The inverted yield curve sets the stage for a 'last gasp rally' in stocks

Now that the yield curve has inverted, what’s next for the stock market?

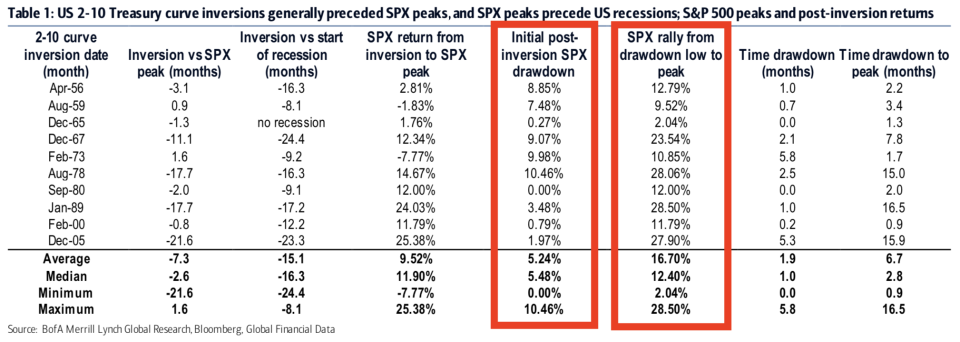

“The U.S. equity market (^GSPC) is on borrowed time after the yield curve inverts,” Bank of America Merrill Lynch’s Stephen Suttmeier wrote on Tuesday. “However, after an initial post-inversion dip, the S&P 500 can rally meaningfully prior to a bigger U.S. recession related drawdown.”

In other words, stocks tend to go down, then go way up, and then go way way down.

On Wednesday morning at about 6 a.m. ET, the 10-year Treasury yield (^TNX) dipped below the 2-year yield. U.S. stock market futures tumbled with Dow futures (YM=F) losing about 300 points in the minutes that followed.

And so if history is a guide, then now might be a time to buy.

“The initial post-inversion drawdown is 5.2% on average (5.5% median) but has ranged from 0% (1980) to 10.5% (1978),” Suttmeier observed of the post-inversion market reactions. “These drawdowns typically last one to two months but have ranged from 0 (1980) to 5.8 months (1973).

“After the initial drawdown, the S&P 500 can have a meaningful last gasp rally,” he added. “This rally has averaged 16.7% (12.4% median) with a range of 2.0% (1965) to 28.5% (1989) and lasts 6.7 months on average (2.8 median) with a range of 0.9 to 16.5 months. The 1967, 1978, 1989, and 2005 inversions saw last gasp rallies in excess of 20% on the S&P 500.”

To be clear, these yield curve inversions and market swings aren’t occurring in a vacuum. In fact, the major concern is that yield curve inversions have a stellar track record of preceding economic recessions. And recessions are always bad news for stocks.

“S&P 500 corrections associated with NBER recessions average 31.7% (22.2% median) and tend to last 14-15 months (range of 1.4 to 33.0 months),” Suttmeier added.

All that said, Bank of America Merrill Lynch’s house view is that we are in the midst of a long-term secular bull market, and that any impending economic recession and market sell-off would just be a blip in much bigger bullish story.

“Recessions do occur during secular bull markets,” Suttmeier said. “The 1950-1966 bull market had three and the 1980-2000 bull market had two. The silver lining is that the S&P 500 pullbacks associated with recessions during secular bull trends are much less severe and averaged 20% (range of 13.9% to 27.1%) rather than the average 40% drawdown (range of 0.0% to 86.2%) for recession pullbacks during secular bear phases.”

—

Sam Ro is managing editor at Yahoo Finance. Follow him on Twitter: @SamRo

Read more:

UBS warns of a 'major surprise this year' that'll send stocks down 9%

How Charlie Munger pulled Warren Buffett away from 'cigar butt' investing

Warren Buffett decries accounting rule change that has made a mess of Berkshire's earnings

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance