Why Baozun, Inc. Stock Gained 161.5% in 2017

What happened

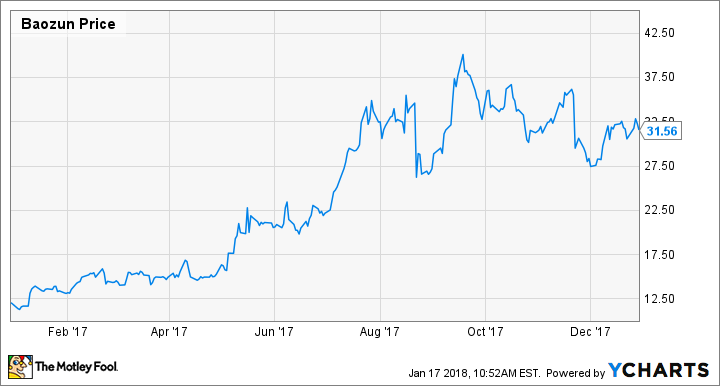

Baozun Inc. (NASDAQ: BZUN) stock climbed 161.5% in 2017, according to data provided by S&P Global Market Intelligence. The company's soaring sales coupled with indications that there's still a long runway for growth in the Chinese e-commerce market helped its stock deliver one of last year's most impressive performances.

So what

Baozun posted a string of impressive earnings reports in 2017 that contributed to increased investor confidence and big share price gains, but the stock's movement was actually somewhat irregular. Strong earnings results in August were followed by steep sell-offs, but the market reversed course in September and proceeded to bid the company's share price to a new all-time high.

Image source: Getty Images.

A similar progression played out in November, with the company recording third-quarter sales and earnings that topped analyst estimates only to trigger more big sell-offs. The stock then regained ground in December on seemingly little news, closing the year out short of the pricing high point it reached in September but still well ahead of the broader market.

Now what

Baozun stock might look pricey trading at roughly 50 times forward earnings estimates, but the company is positioned to benefit from trends and competitive advantages that could enable its stock to continue notching market-beating returns.

Somewhere around 40% of Chinese citizens have yet to connect to the internet, suggesting there's a long, untapped growth runway for the e-commerce market. China's middle class is growing at a rapid clip as well, which bodes well for the emergence of new businesses that would have an interest in Baozun's online sales platform. Thanks to its partnership with Alibaba, Baozun is also able to tap into the network effect of China's largest online retailer, and the relationship will likely help protect the smaller company's hold on its niche against encroachment from competitors.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance