Why Constellation Brands (STZ) Looks Well-Poised Amid Cost Woes

Constellation Brands Inc. STZ is well-positioned for long-term growth due to its robust premiumization strategy. Strength in the beer business, driven by shipment and depletion volume growth, has been the key driver over the years. The company has been witnessing robust consumer demand for its iconic brands, aiding the quarterly results.

Despite the ongoing supply-chain woes, Constellation Brands posted robust sales growth in second-quarter fiscal 2022. Net sales improved 5% and beat the Zacks Consensus Estimate. Organic net sales advanced 14% year over year. Sales benefited from double-digit net sales growth at the beer business, and organic sales growth in the wine and spirits business.

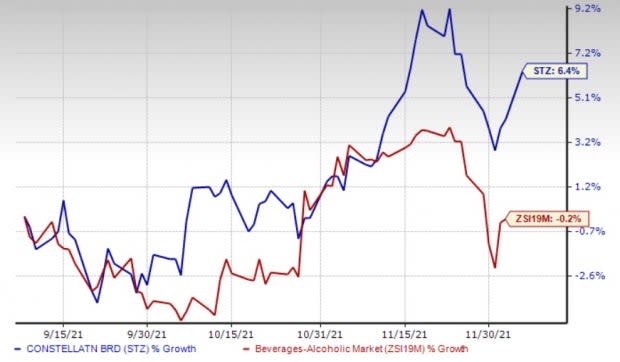

Shares of Constellation Brands have risen 6.4% in the past three months against the industry's decline of 0.2%.

In the past 30 days, the Zacks Rank #4 (Sell) company's estimates for fiscal 2022 earnings per share have been unchanged. For fiscal 2022, its earnings estimates are pegged at $10.00 per share, suggesting 0.3% growth from the year-ago period's reported figure.

Image Source: Zacks Investment Research

Here's Why Constellation Brands Should Retain the Momentum

Constellation Brands is likely to retain its strong performance in the beer business. Sales at the company's beer business advanced 14% in the fiscal second quarter, including an 11.7% increase in shipment volumes and 7.3% depletion volume growth. Sales growth for the segment was driven by robust consumer demand for its iconic brands.

Depletion volume benefited from continued strength in Modelo Especial and Corona Extra. Depletion volume increased 16% for the Modelo Especial and nearly 5% for Corona Extra. The Modelo Especial became the No. 1 beer brand, thus, strengthening its leadership position in the high-end category. It was also the largest share gainer in dollar sales in the U.S. beer category in IRI channels. Meanwhile, Corona Extra was the No. 2 share gainer and No. 3 in the high-end IRI channels.

Constellation Brands remains keen on reviving the performance of the wine & spirits business. The company's wine & spirits premiumization strategy is playing out well, as evident from accelerated growth for Power Brands in second-quarter fiscal 2022. The company's high-end Power Brands, including Kim Crawford, Meiomi and The Prisoner Brand Family, were the key growth drivers. This along with gains from consumer-driven innovation initiatives aided the segment's organic sales, which improved 15% in the fiscal second quarter.

The company is making investments to fuel growth of its power brands through innovation, capitalizing on priority and consumer trends, with successful product introductions. It is lined up for impactful product launches in third-quarter fiscal 2022, including Woodbridge Wine Seltzers, Woodbridge Sparkling Infusions, and Woodbridge 3-liter box wine in chardonnay, cabernet sauvignon, pinot grigio, and pinot noir varietals, as well as a significant expansion of SVEDKA ready-to-drink cocktails in additional markets across the United States. For fiscal 2022, organic sales for the wine and spirits segment are likely to grow 2-4%.

Backed by its strong core beer business results and ongoing share repurchase activity, Constellation Brands provided a robust earnings guidance for fiscal 2022. The company expects net sales growth of 9-11% for the beer segment. Operating income for the beer business is anticipated to increase 4-6%. The robust beer business guidance is backed by the solid performance of its core beer portfolio.

The company expects interest expenses of $355-$365 million for fiscal 2022. It anticipates a reported tax rate of 83% and a comparable tax rate of 20%, excluding Canopy equity earnings impact. On a comparable basis, excluding the Canopy business, earnings per share are expected to be $10.15-$10.45. The company posted earnings per share of $10.44 on a comparable basis, excluding Canopy Growth in fiscal 2021.

Hurdles to Overcome

Constellation Brands continues to witness headwinds from higher cost of goods sold (COGS), marketing investments and SG&A expenses, which have been hurting margins. Increased COGS primarily stems from obsolescence costs associated with excess inventory of hard seltzers due to a slowdown in the overall category in the United States. Additionally, the soft wine and spirits segment's operating margin due to the bulk sales of smoke-tainted wine, which was margin-dilutive, and higher SG&A and marketing expenses, and increased cost of goods sold are headwinds.

Stocks to Watch

We have highlighted some better-ranked stocks from the broader Consumer Staples space, namely MGP Ingredients MGPI, Diageo DEO and Hershey HSY.

MGP Ingredients currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 117.6%, on average. The MGPI stock has gained 28% in the past three months. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MGPI Ingredients' current financial-year sales and earnings per share suggests growth of 55.5% and 61.4%, respectively, from the year-ago period's reported numbers.

Diageo currently has a Zacks Rank #2 (Buy). The company has an expected long-term earnings growth rate of 9.1%. Shares of DEO have gained 8.3% in the past three months.

The Zacks Consensus Estimate for Diageo's current financial-year sales suggests year-over-year growth of 30.7%. The consensus mark for earnings per share indicates growth of 13.6% from the year-ago period's reported figure.

Hershey currently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 4.4%, on average. Shares of the company have gained 2.3% in the past three months.

The Zacks Consensus Estimate for Hershey's current financial-year sales and earnings per share suggests growth of 8.9% and 12.6%, respectively, from the year-ago period's reported numbers. HSY has an expected long-term earnings growth rate of 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

Diageo plc (DEO) : Free Stock Analysis Report

Constellation Brands Inc (STZ) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance