Will the Fed add another brick in the 'Wall of Worry'?

David Nelson, CFA, is the Chief Strategist of Belpointe Asset Management

With an FOMC decision coming Wednesday the Federal Reserve once again takes center stage. All eyes will be on Fed Chairman Jerome Powell as he delivers his first post meeting press conference. With the possible exception of a bombshell announcement on the Robert Mueller investigation, the Fed becomes the center of the universe with investors parsing every word in the release.

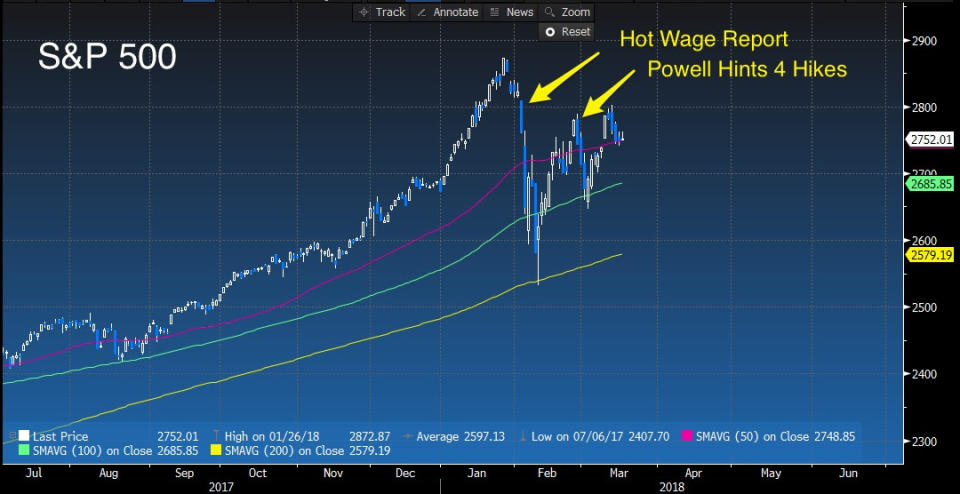

There’s little doubt the Fed will move this month as probability of a hike sits at 100%. It’s important to remember, the recent correction started on the heels of a strong jobs report in January. The hotter than expected wage number sent stocks into a tailspin unable to pull out of the dive until a full correction was in place. The top concern following the report was that the playbook for the Fed would be altered ultimately increasing the pace of normalization.

Adding insult to injury, Powell’s inaugural testimony in front of the House Financial Services Committee a few weeks later caused an additional headwind when he pointed out that economic data from December had strengthened, adding to his confidence that inflation was quickening. I published a post on this just a couple of weeks ago but now the day has arrived, so let’s do a quick review.

Most Fed watchers believe the commentary will still contain the word “gradual” but just what does that mean. For some, it means four hikes this year and for others like yours truly it means three at best. If the recent correction is to be taken at face value four is code for get me out of the market as soon as possible.

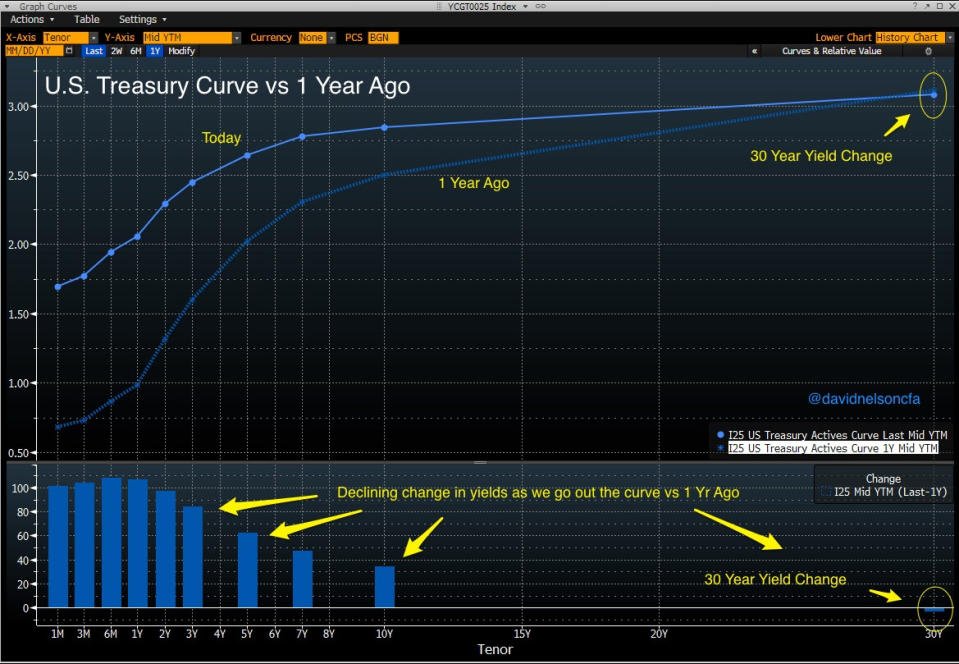

A quick look at the yield curve over the past 12 months supports my belief, rate hikes will be capped at three.

In the last year short-term rates have risen 100 basis points or for those not in finance 1%. Two-, five- and 10-year rates are all higher but to a lesser degree. Ten-year yields up only 27 basis points in that time. Add the fact that all the way out to the end of the curve 30-year yields have actually declined and it becomes crystal clear the yield curve is flattening.

Picture the yield curve with Fed Funds another 100 basis points higher and without a similar move on the long end. Quicker than you can say “inversion,” economists will start talking about the dreaded “R” word. A flattening or inverted yield curve is often thought of as a precursor to recession.

3 things that could push long rates higher

Inflation could pick up faster than anticipated forcing yields higher

The Fed could accelerate the run off of their balance sheet also likely to push yields higher but of course at a cost

Mario Draghi could pick up the pace and move the EU on a path to normalization quicker than expected

As I have pointed out in my post for Yahoo Finance earlier this month, the Fed doesn’t live in a vacuum. If the long end of the curve doesn’t move in response to Fed action or even worse starts to fall, I’m confident they will adjust their flight plan. At the very least you’ll hear the hawkish rhetoric morph into something a little more benign.

No question the Fed has to continue to normalize, needing ammunition for the next downturn, but to date evidence the economy is overheating and or inflation expectations are running out of control still aren’t evident. February’s employment numbers were almost Goldilocks with strong numbers across the board but the dreaded wage number coming in slightly below expectations.

As the saying goes, stocks climb a wall of worry. One of the biggest bricks in that wall usually comes from our friends at the FOMC.

Yahoo Finance

Yahoo Finance