Why AK Steel Stock Dropped 12% in March

What happened

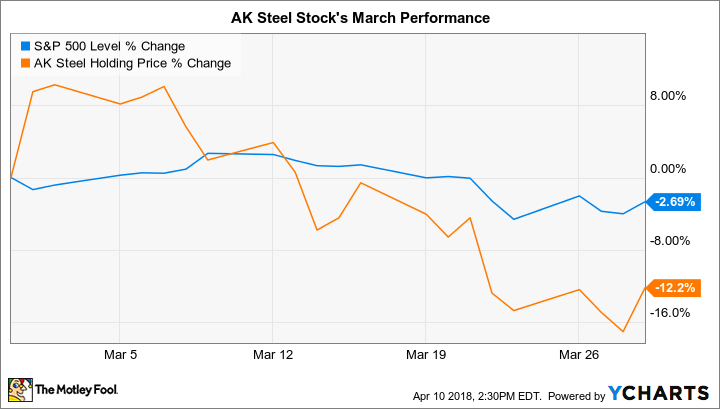

U.S. steel giant AK Steel (NYSE: AKS) shed 12% last month, according to data provided by S&P Global Market Intelligence, compared to a nearly 3% decline in the broader market.

The drop contributed to a rough run for shareholders, who've seen their stock fall by 21% since the beginning of 2018.

So what

March's decline came as investors scaled back their hopes that steel tariffs will lead to a sustained improvement in business results. AK Steel's management team came out in strong support of the protective tariffs early in the month, and the stock rose as well. However, that buzz wore off quickly, especially after it became clear that many U.S. trade partners would be excluded from the tariffs.

Image source: Getty Images.

Now what

The stock price volatility underscores the fact that shareholders are on thin ice when they base their investing decisions on short-term trade policy. Even aggressive tariff moves might create only temporarily higher profits for steel producers, after all. Thus, investors should pay more attention to factors like sales growth, capital efficiency, and profitability. AK Steel will update its shareholders on these key metrics when it reports its fiscal first-quarter results on Monday, April 30.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance