Tesla was a 'Late Bloomer' IPO — here's why: trader

Not all IPOs are created equal, but Tesla (TSLA) is a model “lifecycle trade” stock that’s exhibiting the pattern of a “Late Bloomer.”

That’s according to Kathy Donnelly, proprietary equities trader and co-author of the book “The Lifecycle Trade,” at the most recent Yahoo Finance Premium webinar, “Trading IPOs and Super Growth Stocks.”

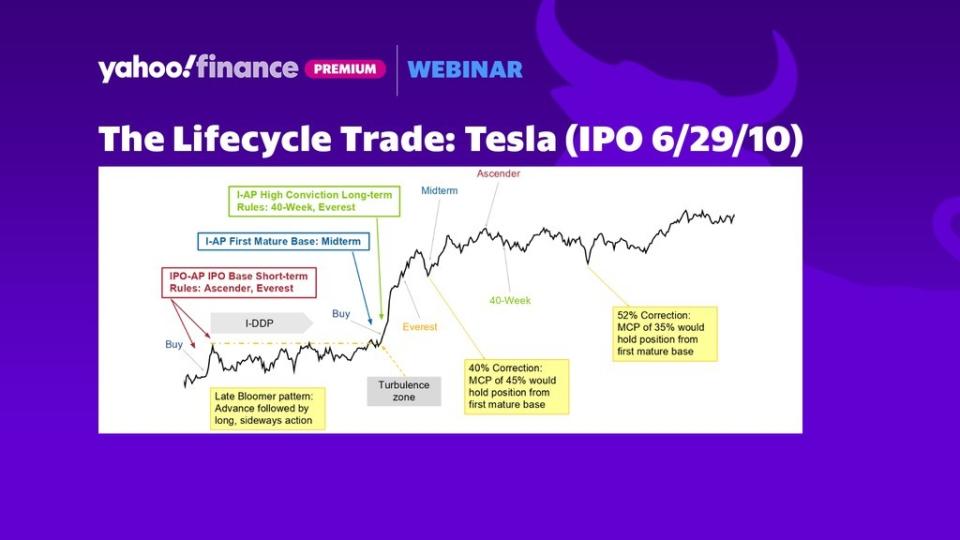

Donnelly breaks down the three stages a stock progresses through after its IPO birth: (1) the IPO Advance Phase (IPO-AP), (2) the Institutional Due Diligence Phase (I-DDP), and (3) the Institutional Advance Phase (I-AP).

“[Tesla] had that IPO base in the beginning and initial run-up ... And in the Due Diligence Phase, it really didn't do much ... [T]hen it created that first mature base, broke out and had that really great, great run there in the Institutional Advance Phase,” says Donnelly.

She and her co-authors further classify public stocks by their price action over time as one of the following patterns: Late Bloomer, Pump and Dump, Stair Stepper, Rocket Ship, One-Hit Wonders, Disappointment.

Tesla is a Late Bloomer, along with Chipotle (CMG), Lululemon (LULU), Cisco (CSCO), Palo Alto Networks (PANW), Shopify (SHOP), Yelp (YELP), Qualcomm (QCOM), and Visa (V).

According to the book, a Late Bloomer begins its journey like many IPOs, moving up from its IPO base. “Just as everyone starts to believe it’s a leader, this pattern quickly stalls out and wears out investors with a long, sideways move, typically for close to a year or more, before starting a massive rally,” say the authors. Tesla is a textbook example.

Any trading plan needs robust and well-defined trading rules along with sound money management. Fielding a question from the audience, Donnelly says, “We have rules for the short-term traders and for the long-term traders ... I'm a long-term. So the 40-week rule that we talked about in the book was actually a rule that I designed and we tested ... But if you're a short-term trader, and you don't like a lot of draw downs, you might prefer the Ascender rule.” For parabolic moves, Donnelly recommends the Everest rule, which has a two-day lookback.

For a detailed look at The Lifecycle Trade methodology, along with some surprising myth-debunking statistics about IPOs, watch the whole 45 minute webinar.

Jared Blikre hosts Yahoo Finance Premium webinars on the first Wednesday of each month at 2:00pm ET. Be sure to follow him on Twitter at @SPYJared to register for the next one on September 2, 2020, and feel free to reach out with any questions.

More from Jared:

Yahoo Finance

Yahoo Finance