Verisk (VRSK) Benefits From Growth Strategy and Acquisitions

Verisk Analytics Inc. VRSK has outperformed its industry in the past six months. Its shares have risen 6.4% compared with the industry’s 3.4% growth.

Strategic acquisitions bode well for the company, allowing it to expand into newer markets and add to its client base. The shareholder-friendly behavior is another positive for the company. Due to Verisk Analytics’ nature of business, it is exposed to various operational risks like security breaches and dependence on external sources.

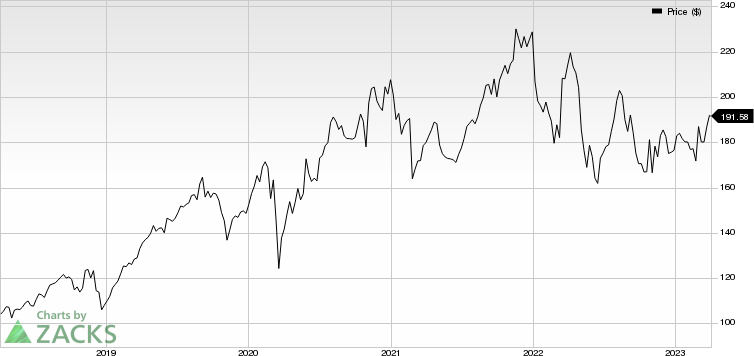

Verisk Analytics, Inc. Price

Verisk Analytics, Inc. price | Verisk Analytics, Inc. Quote

The company reported better-than-expected fourth-quarter 2022 results. Adjusted earnings per share (excluding $1.04 from non-recurring items) was $1.43, which beat the Zacks Consensus Estimate by 22.2%. Such an outperformance was supported by strong segmental revenue growth and core operating leverage. Adjusted earnings decreased 2.7% on a year-over-year basis.

Total revenues of $630 million surpassed the consensus mark by 2.4% but decreased 17.7% from the year-ago figure. The year-over-year decline in VRSK’s top line can be correlated to the sale of its environmental health and safety business, and Financial Services segment.

Current Situation of VRSK

Verisk’s growth is driven by its robust growth strategy, based on organic growth, acquisitions and product development. The company has been benefiting from its investments in people and processes. It continues to focus on entering newer markets for increasing solution diversity, developing new proprietary database and predictive analytics.

Verisk has been making strategic acquisitions to expand its addressable market. It is also done to increase the company’s data and analytics capabilities across industries. The latest acquisition of Sweden-based InsurTech firm, Mavera, is an indicator of Verisk’s attempt at improving its market position.

The company has been consistently rewarding its shareholders in the form of repurchases and dividends. It spent $1.7 billion, $475 million and $348.8 million in 2022, 2021 and 2020, respectively, for share repurchases. Dividends paid in 2022, 2021 and 2020 were $195.2 million, $188.2 million and $175.8 million, respectively.

Some Concerning Points

Verisk Analytics' current ratio (a measure of liquidity) at the end of fourth-quarter 2022 was 0.4, lower than 0.46 at the end of the prior quarter and 0.49 at the end of the year-ago quarter. Declining current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

VRSK currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Business Services sector are Omnicom GroupOMC, ICF International ICFI and Gartner, Inc. IT.

For first-quarter 2023, OMC’s earnings are expected to increase 41% from the year-ago quarter’s $1.96 per share. In 2023, the company’s bottom line is expected to grow 3.6% on a year-over-year basis.

The Zacks Consensus Estimate for Omnicom Group’s first-quarter 2023 earnings is pegged at $1.96 per share, which has been revised slightly upward in the past 60 days. The consensus estimate for OMC’s full-year earnings is pegged at $7.18 per share, which has been revised upward 11.3% in the past 60 days. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

For first-quarter 2023, ICF International’s earnings are expected to increase 16% from the year-ago quarter’s $1.52 per share. In 2023, the company’s bottom line is expected to increase 9.2% on a year-over-year basis.

The Zacks Consensus Estimate for the company’s first-quarter 2023 earnings is pegged at $1.52 per share, which has been revised upward 2% in the past 60 days. The consensus estimate for ICFI’s full-year earnings is pegged at $6.3 per share, which has been revised upward 7.3% in the past 60 days. The company currently sports a Zacks Rank #1.

The Zacks Consensus Estimate for Gartner’s first-quarter 2023 earnings is pegged at $2.58 per share, indicating a 10.7% increase from the year-ago quarter. The bottom line has been revised slightly upward in the past 60 days.

The consensus estimate for full-year 2023 is pegged at $9.49 per share, which has been revised slightly upward in the past 60 days. The company currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance