WEEK AHEAD: What you need to know in markets ahead of Thanksgiving

It’s a short week.

Thanksgiving is on Thursday in the US, and as a result we’ll have just three-and-a-half trading days, a welcome break to markets that have been in a bit of frenzy following the presidential election.

Wednesday will be a busy day in economic data with no fewer than six reports due out, and key economic readings from Europe could keep investors that would rather analyze macro trends than deal with their families busy.

US Economic Update

Quick update: The US economy is already pretty great.

President-elect Donald Trump famously made the cornerstone of his campaign a pledge to “Make America Great Again.” But as we’ve seen with the recent run of US economic data, Trump looks set to inherit an economy doing pretty well right now.

Yahoo Finance’s Rick Newman wrote this week that Trump is set to inherit an economy in far, far better shape than the mess President Obama walked into in January 2009 during the depths of the financial crisis.

Of course, the outcome of the election has had commentators fretting over what it means that a candidate who ran on nationalist — rather than internationalist — themes prevailed. But that is not our concern in this space.

What we know is the US economy is in good shape and, it appears, still improving. And along with that improvement will likely come the big thing missing for the last few years: inflation.

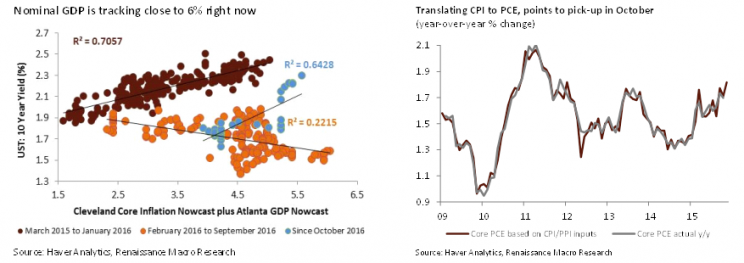

“In our view, the outcome of the US presidential election has provided cover for some investors to participate in a reflation story already in place,” writes Neil Dutta, an economist with Renaissance Macro.

“For example, nominal growth has already picked up notably in H2, likely crossing 5% SAAR… The back-up in nominal Treasury yields is a headwind for equity markets, all else equal. However, in the real world, all else is never equal. The rebound in inflation is a tailwind for corporate earnings.

Dutta adds: “Moreover, the restrained growth in aggregate hours worked and rebound in domestic demand implies stronger productivity, restraining the growth in unit labor costs. Thus, it is highly likely that corporate earnings are accelerating into 2017.” (Emphasis added.)

Fed Chair Janet Yellen signaled on Friday that the Fed is likely to raise rates next month, but doesn’t appear eager to ramp up the tightening cycle quickly.

And as Minneapolis Fed president Neel Kashkari told Yahoo Finance this week, “The economy’s been remarkably stable since I’ve at the Fed the last year. This has been a story of labor force participation… That’s been a good thing for the society and the country.

“My view is we have to allow that process to continue as long as it can, and then if we inflation coming back up we’re well positioned to deal with it.”

Economic Calendar

Monday: No major economic reports.

Tuesday: Richmond Fed manufacturing (0 expected; -4 previously); Existing home sales (-0.7% expected; +3.2% previously)

Wednesday: Durable goods orders (+1.2% expected; -0.3% previously); Initial jobless claims (248,000 expected; 235,000 previously); FHFA house price index (+0.5% expected; +0.7% previously); Markit flash manufacturing PMI (53.4 expected; 53.4 previously); New home sales (-0.5% expected; +3.1% previously); University of Michigan consumer confidence (91.6 expected; 91.6 previously); FOMC Minutes

Thursday: US markets closed. German Ifo business climate (110.5 expected; 110.6 previously); German GfK consumer confidence (9.7 expected; 9.7 previously)

Friday: Trade balance (-$58.9 billion expected; $-56.5 billion previously); Markit flash services PMI (54.7 expected; 54.8 previously); UK GDP (+0.7% expected; +0.5% previously)

Further Reading

Steve Bannon, Trump’s right-hand man, seems like he wants the $1 trillion infrastructure package (Hollywood Reporter)

The way for Trump to do something inspiring as president? Build a big thing (NYT)

Nassim Taleb says Trump’s win was not a black swan (Yahoo Finance)

Goldman’s 10 big market themes for 2017 (Bloomberg) Semi-related: A bunch of Goldman execs made millions on stock options after Trump’s win (Bloomberg)

Trump settled his Trump University lawsuit (Yahoo Finance)

Facebook will buy back $6 billion in stock next year (SEC)

Deutsche Bank’s David Bianco sees the S&P 500 hitting 2,250 by the inauguration (Sam Ro)

Sesame Street has a VC fund (TechCrunch)

Former Saudi oil minister Ali al-Naimi does lunch with the FT (FT)

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance