Xylem Is the Must-Own Sustainable Water Stock, and It's a Rare Bargain Now

Volatile markets always create buying opportunities in stocks, and that might just be what investors needed in order to find a good entry point for a stock like Xylem Inc. (NYSE: XYL). The sustainable water technology stock's valuation has long reflected the attractiveness of its end markets over the long term, and well-priced buying opportunities have been few and far between. However, the recent share price fall -- for no apparent reason other than the broader market's slide -- has presented an interesting situation for investors. Let's take a closer look at why Xylem could be a buy right now.

Three reasons to buy Xylem stock

The company has solid long-term growth prospects due to the increasing need globally to provide water for growing emerging-market populations; replace aging infrastructure in the developed world, increasingly with smart water networks; and meet increasingly stringent environmental standards.

Xylem is exceeding its mid-term expectations and has good earnings momentum.

Management is committed to continuous improvement, and productivity gains are starting to make the stock look a good value on a free-cash-flow (FCF) valuation basis.

Image source: Getty Images

Long-term end market demand

Xylem's management forecasts its mid-term organic revenue growth in the 4% to 6% range, but on an underlying basis, its emerging market growth is significantly higher. Moreover, CEO Patrick Decker has engineered a refocusing of Xylem's strategy toward the key markets of China, India, the Middle East and South East Asia.

That's good news for investors, because management projects Xylem's annual growth from China will be in the mid- to high-single-digit percentage range, and forecasts growth from India in the low double-digit percentages. As Decker said at the Electrical Products Group (EPG) Conference in May: "We are expecting to continue to see double-digit growth in those parts of the world and high single-digit growth in emerging markets overall."

Data source: Xylem presentations. Chart by author.

However, it's not just about emerging markets, because in more developed nations, there's also a need to replace aging infrastructure. And water networks across the globe could benefit significantly from new, smart technology.

For example, Decker estimates that some 25% to 60% of water produced by utilities gets lost due to a combination of leakage, theft, and inaccurate metering/billing -- a longtime problem in the industry. This presents a big opportunity for Xylem to expand its sales of products such as smart meters and infrastructure analytics solutions -- revenues from which are currently growing in the high-single-digit percentages annually.

In addition, companies like Xylem are benefiting as governments enact more rigorous environmental regulations around water treatment. You can see that reflected in the high-single-digit percentage revenue growth delivered by Danaher's water quality platform in the second quarter. Similarly, Decker sees a growth opportunity in newer regulations that increasingly require cities and utilities to prevent overflows of untreated sewage and stormwater from combined sewer systems after heavy rains; companies like drainage and water pipe specialist Forterra, which provide the technology necessary to comply with those rules, are experiencing significant growth as a result.

Xylem's mid-term targets

A quick comparison of the management's current mid-term outlook compared to the guidance it gave in 2015 shows a company exceeding expectations. In other words, Xylem is enjoying good earnings momentum, and investors have cause to feel confident in management's ability to execute.

As you can see below, its revenue and margin outlook has improved, and earnings expectations have increased significantly in consequence. Meanwhile, the increase in capital available for deployment means Xylem has more cash than expected in order to make acquisitions, pay dividends or buy back shares.

Xylem Metric Forecast | Current Outlook to 2020 | Original Target Given in 2015 |

|---|---|---|

Organic revenue growth range | 4% to 6% | 3% to 5% |

Operating profit margin range | 17% to 18% | 16% to 17% |

EBITDA margin range | 21.5% to 22.5% | 20% to 21% |

EPS growth range | Mid-teen percentages | 8% to 12% |

Capital available for deployment | $5 billion | $3.5 billion |

Data source: Xylem presentations.

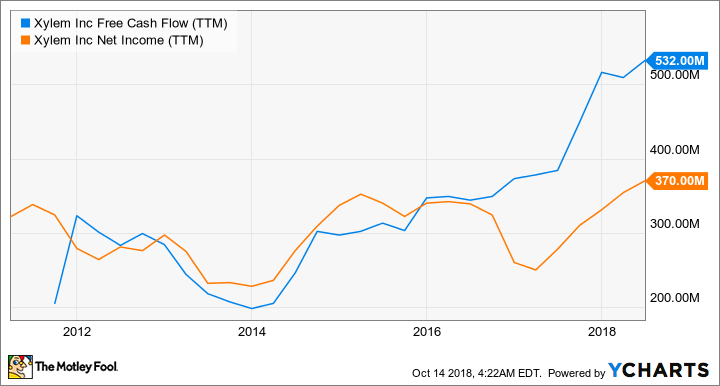

Xylem's valuation is attractive

As you can see above Xylem is becoming more profitable, but it's also converting more of its FCF into net income. You can think of FCF as the actual return you'd get from a business if you owned it yourself. The good news is that Xylem's FCF is higher now, thanks to a mix of productivity improvements and cost-cutting measures.

XYL Free Cash Flow (TTM) data by YCharts

To put this into context, Xylem has forecast EPS in the range of $2.85 to $2.95 in 2018, and expects to convert at least 115% of EPS into FCF. Based on an expected share count of 181 million, this equates to roughly $600 million in FCF. With shares currently trading at around $70 -- giving Xylem a market cap of $12.5 billion -- this means the company is on course to generate 4.8% of its market cap in FCF -- not bad for a business with earnings growth in the mid-teen percentages.

Moreover, at the EPG Conference, Decker also asserted that Xylem would be able to keep converting its earnings into FCF at the current rate or even better due to three factors:

Ongoing reductions in working capital requirements -- relatively less cash will be tied up in running the business.

The new businesses that Xylem has been buying in the smart technology area tend to have better cash generation profiles.

Earnings margin improvement is tending to carry "through to the bottom line as well," meaning that conversion improves as earnings margin improves.

A sustainable water stock to buy

Provided the recent dramatic decline in Xylem's stock price is merely a product of market volatility -- in such periods, highly rated stocks can be punished the most -- then its current valuation and long-term prospects make it an attractive option for investors looking for exposure to the sustainable water investing theme.

The combination of a near-5% FCF yield and mid-teens earnings growth would be attractive in any stock, let alone one with the kind of earnings runway that Xylem has. This could be a good opportunity to take a position in a stock that is rarely cheap.

More From The Motley Fool

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance