What Warren’s Wealth Tax Would Do to Billionaires

Elizabeth Warren says her wealth tax – 2% on household wealth over $50 million, rising to 6% on household wealth over $1 billion – would raise trillions of dollars to pay for new social programs, including universal child care, student loan forgiveness and, at least in part, Medicare for All.

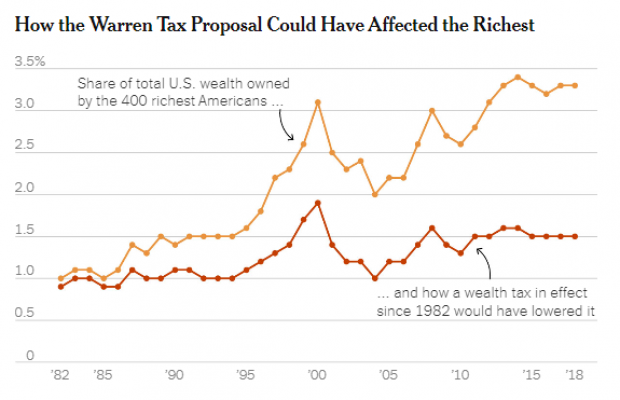

But a wealth tax would do more than just raise revenues, Patricia Cohen pointed out in The New York Times Sunday. It would also limit the growth of some of America’s greatest fortunes and even shrink them in the long run, reducing the intergenerational transfer of wealth. “Over time,” Cohen wrote, “billionaires would have many fewer billions.”

Gabriel Zucman, the University of California at Berkeley economist who has advised both Warren and Bernie Sanders on their tax plans, told Cohen that the reduction of great fortunes was very much part of the plan. “You had a good idea at 30, that's great, you can be a multibillionaire for 10 to 20 years,” Zucman said. “What an annual wealth tax of 6 percent does is that it makes it harder to stay a multibillionaire at age 70, 90, etc. It makes wealth circulate.”

According to an analysis by Zucman and fellow economist Emmanuel Saez, if the wealth tax had been in effect since 1982, the 400 wealthiest people on the annual Forbes list would have a net worth of $3.1 billion each, on average, compared to the current average net worth of $7.2 billion each. Some specific examples from Zucman’s analysis of the effects of a wealth tax, as highlighted in the Times:

Microsoft’s Bill Gates would have had $13.9 billion in 2018, instead of $97 billion.

Amazon’s Jeff Bezos would have had $48.8 billion in 2018, instead of $160 billion.

Facebook’s Mark Zuckerberg would have $32.5 billion in 2018, instead of $61 billion.

It’s not just a wealth tax, though: Warren has also proposed a higher tax on capital gains, and that’s the one that should really worry billionaires, says Erik Sherman at Forbes. Sherman does some basic calculations on wealth taxes of 3% and 6% and finds that most great fortunes would continue to grow at those tax rates. But if Warren’s near doubling of the capital gains tax to 37% were in effect, some billionaires would see their fortunes shrink by half or more. Looking at the period 2010-2019, and including Warren’s taxes on wealth and capital gains, Sherman found, for example, that Jeff Bezos’s $131 billion fortune would fall to $37.2 billion.

Yahoo Finance

Yahoo Finance