Wall Street looks to history for guidance if the Trump-Russia case gets more serious

The drop in stocks this week on reports around the investigation of Trump's campaign caused some analysts to go back and research the stock market and economic impact of Watergate and President Bill Clinton's impeachment by the House.

Even on the chance that President Donald Trump 's handling of the Russia case threatens his presidency, the analysts believe today's economic conditions mirror those in place during Clinton's scandal and so any pullback, while likely to be pretty intense, would be a buying opportunity.

Fresh political uproar has made talk of Trump's impeachment or resignation more serious, albeit still small at this stage. The president fired FBI Director James Comey last week, and a few days later a report of a Comey memo alleged Trump asked the former director to let go of a Russia-related probe.

Analysts say the investing environment today draws closer parallels to the Clinton-Lewinsky scandal, and the historical market performance around that 1990s political turmoil should give traders less to worry about.

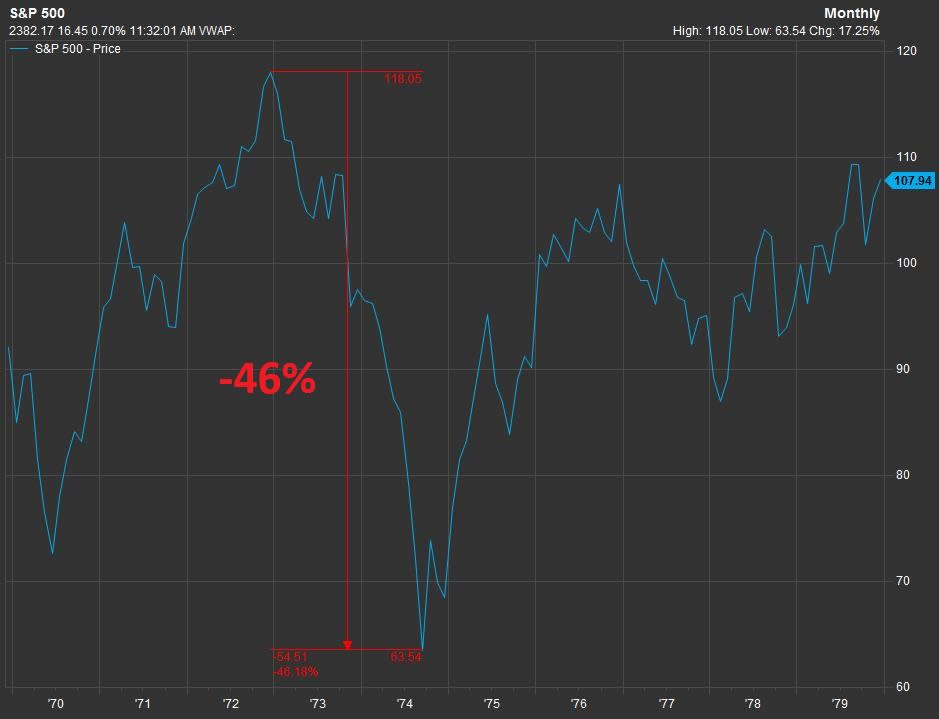

"I don't think Watergate is the appropriate comparison," said Sam Stovall of CFRA Research. "In 1974, [stocks] were already in a bear market that ultimately almost fell 50 percent."

S&P 500 performance (1970 - 1980)

Source: FactSet

Bespoke Investment Group agreed with Stovall. The latest Trump headlines are "not the same, and nobody should expect a 50% decline in the U.S. stock market on political headlines alone!" Bespoke's Macro Strategist George Pearkes said in a note Wednesday.

When President Richard Nixon resigned on Aug. 8, 1974, after the Watergate cover-up scandal, the U.S. economy was in the middle of a recession, hit by an oil embargo and spiking inflation.

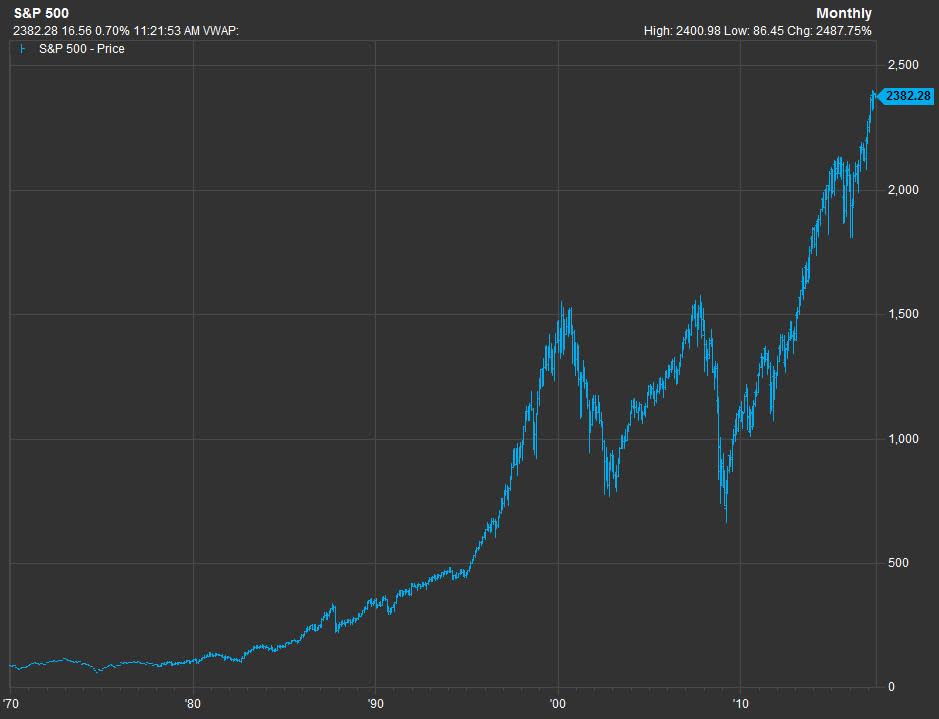

In contrast, in the 1990s the S&P 500 was climbing to fresh records and the U.S. economy was growing well over 4 percent. Inflation was moderate, around 2 to 3 percent.

Similarly, today the U.S. economy is growing around 2 percent, inflation is near the Federal Reserve's desired target, and oil prices have steadied after a sharp drop. U.S. stocks have repeatedly set record highs this year.

S&P 500 performance (1970 - 2017)

Source: FactSet

Here's how the market behaved around the Clinton impeachment hearings:

In January 1998, news broke that independent counsel Kenneth Starr was investigating President Bill Clinton for possible perjury and obstruction of justice.

In just over a month, from July 17 of that year to August 31, the S&P 500 fell 19.4 percent, Stovall said.

He noted the index retested the August low in October 1998 when the House of Representatives voted to start the impeachment process.

Then, "investors concluded that this event would not likely lead to recession," Stovall said in a note Wednesday.

The S&P 500 recovered its entire decline and set a fresh all-time high on Nov. 28, 1998, a few months ahead of the Senate acquitting Clinton in February 1999.

Stocks did not react much to the initial news of Comey's firing. But this past Tuesday, the S&P 500 dropped more than 1 percent in its worst day since September, after a report based on a memo from Comey alleged Trump asked Comey to drop an investigation into former national security advisor Michael Flynn for potential connections to Russia. A senior White House official said in a statement to NBC News that the report was inaccurate.

Traders sold stocks in fear the latest political controversy could keep Trump's pro-growth plan from happening. Short interest, or bets that the average S&P 500 stock would fall, jumped Wednesday to a high for 2017 at 2.538 percent, according to IHS Markit.

The White House did not immediately respond to a CNBC request for comment on market speculation about Trump's future. In contrast to prior administrations, Trump and his team have said the market's performance is the administration's report card.

Trump leaves the country Friday for his first overseas trip as president. House and Senate committees await Comey's testimony, while newly appointed special counsel Robert Mueller takes the lead on the investigation into Russia's influence on the U.S. presidential election. The probe includes potential ties between Trump's associates and Russian officials, sources told NBC News.

Economic backdrop aside, the political volatility on a serious national security issue does draw more parallels with Nixon and Watergate than the Clinton-Lewinsky scandal, said Barry Pavel, director of the Brent Scowcroft Center on International Security at the Atlantic Council.

More importantly, "the sort of crisis-a-day atmosphere at minimum is distracting from the real work that has to get done," Pavel said.

That real work is what the market ultimately cares about.

In the end, whether or not Trump is impeached, or if he leaves office on his own, "the person who would replace him is equally pro-business and pro-tax-reform and probably works better with the Democrats," Stovall said. "It's the uncertainty that's causing investors to sell out of stocks right now."

U.S. stocks steadied Thursday and opened slightly higher Friday, holding weekly losses of just over half a percent in a lull of political developments.

— Reuters contributed to this report

Yahoo Finance

Yahoo Finance