Why Warren Buffett tells Bill and Melinda Gates to take big risks with his billions

From buying railroad Burlington Northern to lending money to Goldman Sachs at the depths of the financial crisis, Warren Buffett’s entire investing career has been rooted in taking big, calculated risks that often lead to hefty rewards.

That mindset extends to the billions of dollars Buffett has pledged to the Bill & Melinda Gates Foundation as part of his philanthropic initiatives.

“When he gave his fortune from Berkshire Hathaway to his children's three philanthropies and to ours, he told all four of us, swing for the fences. I want you to take risks,” Melinda Gates, co-chair of the foundation, told Yahoo Finance.

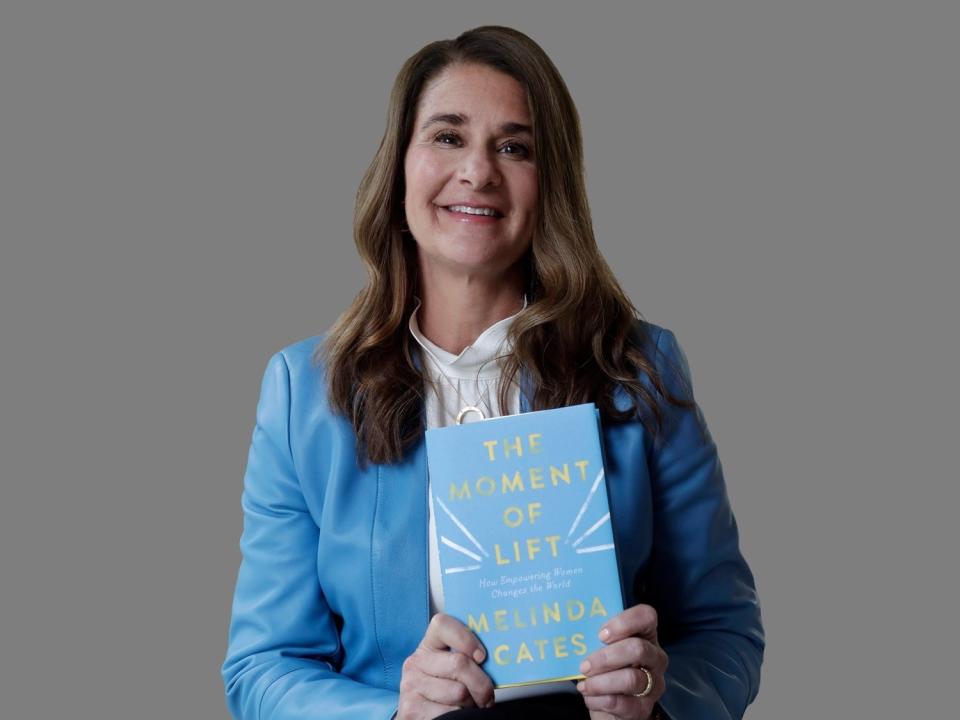

Gates, author of a new book on female empowerment “The Moment of Lift,” added, “The job of philanthropy, which Warren knows well, is to be the catalytic wedge, to take risk where government can't take risk — but you wouldn't want them to with taxpayer money. And he said, you are trying to fill in the gaps where capitalism has failed.”

Buffett stepped up big-time in 2006 to further the efforts of the foundation started by his close friends Bill and Melinda Gates in 2001. The foundation’s work focuses mostly on improving health care and education conditions around the world. The “Oracle of Omaha” pledged most of his fortune in 2006 — 10 million shares — to the foundation. It’s paid out in annual installments.

The foundation is now one of Berkshire’s largest shareholders given the annual payouts. Buffett is a trustee on the foundation, which counts more than $50 billion in assets.

The three billionaires and noted philanthropists remain as close as ever.

“Warren is just — he's just a delight. And so when you pick up the phone and call Warren or he calls you, he's always got a story to tell you, and a chuckle, and a laugh,” Gates said. “And for Bill and me, he is our lift. That's what I would say — Warren is our lift.”

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Watch more:

Yahoo Finance

Yahoo Finance