What's in the Cards for Main Street (MAIN) in Q1 Earnings?

Main Street Capital Corporation MAIN is slated to announce first-quarter 2020 results on May 7, after market close. The company’s revenues and earnings are expected to have declined year over year.

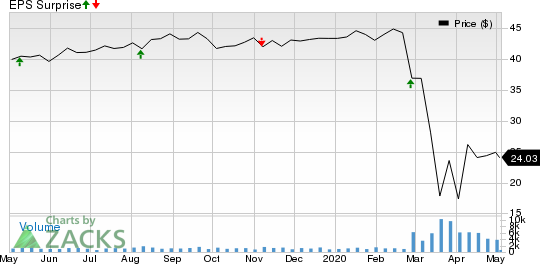

It has a decent earnings surprise history. It surpassed the Zacks Consensus Estimate in three of the trailing four quarters, the positive earnings surprise being 1.7%, on average.

In the last reported quarter, the company surpassed the consensus estimate on higher fee and dividend income, partially offset by rise in expenses.

Main Street Capital Corporation Price and EPS Surprise

Main Street Capital Corporation price-eps-surprise | Main Street Capital Corporation Quote

The Zacks Consensus Estimate for Main Street’s earnings of 57 cents for the to-be-reported quarter has been unchanged over the past seven days. However, it indicates a fall of 11% from the year-ago reported figure. Also, the consensus estimate for sales of $57.7 million suggests a 6% year-over-year decline.

Key Factors to Note

Due to lower interest rates, Main Street is expected to have witnessed a fall in interest income during the quarter. However, the expectation of higher prepayment activities is anticipated to have given fee income some support.

The Zacks Consensus Estimate for interest, fee and dividend income from affiliate investments is pegged at $9.01 million, indicating a 3.2% fall from the previous quarter’s reported figure. Also, income from control investments is expected to fall 1% sequentially to $21.71 million. Both metrics together constitute 53% of the company’s total investment income.

However, Main Street has been witnessing rise in general and compensation-related expenses for the past several quarters.

Earnings Whispers

According to our quantitative model, chances of the company beating the Zacks Consensus Estimate this time around are low. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Main Street is -10.00%.

Zacks Rank: Main Street has a Zacks Rank #3.

Stocks to Consider

Here are some finance stocks that you may want to consider, as according to our model, these have the right combination of elements to post an earnings beat this quarter.

Ameriprise Financial, Inc. AMP is scheduled to release results on May 6. The company currently has an Earnings ESP of +9.63% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ares Management L.P. ARES is likely to release earnings figures around May 6. The company, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +3.52%.

Virtu Financial, Inc. VIRT is slated to report quarterly earnings on May 7. The company, which sports a Zacks Rank of 1 at present, has an Earnings ESP of +39.67%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

Ares Management L.P. (ARES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance