Warren Buffett: Berkshire has dumped its airline stocks, 'world has changed' because of coronavirus

Warren Buffett has gotten Berkshire Hathaway (BRK-A, BRK-B) out of the airline business.

During a virtual address to shareholders for the company’s annual shareholders meeting Saturday, the chairman and CEO called Berkshire’s recent purchase of roughly 10% of four of the world's largest airlines — including American (AAL), United (UAL), Delta (DAL) and Southwest (LUV) — an “understandable mistake.”

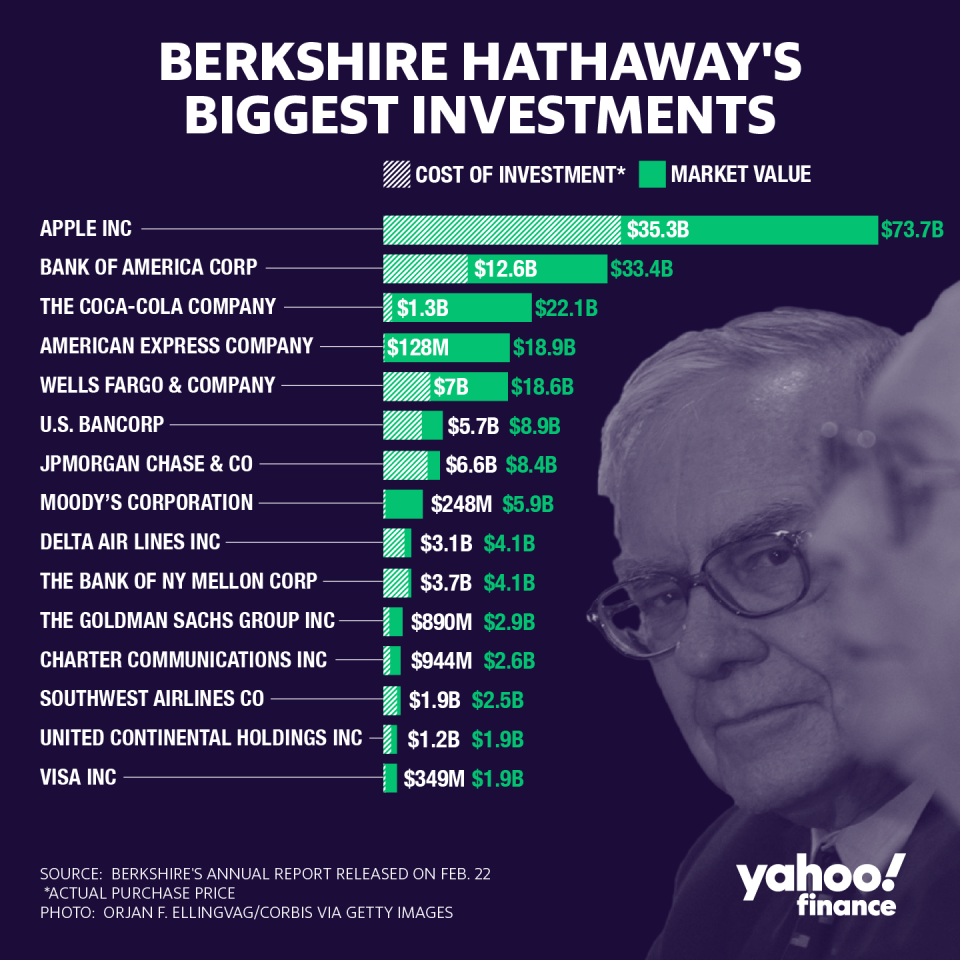

But the company has sold out of its entire interest in the airlines, worth at least $4 billion. In doing so, the Oracle of Omaha admitted to a rare investment misstep, one that’s he pinned on the coronavirus crisis hammering the global economy.

“The world changed for airlines,” the influential investor said at the meeting.

[See also: Airline shares tank after Buffett reveals he dumped airline stocks]

“It turned out that I was wrong about that business because of something that was not in any way the fault of four excellent CEOs,” Buffett said of COVID-19’s shock to air travel — adding that there was “no joy” in managing those companies right now.

“But the companies we bought were well managed. They did a lot of things right. It’s a very, very, very difficult business because you’re dealing with millions of people every day and if something goes wrong for 1% of them, they are very unhappy,” Buffett added.

Prior to stay at home orders put in place across the U.S. on March 1, the Transportation Safety Administration reported scanning nearly 2.3 million passengers — a number consistent with the prior year’s approximate 2 million passengers, per day.

Yet fast forward to April 3, the agency scanned 129,763 passengers, and that number continues to decline. Buffett said he doubts whether the flying public, or even himself, will be willing to travel as frequently as they had by plane before the virus outbreak.

“People have been told not to fly. I’ve been told not to fly for a while. I’m looking forward to flying. I may not fly commercial but that’s another question,” Buffett remarked.

While he expressed hope that he could be wrong, Bufftett said the airline business changed in a major way, most obviously in the level of debt the companies will need to carry in order to stay alive.

The four companies will each need to borrow $10 billion to 12 billion, and in some cases will need to rely on stock sales, which will take away from their upside, he said.

“I don't know whether two or three years from now that as many people will fly as many passenger miles as they did last year, “ Buffett said. “They may and they may not, but the future is much less clear to me about how the business will turn out through absolutely no fault of the airlines themselves.”

Read more:

Why Warren Buffett’s 2008 message to American investors was timed perfectly

Warren Buffett warns coronavirus will affect business, but he 'certainly won’t be selling' stocks

Warren Buffett explains why CEOs prefer ‘cocker spaniels’ over ‘pit bulls’

Berkshire Hathaway was responsible for 1.5% of the taxes paid by corporate America in 2019

An unfortunate story that reflects Berkshire Hathaway's incredible scope

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance