W&T Offshore (WTI) Stock Up 3% Since Posting Q1 Earnings Beat

W&T Offshore, Inc. WTI shares have gained 3% since it reported strong first-quarter results on May 3 despite a decrease in production.

The company reported first-quarter 2022 adjusted earnings (excluding one-time items) of 21 cents per share, beating the Zacks Consensus Estimate of 18 cents. The bottom line significantly improved from the year-ago quarter’s 11 cents per share.

Total quarterly revenues of $191 million surpassed the Zacks Consensus Estimate of $159 million. Also, the top line increased from $125.6 million in the prior-year quarter.

The strong quarterly results were supported by the higher realization of commodity prices.

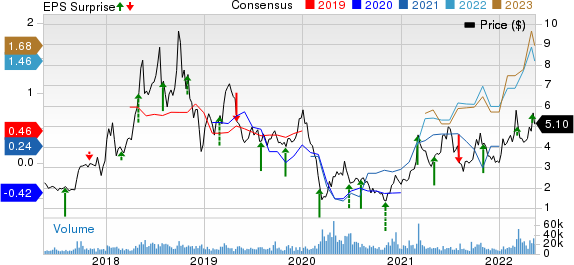

W&T Offshore, Inc. Price, Consensus and EPS Surprise

W&T Offshore, Inc. price-consensus-eps-surprise-chart | W&T Offshore, Inc. Quote

Production Statistics

Total production averaged 37.8 thousand barrels of oil equivalent per day (MBoe/d), down from the year-ago quarter’s 39.7 MBoe/d.

Oil production was recorded at 1,304 thousand barrels (MBbls), down from the year-ago level of 1,377 MBbls. Also, natural gas liquids’ output totaled 349 MBbls, lower than 392 MBbls a year ago. Natural gas production of 10,471 million cubic feet (MMcf) for the reported quarter was lower than 10,799 MMcf in the year-earlier period. Of the total production for the reported quarter, about 48.7% comprised liquids.

Realized Commodity Prices

The average realized price for oil in the first quarter was $94.10 a barrel, higher than the year-ago level of $56.73. The average realized price of NGL increased to $39.60 from $23.88 per barrel in the prior year. The average realized price of natural gas for the March-end quarter was $4.91 per thousand cubic feet, up from $3.35 in the last year’s comparable period. The average realized price for oil-equivalent output increased to $55.29 per barrel from $34.66 a year ago.

Operating Expenses

Lease operating expenses rose to $12.78 per Boe in the first quarter from $11.87 a year ago. Also, general and administrative expenses increased to $4.05 per Boe from $3 in the year-ago period.

Overall, total costs and expenses increased to $93.4 million from the year-ago level of $86 million.

Cash Flow

Net cash from operations for the first quarter was $27.5 million, which declined from $45 million in the year-ago period.

Free cash flow for the reported quarter increased to $46.9 million from $40.4 million in the year-ago quarter.

Capital Spending & Balance Sheet

W&T Offshore spent $17.4 million in capital through the March-end quarter (excluding acquisitions) on oil and gas resources.

As of Mar 31, 2022, the company’s cash and cash equivalents were $215.5 million, down from the fourth-quarter 2021 level of $245.8 million. Its net long-term debt as of the March-end quarter was recorded at $680 million, down from the prior-quarter level of $688 million. The current portion of the long-term debt was $39.9 million.

Guidance

For 2022, W&T Offshore revised its average daily oil-equivalent production upward to 38.2-42.2 MBoe/d from 37.5-41.5 MBoe/d mentioned earlier. The metric also suggests an improvement from 38.1 MBoe/d reported in 2021. Oil production is expected to be 5.3-5.9 MMBbls, while that of natural gas will likely be 43-47.5 Bcf.

The upstream company reiterated its capital spending budget for 2022 at $70-$90 million, which excludes acquisition opportunities. It expects lease operating expenses of $200-$220 million for the year.

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at the following stocks that reported solid first-quarter earnings numbers and presently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess Corporation HES reported first-quarter 2022 earnings per share of $1.30, beating the Zacks Consensus Estimate of $1.12. The higher commodity price realizations backed the strong quarterly results.

As of Mar 31, 2022, Hess had $1,370 million in cash and cash equivalents. The company's long-term debt was $7,934 million at the first-quarter end. The current maturity of the long-term debt is $22 million.

Range Resources Corporation RRC reported first-quarter 2022 adjusted earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.15 per share. The strong quarterly earnings can be attributed to higher realizations of commodity prices.

As of Mar 31, 2022, it had total debt of $1,829.7 million. It had a debt-to-capitalization of 53.3%. In the first quarter, Range Resources’ board of directors approved the authorization of a $500-million share repurchase program.

Equinor ASA EQNR reported first-quarter adjusted earnings per share of $1.60, beating the Zacks Consensus Estimate of $1.57. The strong quarterly results were aided by higher commodity prices and increased contributions from the Martin Linge oil field.

As of Mar 31, 2022, Equinor reported $20,882 million in cash and cash equivalents. The company’s long-term debt was $27,493 million at the first-quarter end. Equinor reaffirmed production growth expectations at 2% for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance