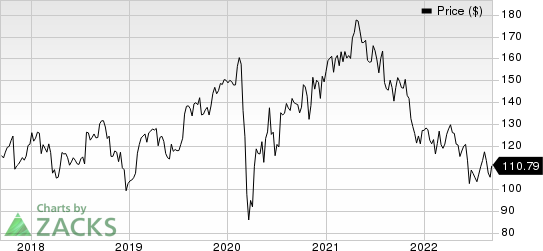

Zimmer Biomet Holdings, Inc. Price

Zimmer Biomet Holdings, Inc. price | Zimmer Biomet Holdings, Inc. Quote

Moreover, Zimmer Biomet’s recently-completed spin-off of the non-core dental and spine business is expected to prove strategic. According to Zimmer Biomet management, this planned spin-off of its Spine and Dental business is part of the company’s third phase of ongoing transformation, which includes changing the complexion of the business through active portfolio management in order to accelerate growth and drive value creation. Per management, for Zimmer Biomet, the transaction is an important next step in the company’s transition into a more streamlined company with a focus on greater and more optimized resource allocation toward innovation in core businesses that are profitable and where it sees attractive markets with opportunities to become market leaders.

On the flip side, earlier this year, Zimmer Biomet noted that volume-based procurement (VBP) in China is expected to be almost neutral to overall revenue growth in 2022. In Q2, the company stated that China is currently performing largely as projected.

In the quarter, the S.E.T. category increased a mere 0.1%, impacted by a year-over-year tough comparable, expected pressure in trauma due to VBP implementation as well as expected pressure in restorative therapies due to a reimbursement shift for Gel-One product. Further, the “Other” category declined 6.1% due to a tough comparable and expected lower capital sales related to a higher mix of ROSA placement versus upfront sales in the quarter.

Added to this, a contraction in the company’s gross margin is concerning. A significant reduction in R&D expenses increases concern about pipeline-related progress.

Through the first half of 2022, Zimmer Biomet recognized customer staffing shortages and an impact of China VBP, both of which dented growth. COVID surges in EMEA and China during the months of Q2 resulted in overall procedure cancellation. The company expects these trends to continue into the third quarter as well.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corporation MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 17.4% against the industry’s 30.7% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 63.8% against the industry’s 32.3% fall over the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has gained 46.4% against the industry’s 13.3% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance