Should You Watch U.S. Bancorp (USB) for Solid Dividends?

Given the ongoing turmoil in the banking industry and expectations of recession in the near-term, solid dividend-yielding stocks are highly desirable. One such stock is U.S. Bancorp USB.

The Minneapolis, MN-based bank was formed in 2001 with the merger of the former U.S. Bancorp and Firstar Corporation. USB provides a wide range of banking and investment services throughout the Midwest and West regions of the United States.

U.S. Bancorp has been increasing its quarterly dividend on a regular basis, with the last hike of 4.3% to 48 cents per share announced in September 2022. Over the past five years, the company increased its dividend four times, with an annualized dividend growth rate of 7.47%.

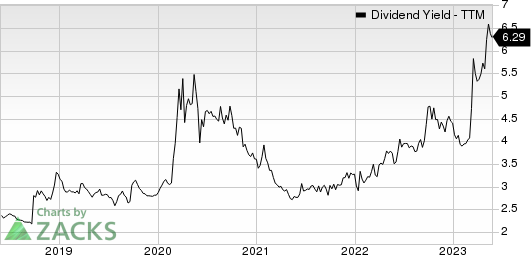

Considering the last day’s closing price of $30.51, U.S. Bancorp’s dividend yield currently stands at 6.29%. This is impressive compared with the industry average of 4.59% and attractive for income investors as it represents a steady income stream.

U.S. Bancorp Dividend Yield (TTM)

U.S. Bancorp dividend-yield-ttm | U.S. Bancorp Quote

Is the U.S. Bancorp stock worth a look to earn a high dividend yield? Let’s check out the company financials to understand the risks and rewards. This will help us make a proper investment decision.

U.S. Bancorp remains focused on its organic growth strategy. Revenues witnessed a compound annual growth rate (CAGR) of 1.3% over the four-year period ended 2022. This rise was due to higher net interest income (NII) with some annual volatility.

The rising momentum continued in first-quarter 2023. Management expects total revenues to reach $28.5-$30.5 billion in 2023. Also, U.S. Bancorp’s efforts to enhance its range of products, services and capabilities will support fee income growth in the upcoming period.

Over the past few years, the bank recorded strong growth in average loans and deposits, as it continued to expand and deepen relationships with current customers, as well as acquired new customers and market share. Average deposits and loans witnessed a three-year CAGR of 10.5% and 14.6%, respectively, in 2022. The rising trend for both metrics continued in first-quarter 2023. For second-quarter and full-year 2023, the company expects average earning assets in the range of $600-$605 billion and $600-$610 billion, respectively.

USB has grown through a series of acquisitions over the years. In December 2022, U.S. Bancorp completed the acquisition of MUFG Union Bank’s core regional banking franchise from Mitsubishi UFJ Financial Group. In December 2021, USB completed the deal to acquire PFM Asset Management, which was carried out through U.S. Bancorp Asset Management. These mentioned acquisitions have strengthened the company’s balance sheet and fee-based businesses.

Hence, despite near-term headwinds like rising expenses and notable exposure to risky loans, USB stock is fundamentally solid. So far this year, shares of U.S Bancorp have plunged 30% compared with the industry's fall of 9.9%.

Image Source: Zacks Investment Research

Therefore, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as this will help generate robust returns over time. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Bank Stocks Worth a Look

A couple of bank stocks, like Columbia Banking System, Inc. COLB and Huntington Bancshares HBAN, are worth a look as these have robust dividend yields.

Considering the last day’s closing price, Columbia Banking System’s dividend yield currently stands at 5.75%. Over the past six months, the shares of COLB have lost 36%.

Based on the last day’s closing price, Huntington Bancshares’ dividend yield currently stands at 5.95%. Over the past six months, the shares of HBAN have lost 30.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB) : Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Columbia Banking System, Inc. (COLB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance