World Wrestling (WWE) Stock Crashes Despite Q4 Earnings Beat

Shares of World Wrestling Entertainment, Inc. WWE slumped more than 9% during the trading session on Feb 6, in spite of the company reporting an earnings beat in fourth-quarter 2019. We note that the company posted lower-than-expected revenues. This was the fourth straight quarter of top-line miss. Nonetheless, both the top and bottom lines registered year over year growth.

The company also informed that it is undertaking a number of endeavors to increase content monetization in 2020 and beyond. These comprise distribution of content in the Middle East and India and the evaluation of strategic alternatives for its direct-to-consumer service, WWE Network. However, it went on to add that at this juncture, the outcome of these initiatives is “subject to considerable uncertainty”. This was enough to hurt investor sentiment.

We note that shares of this Zacks Rank #3 (Hold) company have slumped 18.4% against the industry’s growth of 1.3% in the past three months.

Q4 in Detail

This integrated media and entertainment company reported earnings of 78 cents a share that comfortably surpassed the Zacks Consensus Estimate of 71 cents. The quarterly earnings also exhibited a sharp improvement from prior-year quarter adjusted figure of 44 cents a share. The company’s bottom line was favorably impacted by higher net revenues that helped mitigate increased operating costs and higher interest expense.

WWE’s revenues of $322.8 million increased 18% year over year but fell short of the Zacks Consensus Estimate of $334.4 million. Increased revenues from the Media segment was offset by lower revenues from Live Events and Consumer Products business segments.

Total adjusted OIBDA came in at $107.6 million, up 67% year over year. We note that adjusted EBITDA for the quarter came almost in line with the lower end of the company’s guided range of $108-$118 million. Meanwhile, adjusted OIBDA margin expanded to 33% from 24% in the prior-year period.

Notably, management is strengthening and expanding WWE Network through creation of new content and implementation of programs that will have higher customer attraction and retention power. Further, the introduction of new features, expansion of distribution platforms and foraying into new regions will aid the drive. Further, the company is increasing the monetization of WWE content worldwide. The company concluded the content distribution agreements with BT Sport and ViacomCBS’ Channel 5 in the U.K., Fox Sports in Latin America, PP Sports in China and SuperSport in Africa.

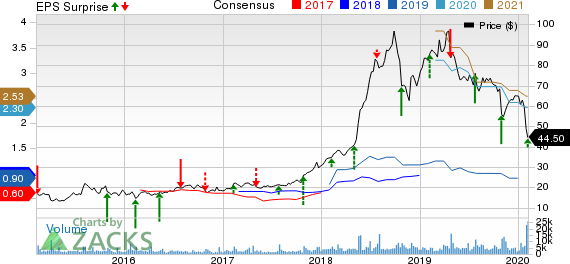

World Wrestling Entertainment, Inc. Price, Consensus and EPS Surprise

World Wrestling Entertainment, Inc. price-consensus-eps-surprise-chart | World Wrestling Entertainment, Inc. Quote

Segmental Details

Media Division: Revenues from the Media division increased 29% to $264.6 million owing to higher domestic rights fees for the flagship programs Raw and SmackDown. This was partly offset by the absence of Mixed Match Challenge on Facebook Watch and lower WWE Network subscription revenues. We note that Network revenues declined 11%, while advertising and sponsorship revenues surged 21%. Remarkably, core content rights fees soared 93%.

The number of average paid subscribers fell 10% year over year to approximately 1.42 million. Management now envisions average paid subscribers of about 1.47 million for first-quarter 2020. Notably, this indicates an improvement on a sequential basis.

Live Events: Revenues from Live Events came in at $27.4 million, down 20% year over year on account of absence of Super Show-Down, a wide-scale event in Australia and fall in ticket sales at North America events, thanks to fewer events.

A total of 70 events (excluding NXT) took place in the quarter — 50 in North America and 20 in international markets. In the prior-year quarter, there were 87 events of which 64 were held in North America and 23 in international markets.

North American ticket sales fell $1.9 million to $17.8 million as 14 less events impacted the results. However, average attendance increased by 15% to approximately 5,800. The average ticket price was $57.13, which was unchanged from the year-ago period. International ticket sales increased to $7 million from $6.5 million in the year-ago quarter. Notably, the average ticket price surged 30% to $84.26. However, this was partly offset by lower average attendance to approximately 4,100 and 3 less events.

Consumer Products Division: The segment’s revenues came in at $30.8 million, down 6% year over year thanks to reduced video game royalties, which were driven by the company’s franchise console game WWE 2K20.

Other Financial Details

WWE ended the quarter with cash and cash equivalents of $90.4 million, long-term debt of $22.1 million and shareholders’ equity of $275.3 million. The company incurred capital expenditures of $12.8 million and generated free cash flow of $106.6 million during the quarter under review.

Management now anticipates capital expenditures of $180-$220 million in 2020 and $120-$140 million in 2021. The company anticipates total capital expenditures will return to roughly 5% of revenues by 2022.

Outlook

WWE remains well poised to reap the benefits of increasing value of live sports content and expanding media and entertainment in international markets. Management expects that higher rights fees in 2020 will lead to approximately $185 million increase in contractual revenues. However, this is likely to be offset by higher operating costs related with development of new revenue generation avenues, the full-year impact of investments made last year with respect to content creation, the reset of performance-based management incentive compensation, and the yearly increase in expenses associated to staff. Management now envisions attaining adjusted OIBDA of $250-$300 million in 2020, up from adjusted OIBDA of $180 million reported in 2019.

For first-quarter 2020, the company now anticipates adjusted OIBDA between $60 and $65 million, suggesting a sharp increase from $12.4 million posted in the year-ago period. This indicates significant increase in revenue on account of the new content distribution agreements in the United States, which became effective in the final quarter of 2019, and the staging of a large-scale event in Riyadh, Saudi. However, management also informed that increase in operating expenses related with development of new revenue generation avenues and the full-year impact of investments made last year with respect to content creation will weigh on the quarterly performance to an extent.

Key Picks

TEGNA Inc. TGNA, which sports a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 10%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The E.W. Scripps Company SSP, which carries a Zacks Rank #2 (Buy), reported a positive earnings surprise in the last reported quarter.

Grupo Televisa TV has a long-term earnings growth rate of 15.1%. The stock carries a Zacks Rank #2.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Grupo Televisa S.A. (TV) : Free Stock Analysis Report

World Wrestling Entertainment, Inc. (WWE) : Free Stock Analysis Report

E.W. Scripps Company (The) (SSP) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance