Wells Fargo Faces New Challenge as Business Loans Decline

After facing problems in its consumer lending operations, Wells Fargo’s WFC commercial lending business is also plagued with challenges now. At the Barclays 2018 Global Financial Services Conference, the company’s chief financial officer, John Shrewsberry, revealed a dismal picture for the bank’s loan book.

Loan Outlook

Shrewsberry pointed out that Wells Fargo’s total loans as of Jun 30, 2018, declined $3 billion sequentially to $944.3 billion. This was mainly due to fall in both consumer and commercial loans. A similar trend is expected to continue in the third quarter of 2018 as well.

Specifically, commercial & industrial (C&I) and commercial real estate (CRE) loans are expected to be down from the prior quarter, reflecting continued “competitive lending environment”, disciplined pricing and strong capital markets. Additionally, Shrewsberry commented, “…as we’ve experienced in other businesses, while reputational issues have not impacted relationships with existing customers, they may have slowed some new customer activity.”

Further, Wells Fargo anticipated consumer loans to decrease “modestly” on a sequential basis. Continued fall in auto loan balances and the sale of $2.5 billion of unpaid principal balance of Pick-a-Pay PCI loans are the main reasons for the marginal decline.

Thus, while other major banks, including JPMorgan JPM and Citigroup C, offered upbeat loan guidance, Wells Fargo’s dismal projections indicate it will likely face tough times in the quarters ahead.

Other Guidance

Shrewsberry provided outlook for few other line-items as well. Management expects net interest income (NII) and net interest margin for the third quarter to be in line with the prior quarter, while reiterating NII of remaining relatively stable for 2018.

Further, gain from the sale of $2.5 billion (unpaid principal balance) of Pick-a-Pay mortgage loans is expected to be approximately $600 million in the current quarter, up from $479 million gain on the sales realized in the second quarter.

Marginal growth in deposit service charges is projected in the third quarter, mainly driven by a rise in customer activity partly offset by higher earnings credit rate for commercial customers. Nonetheless in 2018, it is anticipated to decline owing to the impact of customer-friendly changes to deposit account fees and higher earnings credit rate for commercial customers.

In addition, disappointing mortgage originations will likely hurt Wells Fargo’s mortgage banking business. Mortgage Bankers Association predicts originations to be down 6% year over year in 2018. As such, mortgage banking fees are estimated to decline due to lower originations and a fall production margin in 2018.

On the other hand, in the ongoing quarter, mortgage originations are likely to be in line with 2Q18 level. Furthermore, production margin is expected to be up marginally on higher sales execution gains despite competitive pressures.

Additionally, management affirmed non-interest expense outlook for 2018 and expects it to be in the range of $53.5-$54.5 billion. Also, the same is projected to be in the $52-$53 billion range for 2019 and $50-$51 billion range for 2020.

Moreover, ROE is anticipated to be 12-15% over the next two years, while ROTCE is expected to be 14-17%.

A Bumpy Road Ahead

Despite providing a decent growth outlook, dismal loan performance is anticipatedto adversely impact Wells Fargo’s financials in the upcoming quarters. This apart, the bank continues to face several probes and lawsuits, which will further hurt its reputation.

Though Wells Fargo is undertaking measures and restructuring businesses, these will take time to be conducive to its performance.

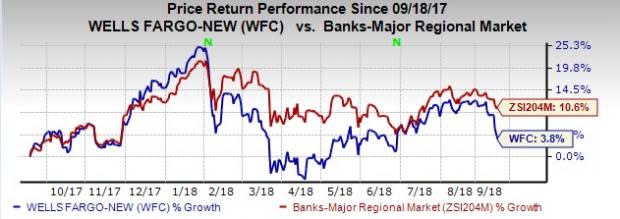

Over the past year, Wells Fargo’s shares have gained 3.8%, underperforming 10.6% rally for the industry it belongs to.

Currently, Wells Fargo carries a Zacks Rank #3 (Hold).

A better-ranked major bank is Comerica Incorporated CMA. The bank’s Zacks Consensus Estimate for earnings moved 1.3% upward over the past 60 days. This Zacks #1 Ranked (Strong Buy) company’s shares have rallied 7.4% so far this year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Electric Car Stock? You'll Never Guess It.

Zacks Research has released a report that may shock many investors. One stock stands out as the best way to invest in the surge to electric cars. And it's not the one you may think!

Much like petroleum 150 years ago, lithium battery power is set to shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, revenues that were already at $31 billion in 2016 are expected to blast to over $67 billion by the end of 2022.

See Zacks Best EV Stock Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Comerica Incorporated (CMA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance