Why We Love Credit Cards, And Why You Should Apply For 1 Of These 4 Cards Today

We love credit cards and here are a few simple reasons why.

Simple Convenience…

With just one credit card, you are able to go around Singapore, and pay for most things without needing any cash in your wallet.

You Save More…

Most convenience in life costs money. For example, you pay more for booking a taxi in advance.

When it comes to the use of a credit card, this isn’t the case. In fact, you get to save more whenever you use your credit card instead of paying by cash. Not using your credit card (when you are able to) doesn’t make any sense.

Almost every credit card that we know off in Singapore gives some form of perks for the use of it. Some cards, like the ANZ Optimum and the Citi Cashback Visa Card, give you cash rebates whenever you use it. Others like the American Express KrisFlyer Card give you miles. Lastly, there are those such as the OCBC Frank Card that gives promotions when you use it for online transections.

You don’t spend a single cent more whenever you use these cards.

At worst, you earn some insignificant perks that you didn’t even know about. In the best of cases, you discover a new way in life to maximise every dollar you spend.

Read Also: How I Stop Withdrawing Money From The ATM

Exclusive Credit Card Promotions For DollarsAndSense Readers For The Month Of October

For the month of October, we have partnered up with Singsaver.com to bring you some great credit cards promotions.

For any of the 4 credit cards mentioned below, you will receive a free $80 NTUC voucher! This is only applicable for the month of October. Applications after 31 October would not count.

Read that again. We are not talking about a possible chance of winning. We are talking about a SURE THING for that $80 NTUC voucher here.

# 1 ANZ Optimum card – Cashback

The first on our list is the ANZ Optimum Card. It’s a brilliant card to have because it gives you up to 5% cash rebate on your preferred category, and 1% cash rebate on all other categories.

The 4 categories you can choose are

1) Dining & Leisure

2) Travel

3) Shopping

4) Groceries.

For example, if you select Dining & Leisure, then you earn a 5% cash rebate for all your spending on that category.

Imagine if you head out for a meal with your colleagues for lunch, and rack up a $500 bill. You pay for the meal with your ANZ Optimum card, while your colleague pays you back in cash. In this instance, you get a cashback of $25 from your card!

Starting Perks:

$80 NTUC Voucher – Only if you apply through DollarsAndSense.sg

+ $168 Cash Rebate – If you spend a minimum of $588 in the next calendar month. Click here for T&C

+ Free 28” Luggage when you apply online. Click here for T&C

# 2 American Express KrisFlyer Card – For Miles

To be honest, there are other travel miles cards out there that provide more mileage for every dollar spent. But there is one area that the American Express KrisFlyer card comes out top in.

It only requires a minimum annual salary of $30,000 for application (i.e. $2,500 monthly salary). That means anyone in Singapore who qualifies to apply for a credit card would definitely be eligible to apply for the American Express KrisFlyer Card.

This is in contrast with other miles cards that require a minimum annual salary of $50,000.

If you start accumulating miles when you start working, you will soon find yourself enjoying your holidays without even having to pay for your flights.

Starting Perks:

$80 NTUC Voucher – Only if you apply through DollarsAndSense.sg

+ 5,000 Free Miles

+ 3,000 Free Miles, if you spend more than $700 within the first 6 months

# 3 Citi Cashback Card

Here is one of the cards that we have held on to for years. If you were fixated with Cashback, this card would give you the most amount of cash rebate.

For example, if you consistently spend $300 each month on petrol, groceries and dining respectively, you would receive a monthly cashback of $72. That translates into a cashback rebate of 8%.

The trick here is consistency. Unlike the ANZ Optimum card, where you can still obtain savings as and when you feel like, the Citi Cashback would work only if your lifestyle consistently requires you to spend on these things. If you do, the cashback you receive would be the best in town.

Starting Perks:

$80 NTUC Voucher – Only if you apply through DollarsAndSense.sg

+ extra $20 cashback each month (minimum monthly spend $200) for first 6 months.

# 4 OCBC Frank Card

Here is another card that we have held on to for years.

The card plays a supporting role in our wallet. It’s not the main card that we use for purchases, since there are better cash rebate and miles cards we utilise.

However, it’s useful for two main things.

Firstly, it’s a card we use for taking the MRT.

You see, to obtain the additional interest on our OCBC 360 account, a minimum credit card monthly spend of $500 is required across all OCBC credit card.

To help us with that, we rope in the OCBC Frank card for our daily transport to help chalk up the spending. If we were already spending $100 each month on transport, we may as well make sure the amount we spend is channelled towards helping us earn more interest.

If you are driving, the card is also useful as you can use it to pay for your carpark fee at the exit gantry.

The card is also particularly useful for online purchases. You can earn 6% on your online purchases when you use the OCBC Frank Card. As mentioned, the card is not a primary card, but acts as a good secondary card to your main cashback and travel miles cards.

Starting Perks:

$80 NTUC Voucher – Only if you apply through DollarsAndSense.sg

How To Apply For These Cards?

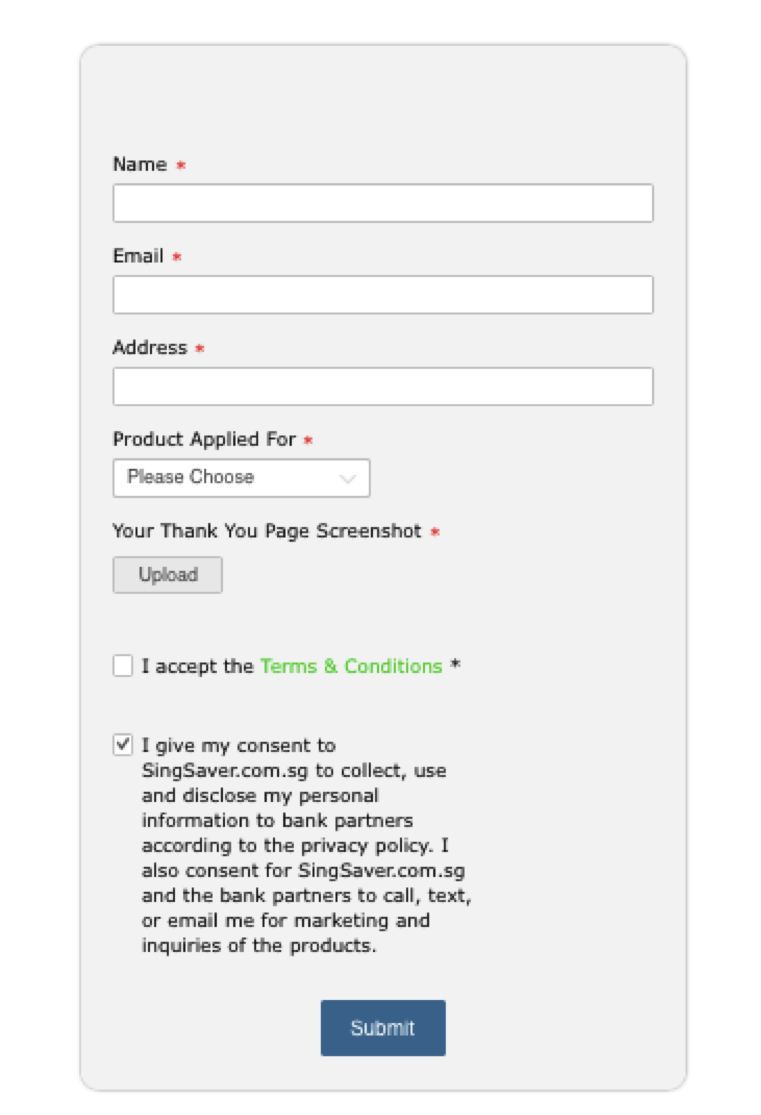

Step 1: Apply for one of these 4 credit cards from the DollarsAndSense X Singsaver Registration Link

Step 2: When you click on the credit card that you want to apply for, you will be redirected to the application form from the respective banks. After your application is done, remember to take a screen shot of the “Thank You” page from the bank.

Step 3: Fill in the form at the bottom in the link. Send the screen shot of the card approval from the bank once you receive it.

It’s that simple. All cards are free for application. So applying for these cards would simply put more money into your pocket (in the form of NTUC vouchers), even if you don’t end up using them often.

The post Why We Love Credit Cards, And Why You Should Apply For 1 Of These 4 Cards Today appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance