Why You Should Add Fidelity National (FIS) to Your Portfolio

Fidelity National Information Services, Inc. FIS is well-poised to grow on the back of its Future Forward initiative, cross-selling efforts, vertical expansion and margin expansion. Thegrowing global e-commerce market holds tremendous opportunity for the company.

Fidelity National — with a market cap of $42.5 billion — provides banking and payments technology solutions, processing services and information-based services to the financial services industry. Courtesy of solid prospects, this stock is worth investing in at the moment.

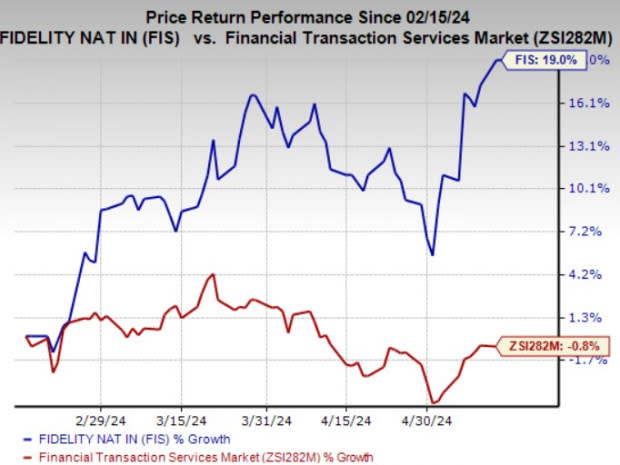

Zacks Rank & Price Performance

FIS currently carries a Zacks Rank #2 (Buy). In the past three months, the stock has gained 19%, against the industry’s decline of 0.8%.

Image Source: Zacks Investment Research

2024 Estimates & Surprise History

The Zacks Consensus Estimate for FIS’ 2024 earnings per share is pegged at $4.93, indicating a 46.3% increase from the year-ago estimated figure. Revenues are expected to be around $10.1 billion in 2024.

The company beat earnings in two of the last four quarters and missed twice.

Growth Drivers

Fidelity National is benefiting from strong recurring revenue growth across all its segments. Strong execution and more accounts should continue to fuel top-line growth in the Banking Segment. The company expects banking-adjusted revenues to grow between 3% and 3.5% in 2024. Moreover, the recent banking uncertainty is boding well for FIS, leading to growth in accounts on file serviced on its platforms and hence rising banking revenues. Growth in existing clients, the contribution of high-growth products and tuck-in acquisitions are expected to fuel revenue growth in the mid-term of around 3.5-4.5%.

The company continues to benefit from increasing Capital Market revenues in the first quarter of 2024. It expects revenues in this segment to grow in the range of 6.5-7% in 2024. The company’s continued investments in emerging platforms like artificial intelligence and blockchain technology should continue to add value to its services. Expanding into the non-core sub-segment, which accounts for 30% of the total segment’s revenues, bodes well. Management expects medium-term revenue growth of 7.5-8.5%. Cross-selling of banking products to capital markets clients highlights a $300 million revenue opportunity, posing the segment well for growth.

The company focuses on top-tier strategic partnerships and future-proof underlying technologies to grow its operations. The company’s growing footprint in the crypto market is praiseworthy. It has partnered with cryptocurrency platforms like Crypto.com and OKCoin to support their respective global expansions. Further, its partnership with bitcoin-focused financial services and technology provider NYDIG is likely to increase traffic to its Digital One Mobile application. It recently unveiled Atelio to enable clients to embed financial services in their offerings. It expects embedded finance TAM’s revenues to be around $230 billion by 2025.

Fidelity National often undertakes shareholder value-boosting measures. In the first quarter, the company returned $1.4 billion to shareholders in the form of share repurchases and $209 million in the form of dividends. Management aims to return a minimum of roughly $4 billion to its shareholders through share buybacks by the end of 2024. The company aims to maintain a 35% dividend payout ratio in 2024. It has a dividend yield of 1.9%, higher than the industry’s average of 0.8%.

The company does not move away from shedding non-core assets to boost efficiency and profitability. It completed a majority stake divestiture in Worldpay in the first quarter of 2024.

However, there are a few factors that investors should keep an eye on. The company is undertaking a multi-year modernization initiative for its platforms and applications following the successful consolidation of data centers and the modernization of its IT infrastructure. These upgrades are likely to result in increased costs in the short term. Nevertheless, we believe that a systematic and strategic plan of action will drive growth in the long term.

Other Stocks to Consider

Some other top-ranked stocks in the broader Business Services space are MoneyLion Inc. ML, Global Payments Inc. GPN, and WEX Inc. WEX. MoneyLion sports a Zacks Rank #1 (Strong Buy), while Global Payments and WEX carry a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MoneyLion’s current-year bottom line indicates a 131.3% year-over-year improvement. The consensus estimate for ML’s current-year top line is pegged at $524.8 million, suggesting 23.9% year-over-year growth.

The Zacks Consensus Estimate for Global Payments’ 2024 earnings is currently pegged at $11.63 per share, indicating 11.6% year-over-year growth. It beat estimates in each of the past four quarters with an average surprise of 1.1%. The consensus mark for GPN’s revenues of $9.2 billion suggests a 6.5% increase from the year-ago level.

The Zacks Consensus Estimate for WEX’s 2024 earnings of $16.27 per share suggests 9.9% year-over-year growth. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 3.3%. The consensus estimate for WEX’s current-year revenues is pegged at $2.7 billion, a 7.6% increase from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fidelity National Information Services, Inc. (FIS) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

WEX Inc. (WEX) : Free Stock Analysis Report

MoneyLion Inc. (ML) : Free Stock Analysis Report