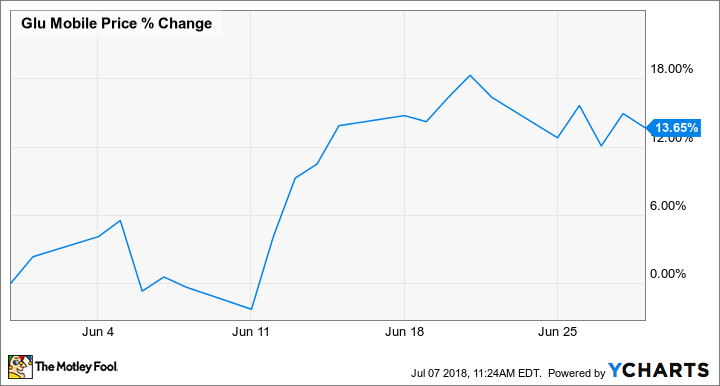

Why Glu Mobile Inc. Stock Gained 13.7% in June

What happened

Shares of Glu Moble (NASDAQ: GLUU) climbed 13.7% in June, according to data from S&P Global Market Intelligence . The mobile-gaming company's share price has climbed roughly 80% year to date on indications that its turnaround effort is proceeding successfully.

Glu is aiming to improve player engagement and spending on its legacy titles such as Kim Kardashian Hollywood, Covet Fashion, and Design Home while also launching new franchises -- and it's seen encouraging early results for recent release MLB Tap Sports Baseball 2018. The stock also gained ground following favorable ratings coverage from Piper Jaffray.

Image source: Getty Images.

So what

Glu posted better-than-expected earnings results at the beginning of May, helping to push its share price roughly 29% higher in the month. The successful debut of MLB Tap Sports Baseball 2018 also added to its stock gains, and some of the momentum from those catalysts carried on through June.

On June 15, Piper Jaffray analyst Michael Olson initiated ratings coverage on the stock, issuing an "overweight" rating and setting a $7.50 price target -- representing roughly 20% upside at the time of the note's publication and the stock's price as of this writing. Glu is a relatively small company with a market cap of roughly $850 million, so it's not unusual to see its valuation post significant gains following positive coverage from a highly regarded ratings firm.

Now what

Glu's valuation has seen some big swings since the company went public in 2007.

Much of the volatility has been tied to shifts in the company's section of the gaming industry -- with the rise and fall of Facebook-based browser games and celebrity-focused titles being among the most notable changes to impact performance.

Glu has recently had success with its pivot away from celebrity-focused games, with 69% of its bookings in the March-ended quarter coming from original intellectual properties. However, there are still reasons to be cautious about the company's long-term prospects. The mobile-games space is highly competitive, and Glu will have to contend with more resource-rich competitors such as Activision Blizzard, Electronic Arts, and Take-Two Interactive, as well as a wide range of smaller independent studios.

Despite favorable trends shaping the broader gaming industry, there's limited visibility on how the company's efforts to introduce new properties will fare -- so those considering buying Glu Mobile should proceed with the understanding that it's not a low-risk investment.

More From The Motley Fool

Keith Noonan owns shares of Activision Blizzard and Take-Two Interactive. The Motley Fool owns shares of and recommends Activision Blizzard, Facebook, and Take-Two Interactive. The Motley Fool recommends Electronic Arts. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance