Why First Solar Stock is Dropping Despite Tariffs

If you only recently began following the solar industry, you might expect that President Trump's decision to impose tariffs on solar panel imports would be the best news First Solar (NASDAQ: FSLR) shareholders could have gotten this year. Because of the technology it uses, the thin-film solar panel manufacturer is the one international manufacturer that's exempt from those tariffs, which gives it a huge advantage in the U.S. market.

But First Solar's stock price has dropped in the days since the announcement, and its shares have underperformed those of some key rivals. Maybe the market thinks First Solar's tariff-related upside isn't as big as was previously expected -- and maybe that's the right way to think about the company's place in the market.

Where First Solar will see a tariff windfall

As of Dec. 5, 2017, at First Solar's analyst day, the company had 13.8 GW of manufacturing capacity between 2018 and 2020, the first three years of the four that the tariffs will be in effect. At that time, before the tariffs were announced, sales of 7.5 GW of that production had been booked, with another 3 GW in late-stage negotiations, according to management.

Image source: First Solar Analyst Day Presentation.

You can see in the chart above that 2018 shipments are only expected to be between 2.7 GW and 2.8 GW, with the remaining 11.0 GW to 11.1 GW forecast to be produced in 2019 and 2020. That's critical, because we know that the tariffs will decline by 500 basis points annually from an initial rate of 30% in 2018 to 15% beginning in early 2021.

Any pricing advantage First Solar has will be highest this year, and subside over time. But its near-term production is already booked, which limits its ability to profit from tariff-enhanced windfall pricing.

Beyond that, we're already getting word that Asian manufacturers are looking to build their own module production capacity in the U.S. JinkoSolar (NYSE: JKS) has agreed to build a plant that will produce solar modules in the U.S., and three Taiwanese solar cell suppliers are looking to invest in capacity here as well. It'll take a year or two to build those plants, but as I pointed out above, First Solar doesn't have a lot of capacity to exploit its price advantage in the meantime.

Image source: First Solar.

What is First Solar's potential in 2021 and beyond?

First Solar certainly took advantage of the threat of solar tariffs in 2017, booking 6.7 GW of sales in the first three quarters alone. And these bookings are the main reason the stock more than doubled in 2017. But investors buying today should be looking at where First Solar will stand in 2021 and beyond, after the temporary tariff advantage dissipates.

Let's look at some numbers to show why there's reason to be concerned about First Solar. Recent sales have primarily been module-only sales, which are much lower dollar-per-watt than system sales, even if they have a higher-percentage gross margin. If we use $0.30 as an average module sale price in 2021 (probably on the high side), we can assume that 5.7 GW of module production will yield $1.71 billion in sales. Management has said that gross margins should exceed 20%, so gross profit should be at least $342 million in 2021 from module-only sales. This is a conservative estimate, and doesn't include operating and maintenance contracts, nor around 1 GW of system development, which will add revenue to the baseline.

The reason I think potential gross profit in 2021 is important because First Solar expects $400 million in operating expenses next year, so if solar modules are going to be the core business, they may not generate enough profit on their own to cover operating costs. Of course, systems and operating and maintenance revenue will generate gross profits as well, but First Solar may not be terribly profitable when tariffs expire.

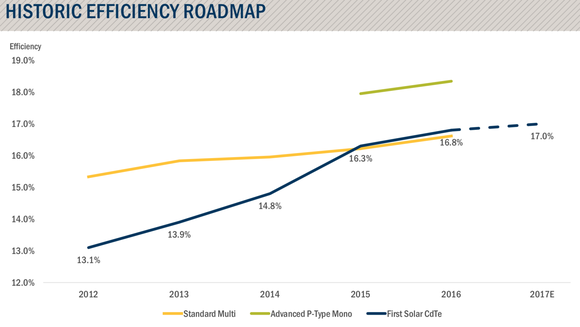

Then there's tech and pricing power to consider. You can see in the chart below that First Solar has done a great job improving its module efficiency over the last five years. Its products are now more efficient than most standard multi-crystalline solar modules.

Image source: First Solar.

But notice the green line on the chart above. That's the efficiency of advanced p-type mono-crystalline solar modules; First Solar is falling behind most of the advanced capacity being built today. In fact, SunPower (Nasdaq: SPWR) already has a solar panel built with commodity mono-silicon solar cells with an efficiency of 19.6% on the market, and higher efficiencies are in its product road map. By 2021, First Solar may be 2% or 3% behind standard mono-PERC (an advanced technology that's rapidly reaching mass production) solar modules, putting it back in the position it occupied during 2012 or 2013.

Management has said there's technology that could bring thin-film solar module efficiency to above 20%, but the timeline for that kind of advancement is unclear. And by the time First Solar gets there, the industry may already be over 20% efficiency for commoditized solar modules.

First Solar's current lead isn't guaranteed

First Solar has had a unique opportunity to exploit with solar tariffs (and the threat of them) pushing U.S. customers toward its thin-film products. But the advantage it has enjoyed over the past year may not last, especially with competitors building U.S. capacity and tariffs set to scale down and eventually expire in early 2022. By then, the company may not be as strong as it seems today, unless it improves efficiency to stay one step ahead of competitors. The recognition that First Solar's advantage in the market will be more fleeting than expected could be one reason the stock price has dropped since tariffs were announced.

More From The Motley Fool

Travis Hoium owns shares of First Solar and SunPower. The Motley Fool recommends First Solar. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance