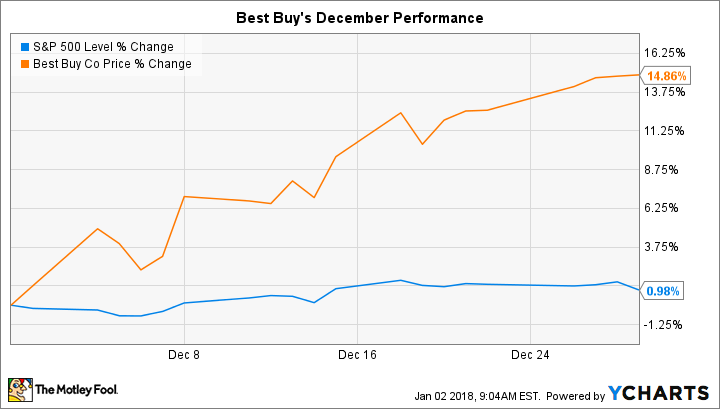

Why Best Buy Stock Jumped 15% in December

What happened

Best Buy (NYSE: BBY) stock beat the market last month as shares gained 15%, according to data provided by S&P Global Market Intelligence.

The rally allowed Best Buy to join several brick-and-mortar retailers that reached 52-week highs just as 2017 drew to a close.

So what

December's jump was powered by rising optimism that the electronics specialist will see robust sales gains over the key holiday shopping period. Best Buy's third-quarter report, issued in mid-November, laid the foundation for this confidence after CEO Hubert Joly and his team boosted their full-year outlook following another quarter of healthy revenue growth.

Image source: Getty Images.

Then, as the shopping season ramped up, investors learned that consumer spending remained strong over the holidays in physical stores and at online merchants. That's good news for popular retailing destinations like Best Buy.

Now what

Best Buy's latest forecast calls for comparable-store sales to rise by between 1% and 3% in its U.S. locations in the fourth quarter, thanks to a flood of innovative product releases including Apple's iPhone X. Yet the better news for investors is that Joly's long-term rebound plan appears to be working.

Sales are steadily rising and Best Buy seems poised to meet, or even exceed, management's goal of between $4.75 per share and $5 per share of annual earnings by fiscal 2021.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance