Whirlpool (WHR) Q1 Earnings and Sales Surpass Estimates

Whirlpool Corporation WHR posted first-quarter 2023 results, wherein both earnings and net sales beat the Zacks Consensus Estimate. However, both metrics declined year over year. Results were impacted by the global demand softness and unfavorable mix of product & price.

Shares of the company have gained 4.5% in the past six months compared with the industry’s 4.3% growth. We also note that shares of WHR jumped more than 3.6% after the trading session on Apr 24. This might be owing to the earnings and sales beat in the quarter under review.

Insight Into Q1

The appliance maker reported first-quarter adjusted earnings of $2.66 per share, surpassing the Zacks Consensus Estimate of $2.14 and our estimate of $2.48. However, the bottom line declined 49.9% from $5.31 reported in the year-ago quarter.

Net sales of $4,649 million surpassed the Zacks Consensus Estimate of $4,550 million and our estimate of $4,533 million. However, the top line dropped 5.5% from the year-ago quarter. Excluding the unfavorable impacts of foreign exchange, net sales amounted to $4,736 million, down 3.7% year over year. The downside is mainly due to unfavorable product price/mix & soft global demands.

The gross profit for first-quarter 2023 was $763 million, down 10.3% from $851 million reported in the year-ago quarter.

Ongoing EBIT of $251 million declined 45.8% from $463 million in the year-ago quarter. The ongoing EBIT margin of 5.4% contracted 400 basis points (bps) year over year.

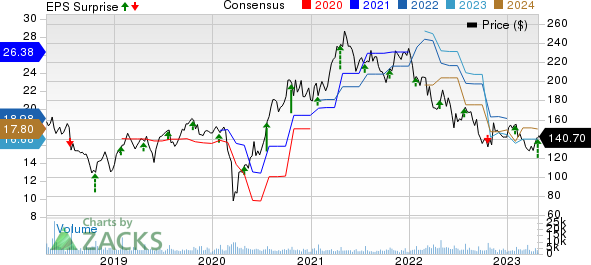

Whirlpool Corporation Price, Consensus and EPS Surprise

Whirlpool Corporation price-consensus-eps-surprise-chart | Whirlpool Corporation Quote

Regional Performances

Net sales for the North America segment decreased 1.6% year over year to $2,747 million. The segment’s EBIT plunged 39.6% year over year to $454 million, while the EBIT margin contracted 630 bps to 10% due to unfavorable price/mix partially offset by the addition of InSinkErator.

Net sales for the EMEA segment were down 18% year over year to $889 million. Organic sales in the region dipped 7.7%. The metric was hurt by drab demand in key countries. The segment’s EBIT was at $5 million against the year-ago quarter’s loss of $27 million. This increase was driven by positive price/mix and held for sale benefits partially offset by raw material inflation.

Net sales from Latin America dipped 0.4% year over year to $757 million, owing to softer demand in Brazil partially offset by sequential demand improvement in Mexico and cost-based pricing actions. The segment’s EBIT of $39 million declined 27.8% compared with the year-ago period’s $54 million. The EBIT margin contracted 190 bps to 5.2%, mainly affected by cost inflation and foreign currency.

Net sales in Asia fell 10.2% year over year to $256 million mainly due to muted consumer demand. Excluding the currency impacts, sales for the region were down 3.4%. The segment’s EBIT of $8 million reflected a 62.9% plunge from the $14 million reported in the year-ago quarter. The segment’s EBIT margin of 3.1% contracted 170 bps from the prior-year quarter due to negative price/mix and foreign currency partially offset by reduced cost inflation.

Other Financial Details

As of Mar 31, 2023, this Zacks Rank #4 (Sell) company had cash and cash equivalents of $1,359 million, long-term debt of $7,382 million and a stockholders’ equity of $2,061 million, excluding non-controlling interests of $173 million.

As of Mar 31, 2023, Whirlpool used cash of $477 million from operating activities. It reported a free cash outflow of $573 million. WHR incurred a capital expenditure of $96 million in the same period.

The company returned $97 million in cash to shareholders as dividends. As of Mar 31, 2023, it has approximately $2.6 billion remaining as share repurchase authorization.

Outlook

For 2023, Whirlpool reaffirmed its full-year expectations for 2023 net sales of approximately $19.4 billion, down 1-2% from the prior year. On a GAAP and ongoing basis, Whirlpool downgraded its earnings per share expectation to $13-$15 from previous expectation of $16-$18. However, it reaffirmed ongoing earnings per diluted share of $16 to $18. Management anticipates a tax rate of 19-21% on a GAAP basis and adjusted basis. For 2023, Whirlpool expects cash provided by operating activities of $1.4 billion and a free cash flow of $800 million.

That said, management is on track with its cost takeout actions and expects $800 to $900 million related to gains from the aforementioned measures and eased raw material inflation.

3 Key Picks

Some better-ranked stocks are Kontoor Brands, Inc. KTB, Ralph Lauren Corporation RL and NIKE, Inc. NKE.

KTB has an expected long-term earnings growth rate of 8% and a trailing four-quarter earnings surprise of 12.4%, on average. Kontoor Brands currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Kontoor Brands’ current financial year sales and earnings suggests growth of 2.5% and 5.8%, respectively, from the year-ago reported numbers.

Ralph Lauren is a major designer, marketer and distributor of premium lifestyle products. It currently carries a Zacks Rank of 2 (Buy). RL has a trailing four-quarter earnings surprise of 23.6%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial year sales suggests growth of 2.5% from the prior-year quarter’s reported numbers.

NIKE, engaged in the business of designing, developing and marketing of athletic footwear, currently carries a Zacks Rank of 2. NKE has a trailing four-quarter earnings surprise of 24%, on average.

The Zacks Consensus Estimate for NIKE’s current financial year sales suggests growth of 9.1% from the corresponding year-ago quarter’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

Whirlpool Corporation (WHR) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Kontoor Brands, Inc. (KTB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance