Wolfspeed Inc (WOLF) Reports 20% Year-Over-Year Revenue Growth Amidst Expansion Efforts

Revenue Growth: Wolfspeed Inc reports a 20% increase in year-over-year revenue, reaching $208.4 million.

Design-Wins Surge: Record quarterly design-wins total $2.9 billion, with a significant portion related to automotive applications.

Gross Margin Pressure: GAAP gross margin declined to 13.3% from 32.6% in the previous year, impacted by underutilization costs.

Operational Expansion: Mohawk Valley Fab revenue tripled sequentially, with expectations of 20% utilization by the fourth quarter of fiscal 2024.

Strategic Divestiture: Completion of the sale of the RF Business to MACOM Technology Solutions for $75 million in cash and equity.

Future Outlook: Revenue for the third quarter of fiscal 2024 is projected to be between $185 million and $215 million.

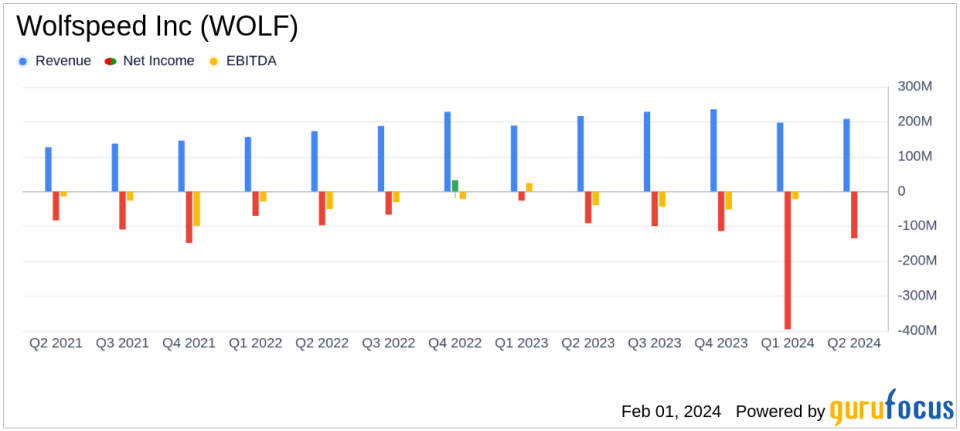

On January 31, 2024, Wolfspeed Inc (NYSE:WOLF) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. The company, a leader in the manufacturing of wide bandgap semiconductors, reported a robust year-over-year revenue growth of 20%, with consolidated revenue reaching $208.4 million. This growth is attributed to the company's strategic focus on silicon carbide and gallium nitride materials and devices, which are essential for power and radio-frequency (RF) applications in various sectors, including transportation and renewable energy.

Financial Performance and Challenges

Wolfspeed Inc's financial achievements this quarter are underscored by a significant increase in design-wins, which hit a record $2.9 billion, indicating strong customer demand, particularly from the automotive sector. The company's Mohawk Valley Fab contributed $12 million in revenue, a threefold increase from the previous quarter, signaling successful scale-up efforts and a positive trajectory towards the targeted 20% utilization by the end of fiscal 2024.

However, the company faced challenges, as reflected in the gross margin, which decreased to 13.3% on a GAAP basis from 32.6% in the same quarter of the previous year. This decline was largely due to $35.6 million of underutilization costs, which impacted the margins by approximately 1,700 basis points. The non-GAAP gross margin also experienced a decline, coming in at 16.4% compared to 35.8% in the prior year. These figures highlight the cost pressures associated with ramping up new production facilities, a critical factor for investors to monitor as it may affect profitability in the short term.

Balance Sheet and Cash Flow Insights

Wolfspeed Inc's balance sheet shows a strong cash position with $2.635 billion in cash, cash equivalents, and short-term investments. The company's total assets amounted to $7.290 billion, with a notable increase in property and equipment, net, to $2.850 billion, reflecting ongoing capital investments. On the liabilities side, Wolfspeed Inc reported long-term debt of $2.137 billion and convertible notes at $3.030 billion, indicating the company's financing strategy to support its expansion efforts.

The cash flow statement reveals that the company used $349.9 million in operating activities and invested $1.449 billion in investing activities, primarily due to purchases of property and equipment. Financing activities provided $947 million, mainly from long-term debt borrowings, showcasing the company's proactive approach to funding its growth initiatives.

Management Commentary

"Were proud of our results this quarter, which reflect robust execution of our strategy and fortify our vision for the future of Wolfspeed and silicon carbide," said Wolfspeed CEO, Gregg Lowe. "We have made considerable progress at our Mohawk Valley facility, tripling revenue sequentially. Our successful scale-up of 200mm wafer production and continued qualification of high-quality EV products on 200mm substrates are critical steps in meeting the continued customer demand. This is demonstrated by a record $2.9 billion of design-wins, predominantly in the EV sector across multiple OEMs."

Looking Ahead

For the third quarter of fiscal 2024, Wolfspeed Inc targets revenue from continuing operations in the range of $185 million to $215 million. The company anticipates a GAAP net loss from continuing operations between $134 million and $155 million, or $1.07 to $1.23 per diluted share. The non-GAAP net loss from continuing operations is expected to be in the range of $71 million to $87 million, or $0.57 to $0.69 per diluted share. These projections exclude certain estimated expenses and do not account for any potential changes in the fair value of the shares of MACOM common stock acquired in connection with the RF Business Divestiture.

Wolfspeed Inc's earnings report underscores the company's strategic advancements and the challenges of scaling production to meet the surging demand for silicon carbide technologies. Investors and potential GuruFocus.com members should consider the company's growth prospects in the context of the semiconductor industry's broader trends towards electrification and energy efficiency.

Explore the complete 8-K earnings release (here) from Wolfspeed Inc for further details.

This article first appeared on GuruFocus.