Yelp's (YELP) Q2 Earnings Top, Revenues Miss Mark, Rise Y/Y

Yelp Inc.’s YELP second-quarter 2019 earnings of 16 cents per share surged 30% year over year and also surpassed the Zacks Consensus Estimate of $12 cents, driven by higher net income and lower share count owing to robust share repurchases.

Revenues of $247 million missed the Zacks Consensus Estimate of $248 million but increased 5% year over year.

The company’s focus on expanding its product portfolio is a key driver. Notably, its two new products — Verified License and Business Highlights — added more than 25,000 active paying locations in the quarter. Moreover, these products boosted the number of paying advertising starts in the Self Serve channel.

Quarterly Details

Advertising revenues (96% of total revenues) rose 5% year over year to $238 million, driven by growth in the number of paying advertising locations and improved productivity from advertising sales force.

Paying advertising locations grew 6% year over year to 549,000 sites. Also, paying advertiser accounts were 194,000, up 1.5% year over year.

Revenues from multi-location advertisers grew 21% year over year, backed by growth across mid-market, franchise and particularly, national advertisers.

Yelp is more and more benefiting from its Home & Local services, which contributed 35% to advertising revenues. Home & Local category was mainly boosted by revenues from ‘Request-A-Quote’, which surged 40% year over year.

Transaction revenues declined 25% year over year to $3 million due to revenue loss as a result of Eat24’s sale to Grubhub.

Other services revenues improved 15% to $6 million, banking on growth of Yelp Reservations and Yelp Waitlist.

Cumulative reviews rose 18% year over year to more than 192 million. App unique devices also climbed 15% year over year to 37 million on monthly average basis.

The company delivered 42% more paid ad clicks to advertisers while reducing their average cost-per-click (CPC) by 25%.

Yelp reported adjusted EBITDA of $55 million, up 17% year over year. Moreover, adjusted EBITDA margin expanded 200 bps to 22%, backed by controlled operating expenses.

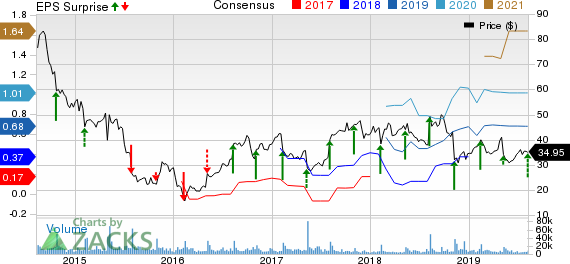

Yelp Inc. Price, Consensus and EPS Surprise

Yelp Inc. price-consensus-eps-surprise-chart | Yelp Inc. Quote

Balance Sheet & Cash Flow

Yelp exited the second quarter with $458 million in cash, cash equivalents & marketable securities, down from $626 million at the end of the prior reported quarter.

Net cash flow from operating activities was $57 million compared with $41 million in the sequential quarter.

During the second quarter, the company repurchased nearly 8.8 million shares for $295 million. As a result, it lowered its outstanding shares by 12% starting this year.

Guidance

For the third quarter, Yelp expects a revenue rise in the range of 8-10% while adjusted EBITDA margins to increase 1-2 percentage points year over year.

The launch of Yelp Portfolios in June is making the management optimistic.

The company reiterates its 8-10% revenue growth prediction for 2019.

Adjusted EBITDA margin is projected to improve 2-3 percentage points for the full year.

Zacks Rank & Key Picks

Yelp currently has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Anixter International AXE, LogMeIn LOGM and Perficient PRFT, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Anixter, LogMeIn and Perficient is currently projected to be 8%, 5% and 10.8%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yelp Inc. (YELP) : Free Stock Analysis Report

Perficient, Inc. (PRFT) : Free Stock Analysis Report

LogMein, Inc. (LOGM) : Free Stock Analysis Report

Anixter International Inc. (AXE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance