Wolverine's (WWW) Brand Strength, E-commerce Aid Customer Wins

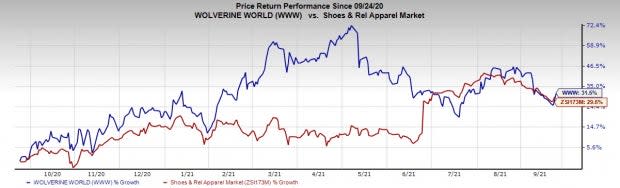

A diversified global business model, immense brand strength and sturdy digital capabilities are aiding Wolverine World Wide, Inc. WWW to navigate the turbulent times. The company’s major brands like Merrell and Saucony have been standing out for quite some time now. Steady product innovations and launches are added positives. It is continuously reinforcing digitization to enhance product flow apart from strengthening its distribution centers. This Rockford, MI-based company’s shares have increased 31.5% over the course of a year compared with its industry’s 29.6% rally.

More on Strategies

Among Wolverine’s sales channels, e-commerce is a constant key driver. The company is leveraging higher digital marketing investments to boost traffic and is deepening its focus on better merchandising to optimize conversion. It is expanding digital content and flow of information as well as managing its consumer database in a better fashion. Solid growth at the brands’ websites is also adding up to the overall digital performance.

Wolverine’s direct-to-consumer (DTC) channels have been strong for a while now. The company’s owned e-commerce revenues more than doubled in the first half of 2021 from the same-period reading in 2019. Owned e-commerce revenues surged 90.7% from the 2019 tally. In the second quarter of 2021, total DTC revenues jumped 17.5% year over year and 68.8% from the 2019 level. Brandwise, saucony.com registered growth of above 20% while Merrell.com revenues skyrocketed more than 150% year over year.

Image Source: Zacks Investment Research

The company is focused on improvising brands that suit consumer preferences aptly on the back of the advanced technologies and accurate market insights. It remains committed toward its latest innovations and launches across different brand banners and brings forward a robust pipeline of new products. Management is on track with the launch of its first Merrell mobile app. Also, the company is quite focused on driving growth across performance product categories including hiking, running and work categories.

In addition, Wolverine’s international business, which comprises a widespread network of global partners, continues to be impressive. Saucony stores and core technical products are performing impressively in China as the brand's joint venture business is ramping up. Also, the company’s EMEA market continues to show strength and is a significant growth opportunity. The company’s Merrell brand also has global growth potential, mainly in the EMEA.

Wrapping Up

The aforesaid strategies are expected to keep Wolverine’s sturdy momentum alive in the future. Management anticipates delivering significant growth in 2021 from the 2020 and 2019 levels, driven by accelerating demand for its brands. Robust products, impressive merchandising practices and healthier inventory positions are likely to fuel growth. For 2021, the company projected revenues in the band of $2,340-$2,400 million, suggesting growth of 31-34% from the 2020 reading and a 5.6% rise from the 2019 actuals at the upper end of the range. Adjusted earnings per share are envisioned in the bracket of $2.20-$2.30, indicating growth from 93 cents reported in 2020.

The Zacks Consensus Estimate for 2021 sales and earnings is currently pegged at $2.46 billion and $2.31 per share, respectively. These estimates imply corresponding growth of about 37% and 148% from the respective year-ago reported figures. The company’s earnings status looks pretty good as the metric beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 23%. An expected long-term earnings growth rate of 10% for this currently Zacks Rank #2 (Buy) stock further adds to its attractiveness.

Other Key Bets to Consider

Steven Madden SHOO has a long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ralph Lauren RL, presently a Zacks #1 Ranked stock, has a long-term earnings growth rate of 15%.

GIII Apparel GIII has a long-term earnings growth rate of 11.6% and a Zacks Rank of 1, presently.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance