Why Weyerhaeuser Stock Rocketed 20% in January

What happened

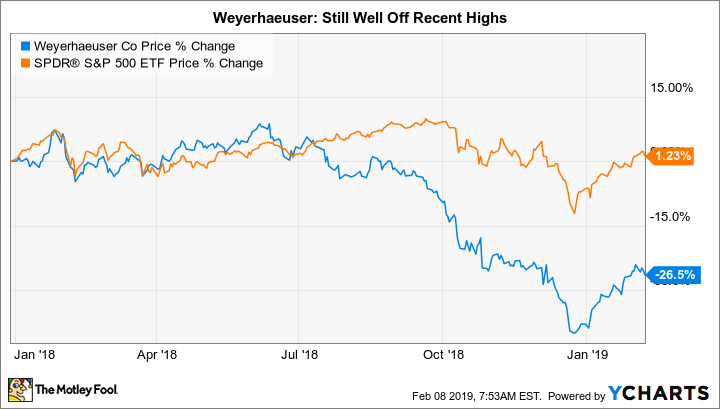

Shares of real estate investment trust Weyerhaeuser (NYSE: WY) jumped a huge 20% in January, according to data from S&P Global Market Intelligence. That easily outdistanced the market's roughly 8% climb and the broader REIT sector's advance of roughly 12%, using the Vanguard Real Estate ETF (NYSEMKT: VNQ) as a proxy for the space.

Image source: Getty Images.

There was a big difference on the downside, too. In 2018, a late swoon left the S&P 500 Index off by around 6%. REITs dropped a little more, coming in with a 10% decline. But Weyerhaeuser fell by a relatively disastrous 38%.

So what

Weyerhaeuser's disparate performance should give you a quick indication that something is vastly different about this REIT. In fact, it's one of just a few companies focused on owning and operating timberland. This is a pretty interesting asset class, given that proper maintenance of timberland makes it a constantly renewing asset. And, of course, wood and the various products created from it are some of the most recyclable products on Earth.

However, much of the timber that comes from Weyerhaeuser's forests gets used in construction. That's a highly cyclical industry that's tightly tied to the economy's ups and downs. Weyerhaeuser also sends a lot of its wood to China. One of the big concerns pushing markets lower in late 2018 was U.S. economic growth. China's economy, meanwhile, has been slowing for a number of years. The current trade war between China and the United States has only exacerbated the situation. It was a combination of these issues that left Weyerhaeuser's stock reeling in late 2018.

Economic concerns abated somewhat in January, however, with investors embracing a more aggressive stance. Thus, Weyerhaeuser's stock recovered more than the broader market and its less economically sensitive peers. At the same time, though, the the big January gain still wasn't enough to offset the huge losses experienced in 2018.

Now what

Every company has its nuances, but sometimes those differences can have a big impact on performance. There's nothing inherently wrong with Weyerhaeuser's business today. It's still doing the same thing it always has -- growing trees. But the nature of its operations, which are tightly tied to the ups and downs of the cyclical construction market, is a key attribute that investors need to fully understand before stepping aboard here. That fact was on clear display in late 2018 and again in January.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance