Why ImmunoGen, Inc. Jumped Higher Today

What happened

Shares of ImmunoGen (NASDAQ: IMGN) closed up 12% as the American Society of Hematology (ASH) meeting wraps up. The biotech presented over the weekend, which shouldn't be affecting the price of shares midweek, but perhaps investors have taken awhile to digest the data.

So what

ImmunoGen presented data from a phase I trial testing IMGN779 in patients with relapsed or refractory acute myeloid leukemia. The purpose of the trial is to test ever-increasing doses to determine the best dose to take into a phase II trial.

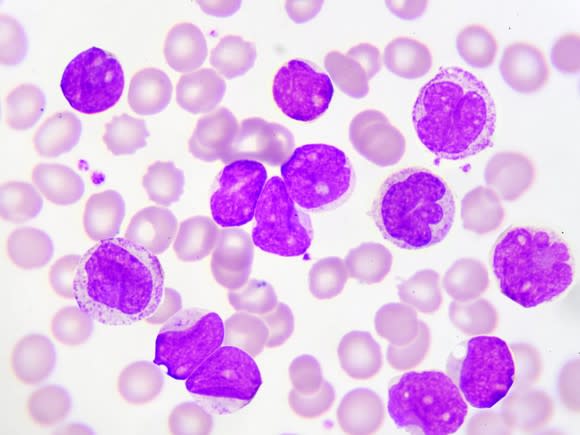

So far, the company hasn't reached the maximum tolerated dose, but has already started to see anti-leukemia activity with 16 of 17 patients treated at a dose of 0.39 mg/kg showing a decrease in peripheral blasts -- leukemia cells in blood samples -- within 10 days after first dose. The median maximal decrease of peripheral blasts was 71%. Seven of the 17 patients had reductions of 48% to 96% in bone marrow blasts -- leukemia cells in the bone marrow -- and all of those had poor prognostic features suggesting they'd be hard to treat.

Image source: Getty Images.

ImmunoGen also presented some preclinical data for IMGN779 showing that the drug combined with a chemotherapy cytarabine killed cells in a laboratory test better than the drugs individually. The combination also increased survival and complete response in animal models of acute myeloid leukemia. ImmunoGen believes the combination is working because cytarabine increases the expression of a protein called CD33, which IMGN779 is designed to target.

At ASH, the company also presented preclinical data for another drug, IMGN632, which looks promising -- as much as laboratory tests can show promise -- but the drug isn't in phase I trials yet, so it's too early to be driving the share price higher.

Now what

ImmunoGen has been a volatile stock over the last year with investors interpreting data in weird ways -- such as a double-digit increase after the company presented earlier data from this phase I trial and a double-digit decline when the abstracts for ASH were released. It isn't surprising, therefore, that the stock is moving days after its ASH presentations, which may not have anything to do with the move anyway.

Long-term investors should be happy with the IMGN779 data so far, but realize that phase 3 data from ImmunoGen's most advanced drug, mirvetuximab, which is due out in the first half of 2019, will affect the company's valuation in the long term. These double-digit moves will then just look like blips on the long-term stock chart.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Brian Orelli has no position in any of the stocks mentioned. The Motley Fool recommends ImmunoGen. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance