Walmart Q2 Preview: Rebound Quarter Inbound?

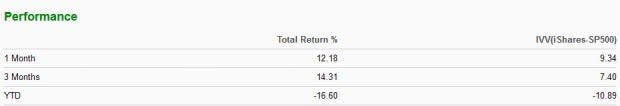

The Zacks Retail and Wholesale Sector has struggled year-to-date, but over the last month, it’s outperformed the S&P 500, penciling in a solid 12% gain. Below is a table illustrating the sector’s performance vs. the S&P 500 over several timeframes.

Image Source: Zacks Investment Research

A titan residing in the sector, Walmart WMT, is on deck to reveal Q2 results on Tuesday, August 16th, after market close.

Walmart is a massive retailer, with its product offering ranging from grocery to cosmetics, electronics to stationery, home furnishings to health and wellness products, and apparel to entertainment products, to name a few.

We see their stores at seemingly every turn. How does the retail giant stack up heading into its quarterly print? Let’s take a closer look.

Share Performance & Valuation

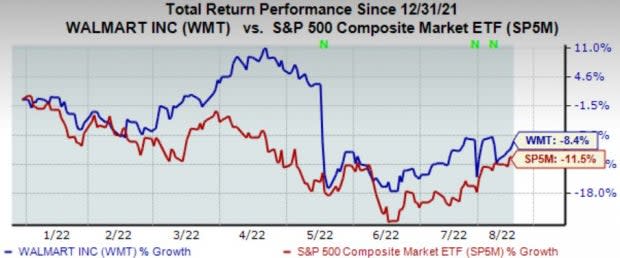

Walmart shares have outperformed the S&P 500 by a respectable margin year-to-date, but are still down nearly 9%.

Image Source: Zacks Investment Research

However, over the last month, WMT shares have lagged the general market, tacking on 5% in value vs. the S&P 500’s gain of nearly 11%.

Image Source: Zacks Investment Research

In addition, Walmart shares carry relatively strong valuation levels. The company’s 22.9X forward earnings multiple is just a tick above its five-year median of 22.6X and represents an enticing 14% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been overwhelmingly bearish for the quarter-to-be reported, with 12 downwards estimate revisions coming in over the last 60 days with a 100% revision agreement. The Zacks Consensus EPS Estimate resides at $1.60, reflecting a 10% decrease in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

Still, Walmart’s top-line looks to register solid growth – WMT is forecasted to have generated a mighty $151 billion in revenue throughout the quarter, penciling in a substantial 7% year-over-year uptick.

Quarterly Performance & Market Reactions

The retail titan has consistently reported bottom-line results above the Zacks Consensus EPS Estimate, with seven bottom-line beats over its last ten quarters. However, in its latest quarter, WMT recorded a disheartening 11% EPS miss.

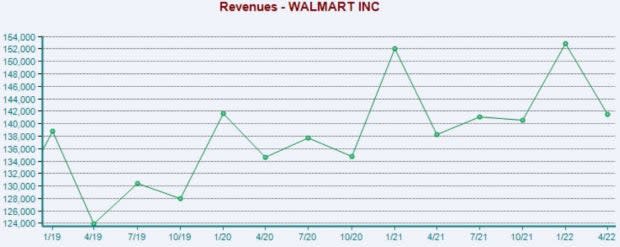

Top-line results have been remarkable – Walmart has chained together nine consecutive revenue beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has primarily acted poorly to the company’s earnings releases, with shares moving down following four of its previous six quarterly prints.

Putting Everything Together

Walmart shares have been notably defensive throughout 2022, but over the last month, shares have lagged the general market. In addition, valuation levels are relatively sound compared to its sector.

Analysts have been very bearish for the quarter to be reported, and the company’s bottom-line is forecasted to take a deep hit, a reflection of rising costs eating deep into margins. However, WMT’s top-line is forecasted to register solid growth.

Furthermore, Walmart has consistently reported quarterly results above estimates.

Heading into the print, Walmart WMT carries a Zacks Rank #4 (Sell) with an overall VGM Score of a C.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance