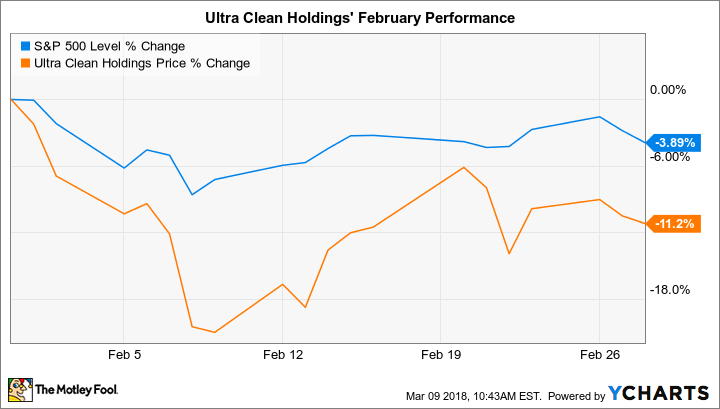

Why Ultra Clean Holdings Inc. Stock Fell 11% in February

What happened

Shares of semiconductor parts supplier Ultra Clean Holdings (NASDAQ: UCTT) trailed the market last month, shedding 11% compared to a 4% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

The has stock gained over 50% in the past 12 months compared to a 17% boost in the broader market.

So what

February's decline came after the company's fourth-quarter report failed to live up to Wall Street's high expectations. Sales growth was a solid 43% thanks to spiking demand for its semiconductor subsystems. Earnings came in just below expectations, though, despite a modest uptick in profitability.

Image source: Getty Images.

Now what

CEO Jim Scholhamer said the results were part of an "extraordinary year of expansion and profitability" and his team signaled continued gains on both fronts. Sales are expected to rise to between $275 million and $290 million in the first quarter of 2018, which would translate into a 28% increase year over year. Operating margin should hold steady at between 8% and 10%.

These are good numbers, so the stock decline likely had more to do with its intense run-up lately rather than any looming issue with the business.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance