What’s next for the stock market jolted by Trump's win

More earnings growth.

And while we may see some sell-offs here and there, Wall Street’s top strategists see earnings growth translating to higher stock prices.

“We believe that rising earnings and multiples will push equity returns into the double digits from our previous high-single-digit baseline,” writes RBC chief equity strategist, Jonathan Golub.

“A pickup in inflation and rising business confidence should result in an acceleration in bottom-line growth. As a result, we are raising our 2017 EPS forecast to $127 from $124.” (Emphasis added.)

Golub isn’t the only pro telling clients to be bullish. JPMorgan’s Dubravko Lakos-Bujas wrote that the election outcome was “pro-growth for equities,” arguing that the S&P 500 would rally to 2,300 by early next year. Deutsche Bank’s David Bianco just raised his yearend target for the S&P 500 to 2,200 from 2,150, and his EPS forecast to $119 from $118. For 2017, he sees the index rallying to 2,350 on $128 EPS.

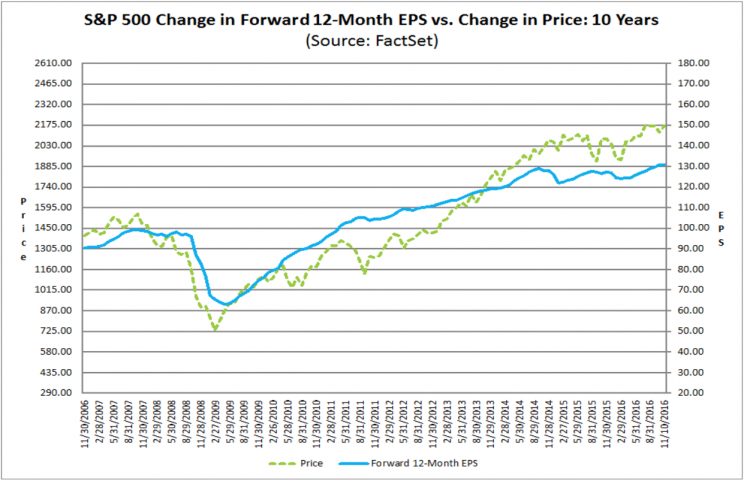

Over the last couple years, earnings for US corporates have been basically flat — we’ve only recently emerged from an earnings recession — while margins have been compressed as wages rise.

The level of the stock market, in turn, has been more or less locked inside a tight range.

Since Donald Trump’s presidential election win, stocks have been rising — the Dow traded to a record high on Friday — as bond yields, the US dollar, and inflation expectations have all jumped higher.

Each of these dynamics has big implications for financial markets.

The stock market, however, has decided that all of the most likely changes under a Trump administration are likely to be good.

“Equities should rally given the aforementioned backdrop, including better earnings, higher multiples, and the benefit of lower corporate taxes,” Golub writes.

“Over the near term, Trump’s policies should play out in the form of higher interest rates, commodity prices, and business optimism.”

Higher rates improve the profitability of the banking. Additionally, Golub notes, rising yields pressure bond prices — bond prices fall when yields rise — which could result in a “rotation toward equities.” Instead of the long-argued case of TINA (There Is No Alternative) to stocks, we could see stocks not become the only alternative but the best alternative. Certainly a welcome change.

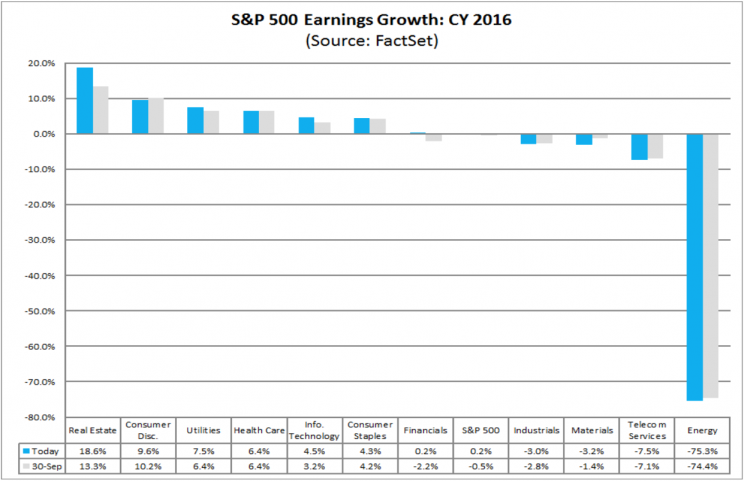

Higher commodity prices should also help stocks as the energy sector was ground zero for the nosedive in corporate earnings over the last couple years. A reversal to increasing profits in this sector would likely buoy earnings across the broader market.

The final point — increasing business optimism — is really, to our minds, what the rally in stocks is all about.

Stock prices are a reflection of how much investors are willing to pay for future profits. Unlike bond investors who are concerned about getting their money back, stock investors are concerned about seeing their money grow. Optimism, in this sense, is baked into the analysis of stock prices.

Over the last several years, no idea has been more persistent in the business community than that regulations and gridlock in Washington are hurting business.

And while the data on this is mixed — hiring remains robust, consumer spending is strong, though fixed investment is a laggard — the idea that the government is holding back business matters as much as the actual evidence that this is the case.

Business optimism, to the stock market, is a very real (if intangible) idea.

“Over the last several days, the narrative has shifted and investors appear to be focused on the pro-growth and reflationary aspects of a Trump presidency, leading to a snapback in equities and other risk assets and a sell-off in safe-haven securities,” Golub writes.

This weekend we cautioned on the flaws of how market prices and market narratives move together — or don’t!

Stocks on Monday were trading roughly flat, and Golub’s analysis doesn’t necessarily imply this won’t be the case going forward. Stocks like more earnings, but more earnings don’t equal higher prices.

The initial reaction to Trump’s win, however, indicates investors are excited to have something to be excited about. And what better days are here, and ahead, for the stock market.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance