Our Writer Tested the CMC Markets Demo Account So You Don’t Have To. Here’s What He Thinks.

As a lifelong CFD trader, I’ve tested my fair share of trading platforms.

My trading journey started on—you guessed it—MT4. This trusted platform is used mainly for executing trades. No one really does analysis on MT4. I used to draw support and resistance lines and trade purely off those (to no success).

I then moved on to MT5, which just seemed like a laggy version of MT4. These days, I’m using CTrader, which is much more advanced and suited for my style of trading, which involves trendlines, candlestick patterns, and a few indicators.

While I’m content with the tools at my disposal, I’m always on the lookout for new technology that can help me stay on top of the trading game.

CMC Markets’ award-winning proprietary platform, Next Generation platform, promises institutional-grade features, lightning-fast execution, and advanced tools that help you trade better. After a week of testing the demo account, it created a need in me that I didn’t even know existed.

But first, what is CFD trading?

For newbies out there, CFD stands for contracts for difference. Simply put, CFD trading lets you speculate on the financial markets—without having to own any assets.

This means if I predict that the stock price of Netflix will go up, instead of purchasing shares in Netflix, I can just place a “Buy Order” through a broker. And if the price goes in my favour, I can close my position for an instant profit (without the shares ever being in my possession).

The beauty of CFD trading is that you can profit from either direction:

Think the price of Tesla is going to tank? Sell.

Think the price of Apple is going to rise? Buy.

Simple as that.

Getting started with a demo account

I’ve opened trading accounts with at least 15 brokers in my journey as a trader—you can say I’m a broker-hopper. I’m disloyal mainly because, like a true Singaporean, I’ll never say no to a welcome promo. Also, I’m always looking to trade new markets.

When it comes to opening a new account on a brokerage, the process can be tedious. Some brokers may require bank statements, credit card details, and even proof of residence.

CMC Markets

More Details

Key Features

Extensive range of product catalogue where clients are able to trade over 9,000 instruments

Access to award winning trading platforms with rich, highly customisable features such as an advanced order panel

No withdrawal fees

Free demo account available for practice

With CMC Markets, it took me a grand total of 1 minute 30 seconds to get from clicking this button on its website…

…to landing on its full trading interface.

All you need to provide is some very basic information and then verify your email address.

What do you get on a demo account?

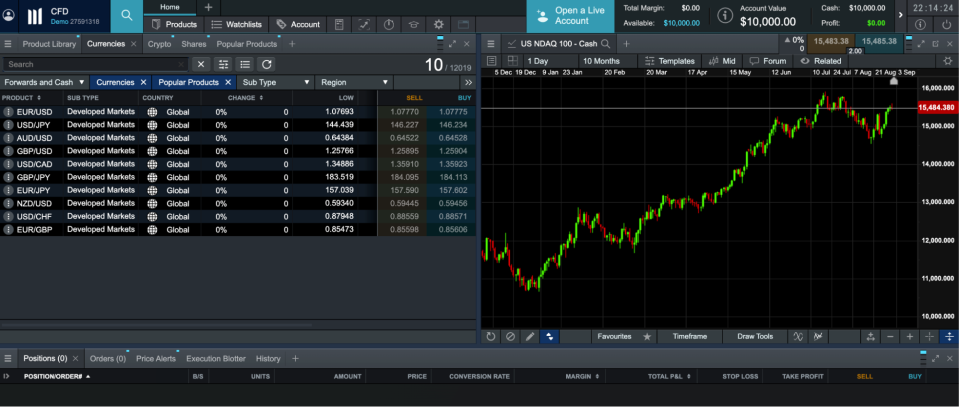

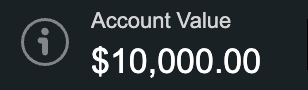

With a free demo account, CMC Markets gives you $10,000 of virtual funds to trade with on the CMC Next Generation Platform or MT4.

You can trade anything from forex, indices, commodities, shares and treasuries, and there are over 10,000 CFD products available for you to trade.

First impressions of the Next Generation Platform

I’m not going to lie—the Next Generation platform was pretty overwhelming at first. But then again, so is Microsoft Excel. And we all figured that one out, amirite?

It took me about 15 minutes of toggling around to get my bearings.

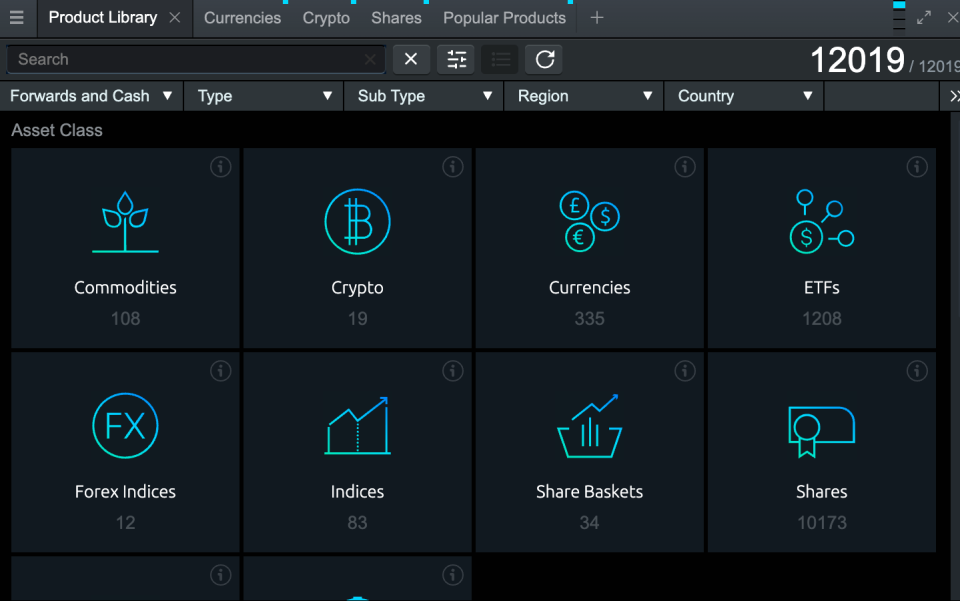

To start viewing charts, select your preferred asset class from the product library on the left side of the interface:

When I trade on my personal accounts, I usually trade Forex. So that’s what I’ll be exploring first.

Here’s the chart of EUR/USD. I went with the “dark theme”, which you can select once you first access the interface.

From just a few minutes of playing around, I can already tell I’m going to love doing my analysis on these charts. Scrolling, zooming in and out, and drawing my lines are simple and intuitive.

Placing a trade on the Next Generation Platform

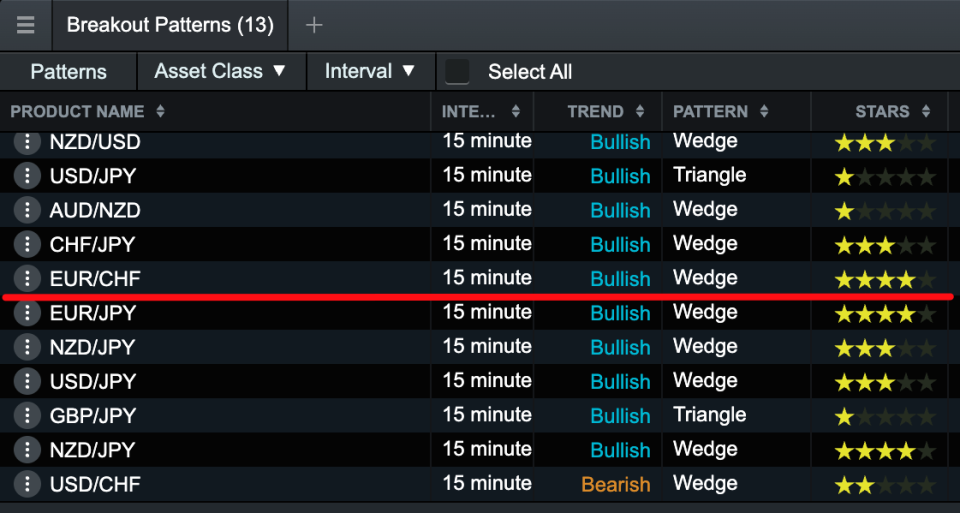

One of the coolest tools on the Next Generation platform that I simply had to try is called the “Pattern Recognition Scanner”. And this is what I’ll be using to take my trade.

The Pattern Recognition Scanner automatically scans over 120 instruments every 15 minutes, looking for emerging and completed chart patterns, such as wedges, channels and head & shoulder formations.

It then gives you a “price projection box”, as shown in the image above, which is an area where the system predicts price action could go.

Here’s what you’ll see when you access the Pattern Recognition Scanner and select “Breakout Patterns”.

Currently, the scanner is telling me there’s a bullish wedge about to breakout on EUR/CHF with a 4-star grade. Let’s see what this looks like on the chart.

Upon clicking that pair, a pop-up chart appears with the pattern and price projection box already plotted out for me. Beautiful.

Let’s see if I can make some money trading this breakout.

With my stop loss placed below the wedge, I’m risking $105.12 (about 1% of my account). My plan is to close the trade for a profit if it can get to the price projection box.

I had to recreate the pattern and price projection box because they disappeared after I logged out—which is kind of a bummer. But anyway, I won the trade!

The blue arrow shows where I entered my position. The price came very close to my stop loss level (red line) before shooting all the way up to the price projection box (blue rectangle).

Before:

After:

Banking profits using the Pattern Recognition Scanner was good fun. But remember, this tool is not meant to be your entire trading strategy. Use it as a form of confluence within a well-thought-out trading plan. It’s definitely going to be part of mine moving forward.

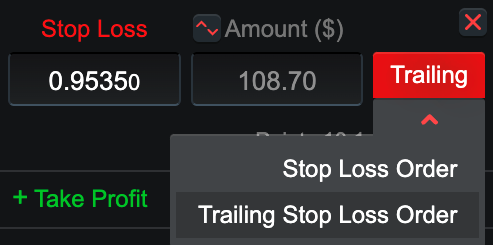

Exploring advanced order execution types

Speaking of a trading plan, stop losses are a critical part of every strategy, and no trade should be placed without them. A stop loss is a price where you’ve decided you’re going to exit your trade.

As I was executing my position on EUR/CHF, I noticed that the Next Generation platform had a trailing stop loss feature built-in.

When applied to your trade, this feature automatically shifts your stop loss as the price goes in your favour—helping you lock in profits.

This saves you lots of time, as you don’t have to constantly monitor your trade and manually shift your stop loss.

Another nifty feature they offer—for a premium—is a guaranteed stop loss. When enabled, your trade will always close at the exact price you indicate. This is especially useful when trading during news releases, where the price can be volatile. It offers an extra level of protection.

CMC Markets’ Next Generation Platform vs MT4

MT4 is certainly a reliable and easy-to-use platform, so how do its features compare to those of the Next Generation Platform?

CFD Next Generation | MT4 | |

Web-based platform |  |  |

Available Asset Classes | ||

Currencies |  |  |

Cryptocurrencies |  |  |

Commodities |  |  |

Indices |  |  |

Shares |  |  |

Treasuries |  |  |

In-Built News | ||

Insights |  |  |

Reuters |  |  |

Economic Calendar |  |  |

Monitoring Tools | ||

Price Alerts |  |  |

Automated Trading |  |  |

Pattern Recognition |  |  |

Indicators | ||

In-Built |  |  |

Custom Indicators |  |  |

Stop Loss Features | ||

Trailing |  |  |

Guaranteed |  |  |

Don’t miss CMC Markets’ welcome bonus!

Keen on trying CMC’s Next Generation platform or happy sticking with MT4? Either way, don’t miss out on this MoneySmart exclusive welcome bonus.

CMC Markets

More Details

Key Features

Extensive range of product catalogue where clients are able to trade over 9,000 instruments

Access to award winning trading platforms with rich, highly customisable features such as an advanced order panel

No withdrawal fees

Free demo account available for practice

Get S$100 CFD trading credits and S$50 Grab e-vouchers when you deposit and trade with CMC Markets

Create a Next Gen Account or MT4 Account

Deposit S$1,000

Make 5 trades before 18 November 2023

Limited to the first 100 new clients. Please read the full T&Cs here.

This post was written in collaboration with CMC Markets. While we are financially compensated by them, we nonetheless strive to maintain our editorial integrity and review products with the same objective lens. We are committed to providing the best information in order for you to make personal financial decisions with confidence. You can view our Editorial Guidelines here.

The post Our Writer Tested the CMC Markets Demo Account So You Don’t Have To. Here’s What He Thinks. appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Our Writer Tested the CMC Markets Demo Account So You Don’t Have To. Here’s What He Thinks. appeared first on MoneySmart Blog.

Original article: Our Writer Tested the CMC Markets Demo Account So You Don’t Have To. Here’s What He Thinks..

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.