Why Shopify Stock Gained 13% in September

What happened

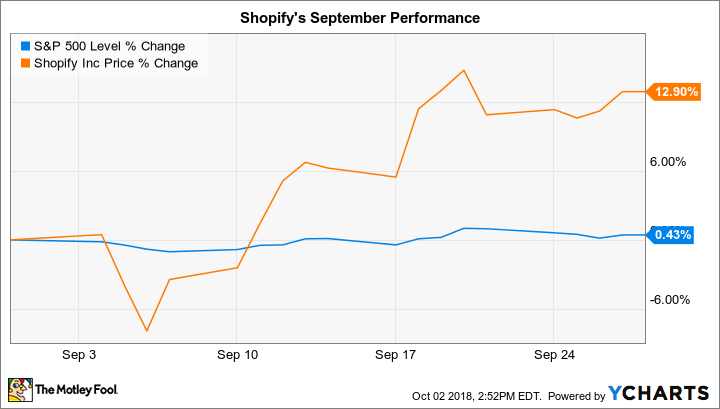

E-commerce platform Shopify (NYSE: SHOP) outpaced the market last month by rising 13% compared to a 0.4% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

The rally contributed to solid gains for shareholders, who've seen their stock gain over 50% so far in 2018.

So what

Shopify didn't announce any operating news last month, but the stock still attracted unusually high levels of demand from investors. Shares jumped 10% over a few consecutive trading days in mid-September, with support from an investment firm stock upgrade. An analyst at Wedbush said he sees the e-commerce platform growing well beyond its current customer base even as newer offerings, like an Instagram integration, widen its appeal to more merchants.

Image source: Getty Images.

Now what

Shopify executives said in late July that they expect third-quarter growth rates to slow to around 50% from the 62% spike the company logged in the second quarter. For the full year, Shopify predicts cracking $1 billion of annual revenue while generating an operating loss of between $105 million and $110 million.

Investors are hoping key growth metrics, including merchandise volume and recurring subscription revenue, keep climbing at rates that show Shopify is soaking up market share in a quickly growing industry.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Shopify. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance