XRP Trails the Broader Market ahead of Key SEC v Ripple Court Dates

Key Insights:

On Monday, XRP tumbled by 13.82% to end the day at $0.4877. The sell-off saw XRP fall to sub-$0.50 for the first time since March 2021.

While finding support this morning, key dates in the SEC v Ripple case are approaching.

Key technical indicators bearish. XRP sits well below the 50-day EMA.

On Monday, XRP tumbled by 13.82%. Following a 2.57% decline on Sunday, XRP ended the day at $0.4877. The downside came ahead of some key court dates in the SEC v Ripple case.

An extended sell-off saw XRP slide through the day’s Major Support Levels to sub-$0.50 levels for the first time since March 2021.

Risk aversion stemming from inflation angst and investor sentiment towards Fed monastery policy left riskier assets in the red.

News updates from the SEC case against Ripple have provided little support, with the SEC winning a minor victory last week.

Ripple Lab and the SEC Remain Focused on William Hinman Documents

On Monday, defense attorney James Filan shared a brief update on where things stand in the SEC v Ripple Lab case.

On Friday, May 13, Ripple Defendants are due to respond to the SEC’s brief claiming the Hinman documents are protected by the attorney-client privilege. The SEC is then due to respond to Ripple Defendants’ comments on May 18.

#XRPCommunity #SECGov v. #Ripple #XRP Quick scheduling update. Ripple Defendants’ response to the SEC’s brief claiming the Hinman documents are protected by the attorney-client privilege is due Friday, May 13th. The SEC’s reply to the Ripple Defendants’ response is due May 18th.

— James K. Filan 🇺🇸🇮🇪96k+ (beware of imposters) (@FilanLaw) May 8, 2022

William Hinman, former SEC Director of the Division of Corporation Finance, is a central figure in the SEC v Ripple case.

By way of background, Hinman said that Bitcoin (BTC) and Ethereum (ETH) are not securities in a 2018 speech. The SEC is looking to shield documents and emails relating to internal discussions and Hinman’s famous speech.

The SEC has filed numerous motions in an attempt to shield the 2018 Hinman speech documents on the grounds of attorney-client privilege.

The outcome of these two responses could prove pivotal to the case. A ruling in favor of Ripple would tip the case in Ripple’s favor.

Last Wednesday, Judge Sarah Netburn granted the SEC’s request to file a reply brief in connection with attorney-client privilege claims regarding the Hinman speech documents.

XRP Price Action in the Hands of the SEC Case

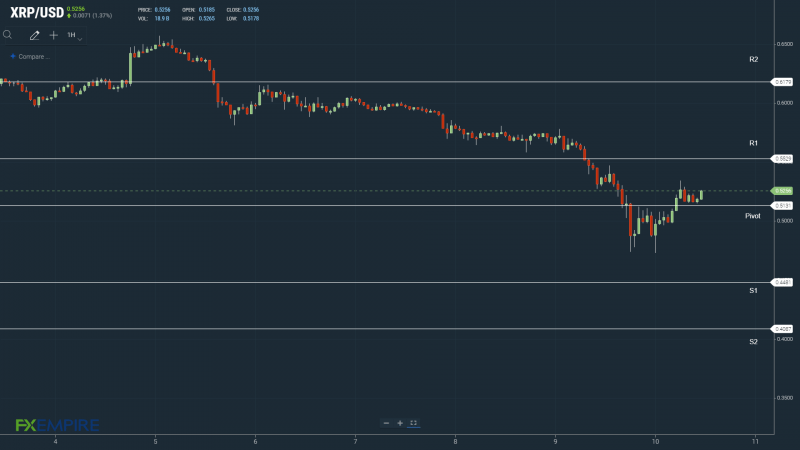

At the time of writing, XRP was up 8.02% to $0.5268. A mixed start to the day saw XRP fall to an early morning low of $0.4729 before striking a high of $0.5343.

Technical Indicators

XRP will need to avoid the $0.5131 pivot to target the First Major Resistance Level at $0.5529. XRP would need broader crypto market support to breakout from this morning’s high of $0.5343.

In the event of an extended rally, XRP should test the Second Major Resistance Level at $0.6179. The Third Major Resistance Level sits at $0.7222.

A fall through the pivot would bring the First Major Support Level at $0.4481 into play.

Barring another extended sell-off throughout the day, XRP should avoid sub-$0.40. The Second Major Support Level at $0.4087 should limit the downside.

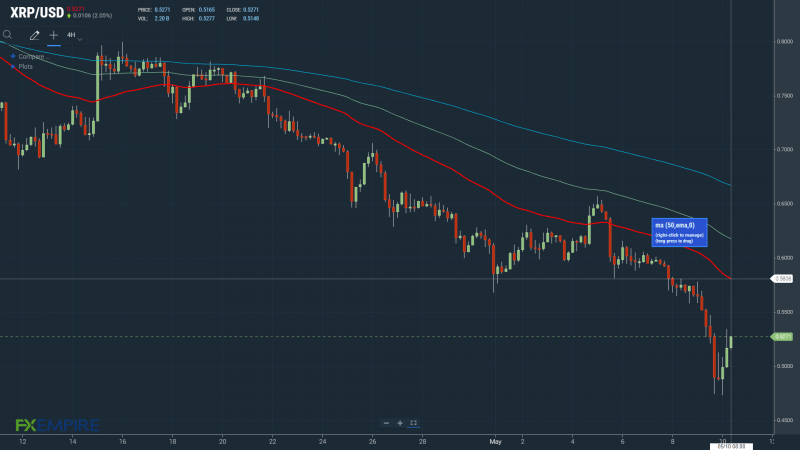

The EMAs and the 4-hourly candlestick chart (below) send a bearish signal. At the time of writing, XRP sits below the 50-day EMA, currently at $0.5808. This morning, the 50-day EMA pulled back from the 100-day EMA. The 100-day EMA also pulled back from the 200-day EMA, XRP negative.

A move through the 50-day EMA would support a return to $0.60.

This article was originally posted on FX Empire

More From FXEMPIRE:

Investors think unlikely Musk buys Twitter at agreed $44 billion price

Pirelli operating profit tops estimates in Q1, trims year margin forecast

French TV blockbuster producer Banijay to go public via Arnault-backed blank check company

Under fire over inflation, Biden nods to Fed and attacks Republicans

Yahoo Finance

Yahoo Finance