Why Shares in MSC Industrial, Freeport, and Fastenal Fell Double Digits in May

What happened

Shares in industrial supply companies Fastenal (NASDAQ: FAST) and MSC Industrial (NYSE: MSM) and mining company Freeport-McMoran (NYSE: FCX) all declined by double digits in May, according to data provided by S&P Global Market Intelligence.

MSC's 15.5% fall was almost matched by Fastenal's decline of 13.3%, but both were overshadowed by Freeport-McMoran's 21.1% decline. The reason can be largely put down to some evidence of a cyclical slowdown in the economy, accompanied by fears over the impact of a protracted U.S.-China trade conflict.

Image source: Getty Images.

Industrial supply companies are seen as good bellwethers of the economy -- they have very short-cycle sales, and when economic activity starts to slow down, their revenue takes a hit. Meanwhile, the key swing factor in Freeport-McMoran's earnings prospects is usually its copper mining activities. Copper is one of the most cyclically aligned commodities out there -- the metal is extensively used in construction, electrical equipment and electronics, machinery, and transportation.

Evidence of a slowdown

The first place investors usually look for any signs of a slowdown in the industrial economy is the Purchasing Managers Index (PMI) from the Institute for Supply Management (ISM). The PMI is a long-established survey of private manufacturing businesses. For reference, a reading above 50 indicates expansion.

As you can see below, the PMI and the related New Orders index have come down notably in recent months. Both numbers are still above 50, and the price of copper has only come down a bit lately, but the trend is downward, and the market seems to be joining the dots and projecting a decline in manufacturing activity, which is putting pressure on copper prices.

US ISM PMI data by YCharts.

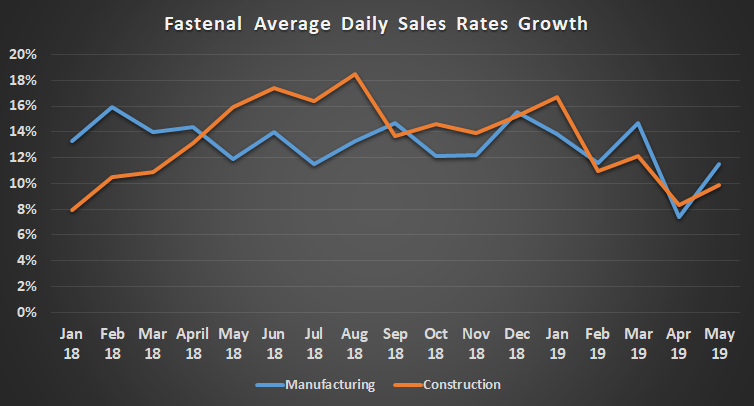

Turning to the company-specific data, the evidence from Fastenal's daily sales data for manufacturing and construction shows the downtrend in the company's daily sales growth in 2019 -- in case you are wondering, the May data was released in June, after the stock price decline in May.

Data source: Fastenal presentations. Chart by author.

MSC Industrial reported its second-quarter earnings in the middle of April, with CEO Erik Gershwind noting, "At the halfway point of the fiscal year, gross margins and operating expenses are as anticipated, but revenue growth has slightly underperformed our expectations."

A slowdown in sales is the last thing industrial supply companies need as there is strong evidence that Amazon.com's entry into the industry has held back the kind of margin growth that usually accompanies an ongoing economic expansion.

So what

As you can see above, Fastenal's underlying sales growth did bounce back in May, and despite the negative sentiment around the trade dispute and its possible impact on copper demand from China, the impact on copper prices has been pretty mundane so far in 2019.

There's little doubt that certain sectors of the industrial economy are facing significant headwinds in 2019 -- notably the automotive sector and parts of consumer electronics -- but there are also areas of strength, such as aerospace, while heavy industrial capital spending is improving. In other words, it's wrong to conclude that cyclical industrial stocks are headed for a sharp contraction in overall demand in 2019.

Now what

For Freeport-McMoran, the key is the impact of the trade dispute and/or China's growth prospects. Meanwhile, for Fastenal and MSC Industrial, the key will be U.S. industrial economy and whether it matches current expectations. Growth is definitely slowing -- FedEx's forecast is for U.S. industrial production growth to be 2.4% in 2019 and 2% in 2020, after a strong 4% in 2018 -- but it's still an environment in which these companies can grow revenue and earnings.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and FedEx. The Motley Fool owns shares of MSC Industrial Direct. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance