Why Is Perrigo Company (PRGO) Up 4.7% Since Its Last Earnings Report?

It has been about a month since the last earnings report for Perrigo Company plc PRGO. Shares have added about 4.7% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is PRGO due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Perrigo Surpassed Earnings in Q4, Revenues Down Y/Y

Perrigo Company reported fourth-quarter 2017 adjusted earnings of $1.28 per share, which beat the Zacks Consensus Estimate of $1.24 by 3.2%. The bottom line also increased 3.2% from the year-ago figure.

Net sales in the reported quarter declined 3.6% to $1.28 billion as divestitures of some businesses hurt the top line. But the metric surpassed the Zacks Consensus Estimate of $1.25 billion. Moreover, excluding the impact of divestitures, sales nudged up 2.1% year over year.

Segment Discussion

CHCA: CHCA net sales in the fourth quarter of 2017 came in at $644 million, up 2.7% year over year. This upside can be attributed to a strong performance from the gastrointestinal and analgesics categories compared with the year-ago quarter. New product sales of $17 million also contributed to the top line, led by the store brand version of Nexium, launched last September, and smoking cessation products.

However, this upside was partially offset by lower sales from nutritional drink products in the infant nutrition category as well as pricing pressure in certain OTC (over the counter) categories.

CHCI:CHCI segment reported net sales of $374 million, down 10.8% (declined 16.9% on a constant-currency basis) from the year-ago period. Excluding contributions from the divested European distribution businesses and favorable currency movements, organic net sales increased approximately 3.3% owing to higher sales of new products.

The company also witnessed higher new product sales in the personal care category as well as the store brand business in the U.K. However, this was partially offset by lower net sales in the anti-parasite category.

Prescription Pharmaceuticals (RX): The Prescription Pharmaceuticals segment net sales slipped 1.7% to $261 million on a reported basis and 1.8% on a constant-currency basis. This sales dip can be attributed to lower sales of Entocort due to competitive pressures and price erosion.

2017 Results

Full-year sales decreased 6.3% year over year to $4.9 billion. The metric was however, in line with both the Zacks Consensus Estimate and preliminary results.

The 2017 earnings per share of $4.93 were slightly higher than the Zacks Consensus Estimate of $4.89 but declined 2.8% compared with the year-ago figure.

2018 Earnings Outlook

Perrigo expects revenues in the range of $5.0-$5.1 billion in 2018, above 2017 revenues of 4.9 billion.

The company projects earnings in the band of $5.05-$5.45 per share, also ahead of the full-year adjusted earnings of $4.93.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been eight revisions lower for the current quarter. In the past month, the consensus estimate has shifted by 6.2% due to these changes.

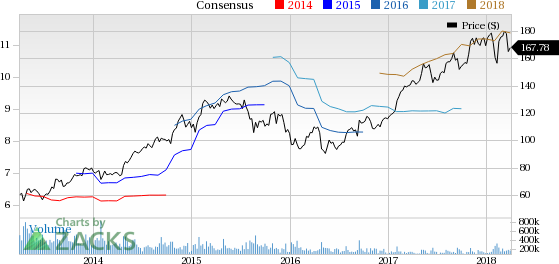

Perrigo Company plc Price and Consensus

Perrigo Company plc Price and Consensus | Perrigo Company plc Quote

VGM Scores

At this time, PRGO has a nice Growth Score of B, though it is lagging a lot on the momentum front with an F. However, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for value and growth investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of these revisions indicates a downward shift. Notably, PRGO has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance