Wolverine's (WWW) Q3 Earnings Beat, Sales Miss Estimates

Wolverine World Wide, Inc. WWW reported mixed third-quarter 2021 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues lagged the same. However, both the top and bottom lines improved year over year. Strong demand for its brands, robust direct-to-consumer sales and solid performance at stores primarily contributed to year-over-year growth. Results also benefited from the sale contribution of the Sweaty Betty brand, which was acquired on Aug 2. The company's underlying results in the quarter represented revenues and earnings, excluding the Sweaty Betty contributions.

However, results partly reflected the negative impacts of the ongoing supply-chain disruption caused by Vietnam factory closures and global logistic delays due to port congestions. The company's Merrell brand was the most impacted by the factory closures in Vietnam, while the Saucony and Sperry brands performed well. To accommodate the recent supply-chain challenges, management slashed its 2021 view.

Other companies in the industry also witnessed similar significant impacts of factory closures in Vietnam, with NIKE NKE, carrying a Zacks Rank #5 (Strong Sell), witnessing pronounced impacts. NIKE reported lower-than-expected revenues in first-quarter fiscal 2022, attributable to the ongoing supply-chain challenges and factory closures due to COVID-19, which resulted in product shortages. While the digital and NIKE-owned businesses reflected gains from strong demand and improved traffic, its Wholesale business witnessed impacts of the supply constraints.

NIKE lowered its fiscal 2022 guidance to reflect the impacts of 10 weeks of lost production in Vietnam since mid-July and expectations of the elevated transit times to remain consistent with the current levels. For fiscal 2022, the company anticipates revenue growth in the mid-single digits compared with low-double-digit growth mentioned earlier. NIKE expects revenue growth to be flat to down in low-single digits, particularly in second-quarter fiscal 2022, owing to the impacts of the lost production due to factory closures and delayed delivery times for the holiday and spring seasons.

Another company on the list is Deckers DECK. While Deckers' production remained largely unaffected due to lower exposure of factories located in Southern Vietnam, the company has been experiencing disruption and delays within its sourcing network — which includes material vendors and third-party manufacturers — related to COVID-19 outbreaks. The impacts of the same were visible in its second-quarter fiscal 2022 performance, wherein results lagged analysts' expectations.

Deckers has been witnessing extended transit lead times and cost pressures, owing to container shortages, port congestion, and trucking scarcity, which have led to shipping delays and greater use of air freight. These are likely to continue impacting the company's operations. We note that management trimmed its fiscal 2022 revenue projection for the UGG brand, owing to shipment disruption. The company expects the metric to grow in the high-single digits versus the previously discussed high-single-digit to low-double-digit range.

Wolverine's Q3 Insights

Wolverine posted third-quarter adjusted earnings of 62 cents per share, beating the Zacks Consensus Estimate of 61 cents. Adjusted earnings also increased significantly from 35 cents earned in the year-ago quarter. On a constant-currency (cc) basis, adjusted earnings were 61 cents per share. Higher sales and margins fueled the bottom-line performance, offset by supply-chain disruptions. Excluding the Sweaty Betty contribution, underlying adjusted earnings were 60 cents per share.

Revenues of $636.7 million lagged the Zacks Consensus Estimate of $654 million but improved 29.1% year over year and 11% from third-quarter 2019. At cc, revenues grew 28.2% year over year. Strength in the direct-to-consumer platforms and robust sell-through at retail aided the top line. Factory closures and logistics delays hurt the company's top line by at least $60 million. The top line also benefited from the inclusion of revenues from the recently acquired Sweaty Betty brand to its portfolio. Underlying revenues were $597.6 million, reflecting year-over-year growth of 21.2% and an increase of 4% from the comparable 2019 period.

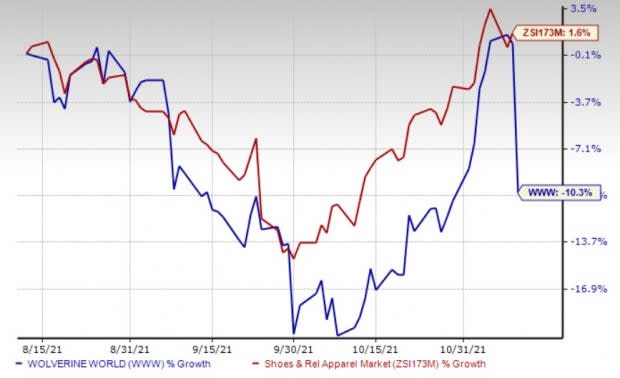

Shares of Wolverine declined 10.9% yesterday, following the lower-than-expected sales performance in third-quarter 2021 and the updated 2021 view in response to the ongoing supply-chain issues. Over the past three months, shares of the Zacks Rank #2 (Buy) company have declined 10.3% against the industry's 1.6% growth. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

In third-quarter 2021, Wolverine's total direct-to-consumer e-commerce revenues, including Sweaty Betty, more than doubled from the third-quarter 2019 level. Direct-to-consumer store revenues increased more than 35% from the 2019 level.

E-commerce revenues rose 45% year over year and 129% from the 2019 figure. Underlying e-commerce revenues were up 13.3% year over year and 77.3% from third-quarter 2019.

Wolverine's Merrell brand reported mid-single-digit revenue growth, including significant impacts of Vietnam factory closures. Meanwhile, the Saucony and Sperry brands drove more than 40% revenue growth each.

Margins & Costs

Adjusted gross profit was $284 million, up 39.4% year over year. Adjusted gross margin expanded 330 basis points (bps) year over year to 44.6%, with adjusted underlying gross margin expanding 190 bps year over year to 43.2%. Gross margin benefited from higher average selling prices, favorable product mix and the inclusion of Sweaty Betty for nearly two months of the quarter.

However, air freight costs partly offset gross margin. The company incurred total air freight costs of $10 million in the third quarter. Of this, about $7 million were excluded from its adjusted results. Including the total air freight costs, the adjusted gross margin would have been 43.5%, reflecting a 220-bps increase from the prior year.

Adjusted selling, general and administrative expenses jumped 37.1% to $207.7 million. The increase was driven by higher revenues, the addition of Sweaty Betty and increased marketing investments.

Adjusted operating profit significantly surged to $76.3 million from $10.6 million in the prior year, with the adjusted operating margin increasing 140 bps to 12%. The adjusted operating margin was aided by strong revenue growth, gross margin expansion and balanced operating expense management. Adjusted underlying operating margin of 12.5% expanded 190 bps year over year.

Wolverine World Wide, Inc. Price, Consensus and EPS Surprise

Wolverine World Wide, Inc. price-consensus-eps-surprise-chart | Wolverine World Wide, Inc. Quote

Segmental Performances

Revenues at Wolverine Michigan Group increased 13.1% year over year to $324.8 million. At cc, the segment's revenues jumped 12.1%.

Wolverine Boston Group's revenues rose 33.5% to $258.8 million from the year-ago quarter's number. At cc, the segment's revenues rose 32.5%.

Other Financials

Wolverine ended the quarter with cash and cash equivalents of $183.6 million, long-term debt of $704.4 million, and stockholders' equity of $641.9 million. Net inventories at the end of the third quarter decreased 26.5% year over year to $412 million.

The company delivered $17 million of cash flow from operating activities at the end of the third quarter. Net interest expenses declined 25% to $9.6 million.

Outlook

Management anticipates the demand for its brands to remain strong, as evident from the strong order book, which extends into third-quarter 2022. It also remains optimistic about the composition of its portfolio, with performance categories like hiking, running, and work expected to do well. Also, it is encouraged by the addition of the Sweaty Betty brand to its portfolio, which is likely to enhance its digital capabilities and apparel offerings.

However, the company slashed its 2021 revenue and earnings guidance to reflect the impacts of the ongoing supply-chain headwinds. Wolverine notes that the unexpected factory closures and a volatile logistic environment have been hurting its performance for the last four months of 2021. It expects the volatility to continue in the near term.

For 2021, Wolverine projects revenues of $2.4 billion compared with $2,340-$2,400 million mentioned earlier. The latest revenue projection suggests growth of 35% from that reported in 2020 and 28% underlying growth. The revenue outlook represents mid-single-digit growth (including Sweaty Betty) and low-single-digit growth (excluding Sweaty Betty) from the 2019 reported level.

Reported earnings per share are forecast to be $1.16-$1.21 for 2021, down from the $1.85-to $1.95 mentioned earlier. Adjusted earnings per share are envisioned to be $2.05-$2.10 for 2021 compared with the previously discussed $2.20-$2.30. For fourth-quarter 2021, management anticipates adjusted earnings per share of 38-43 cents, with the higher end of the range suggesting 100% growth from the 2020 reported level.

On the flip side, Steven Madden SHOO, with a Zacks Rank #2 at present, raised its view for 2021 despite the global supply-chain disruptions. The company is confident about its brands. It is focused on creating trend-right merchandise assortment, deepening relations with customers via marketing, enhancing digital commerce agenda, expanding international markets, and efficiently controlling expenses. A robust business model positions it well to cash in on market-growth opportunities and boosts stakeholders' value in the long run.

For 2021, Steven Madden projects revenue growth of 50-52% from the 2020 reported level. The view is also higher than the earlier mentioned 43-47% increase. Adjusted earnings per share are envisioned to be $2.30-$2.35, up from the previously stated $2-$2.10. Notably, Steven Madden reported adjusted earnings of 64 cents in 2020.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance