This is what the world of finance really thinks of Donald Trump

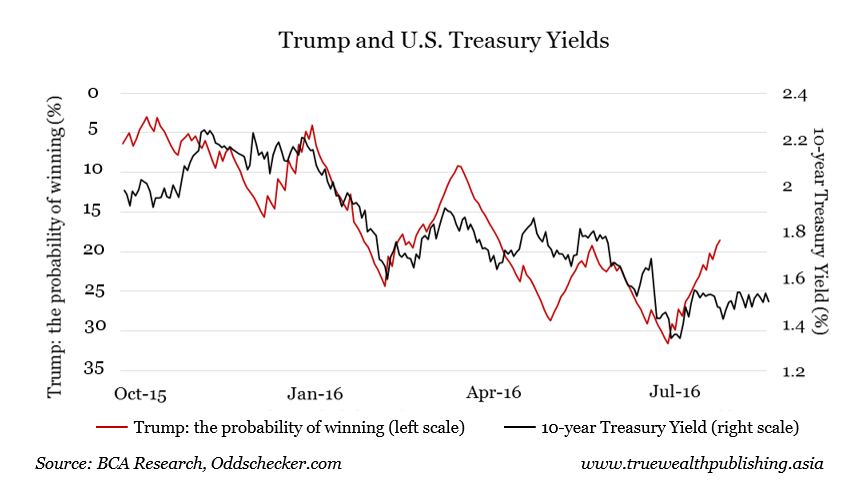

The chances are slim – somewhere between 4 and 21 percent, depending on the source – that Donald Trump will become the next president of the U.S. But as long as there’s any chance at all that he’ll become the American president (and as long as he’s a candidate for the November 8 election, there is) expect U.S. Treasury bond yields to stay low. What does that mean? As we’ve written before, the bond market is boss. It’s many times the size of stock markets. And what the bond market is saying is that it’s scared of Donald Trump. The odds on Trump vs. U.S. Treasuries The chart below shows that the greater the chances of Trump becoming U.S. president, the lower 10-year Treasury yields have fallen. In the graph, the red line shows the odds of Trump winning (the odds are higher as the line falls). (The graph reflects a two-week delay between the updated odds and Treasury yields.) In October last year, the probability of Trump winning the election (according to odds comparison site oddschecker.com) stood at about 10 percent – and 10-year Treasury yields were at nearly 2.4 percent. (Remember, when yields on bonds fall, their price rises, and vice-versa… see here for more about how bonds work.) But in the following months, Trump’s campaign gained momentum and the Republican candidate field narrowed. In July, Trump won the nomination, and his chances of winning the presidency hit a high of 30 percent. The 10-year Treasury yield hit record lows at close to the same time. Since then, Trump’s chances have fallen to around 15 percent (see our piece on prediction markets here). And yields have recovered, but are still close to record lows.

Why this relationship exists Why is there an inverse relationship between Trump’s odds of winning the U.S. presidential election and 10-year U.S. Treasury yields? U.S. Treasuries are viewed as a safe, risk-free, safe-haven asset (even though, as we’ve explained before, they are not really risk-free). When investors get nervous about markets, they sell more risky assets and buy Treasuries. At first, this might seem strange. A few months ago, Trump floated the idea of “making a deal” with creditors if the U.S. ever has problems paying back its debt. Even though he later clarified his comments, Trump’s business practices (and in particular, his liberal use of American bankruptcy laws) should give pause to investing in American assets in the event that Donald Trump becomes president. This suggests that investors might sell – rather than buy – Treasuries if the odds of a Trump presidency increases. But more to the point, many well-placed observers have expressed concerns about the stability of the global macroeconomic and geopolitical environment in the event of a Trump presidency. For example, an all-out trade war with China appears to be one of Trump’s main foreign policy objectives. To many investors, Trump’s promises to “Make America Great Again” (his campaign slogan) are synonymous with a fortress mentality that would alienate allies and trading partners. Trump represents enormous uncertainty. In this case, the safety of Treasuries – and the ability of the country’s central bank to do whatever it wants to pay back debt – beats concerns over Donald Trump. Even though an American politician is a big source of concern and potential instability, the antidote for investors is to… buy American Treasury bonds. That’s how Treasuries have become a hedge against Donald Trump becoming president. (And the bond market is otherwise “broken” … see what we wrote here.) One way to hedge a Trump presidency – if the relationship between Trump’s chances of becoming president and U.S. Treasury yields continues – is to buy shares in the iShares 20+ Year Treasury Bond ETF (New York Stock Exchange; ticker: TLT). It’s up 13 percent over the past year, and 17 percent since the beginning of the year. But buyer beware. Yields can fall only so far. As shown in the graph above, yields may be poised to rise. And a sharper reversal (thanks to higher U.S. interest rates, or lower chances of a Trump presidency) could trigger a sharp fall in Treasury prices, and TLT’s share price.

Kim Iskyan

Yahoo Finance

Yahoo Finance