XRP Targets $0.40 as Investors Bet on a Favorable SEC v Ripple Outcome

Key Insights:

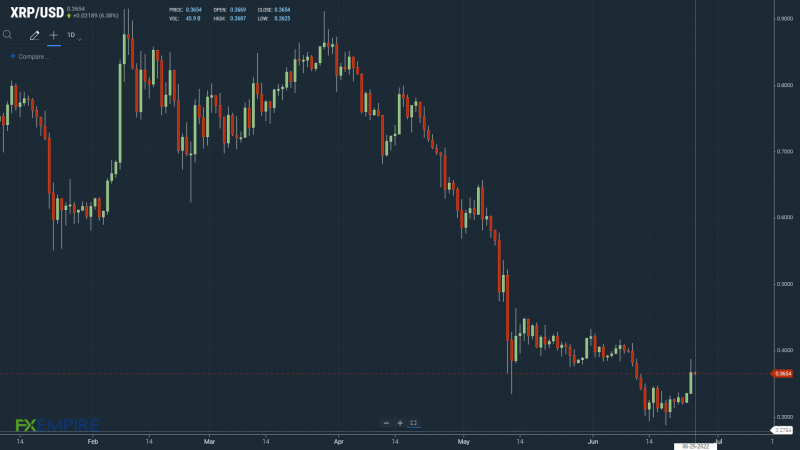

XRP rallied by 9.5% on Friday, with support coming from a broad-based crypto rally.

However, adding to the upside was investor sentiment towards the outcome of the SEC v Ripple case, with investors betting on a settlement.

Technical indicators are bullish, with XRP sitting above the 100-day EMA.

On Friday, XRP rallied by 9.5% to lead the crypto top ten. Following a 4.1% gain on Thursday, XRP ended the day at $03669.

A bullish morning saw XRP surge from an early low of $0.3351 to a late morning high of $0.3868.

XRP broke through the day’s Major Resistance Levels before a pullback to end the day at $0.37.

While falling back to sub-$0.37, XRP avoided a fall through the Third Major Resistance Level at $0.3614.

Despite a second consecutive day in the green, XRP remains under pressure as investors await the court ruling in the SEC v Ripple case.

Court Ruling on Hinman Speech-Related Documents Pivotal to XRP

The SEC, Ripple, and Investors are currently awaiting a court ruling that could have a material impact on XRP and the broader-crypto market.

In 2018, the former SEC Director of the Division of Corporation Finance said that Bitcoin (BTC) and Ethereum (ETH) are not securities.

Hinman has become the focal point of the case as both sides navigate the question of whether XRP is a security.

This year, the SEC has focused primarily on ensuring that the defense and the public don’t see the content of Hinman’s speech-related documents. The SEC continues to claim that these documents fall under the attorney-client privilege.

With the courts entertaining the SEC filings, allowing the SEC to file at least six motions to protect the documents under the attorney-client privilege, the ruling could go either way. Some may argue that Judge Sarah Netburn has given the SEC some wriggle room to eliminate the chance of more motions or even an appeal.

As a ruling nears, XRP has found support, rising from a June 18 current year low of $0.2868. Ultimately, XRP should make its way to December 2020 levels, the month the SEC filed its case against Ripple.

For XRP holders, a favorable outcome would then support a run at the April 2021 high of $1.965.

The upside potential could be significant, which may draw sidelined investors back into the market.

XRP Price Action

At the time of writing, XRP was down 0.41% to $0.3654.

Technical Indicators

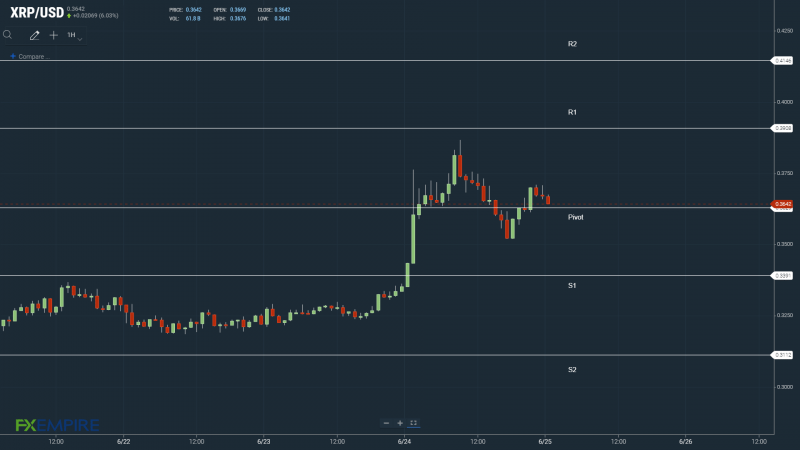

Avoiding a fall through the $0.3629 pivot would bring the Friday high of $0.3868 and the First Major Resistance Level at $0.3908 into play.

XRP would need the broader crypto market to support a breakout from $0.3850.

In the case of an extended crypto rally, XRP could test resistance at $0.40 and the Second Major Resistance Level at $0.4146. A breakout remains hinged on investor sentiment toward the court ruling. The Third Major Resistance Level sits at $0.4663.

A fall through the pivot would bring the First Major Support Level at $0.3391 into play. Barring an extended sell-off , XRP should avoid sub-$0.33. The Second Major Support Level sits at $0.3112.

The EMAs and the 4-hourly candlestick chart (below) send a bullish signal. At the time of writing, XRP sat above the 100-day EMA, currently at $0.3440. Today, the 50-day EMA closed in on the 100-day EMA. The 100-day EMA narrowed to the 200-day EMA, price Positive.

A bullish cross of the 50-day EMA through the 100-day EMA would support a breakout from the 200-day EMA. From there, the bulls would target $0.40.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance